Trading in the Forex market offers lucrative profit opportunities, but it also comes with its fair share of risks. One of the riskiest periods for trading is during the midnight market opening hours. It is often considered a low-liquidity period.

Traders experience a wider spread, sudden volatility, and delays in execution during these times, which ultimately lead to slippages during execution, unexpected stop-loss hits, unfulfilled orders, and losses. In this blog, we will explore what happens during the midnight market opening hours, understand why experienced traders avoid trading during these periods, and learn how they protect their trades from slippage and unforeseen stop-loss triggers.

High Volatility

The midnight market opening hours, often described as periods of low liquidity, witness the market becoming highly volatile. This volatility is characterized by sudden price swings and abrupt fluctuations, complicating the task of accurately predicting market movements.

Traders with tight stop-loss orders may find themselves facing premature stop-outs, even if the eventual market direction favors their position. During these volatile periods, the probability of encountering significant slippages increases, which can lead to substantial financial losses.

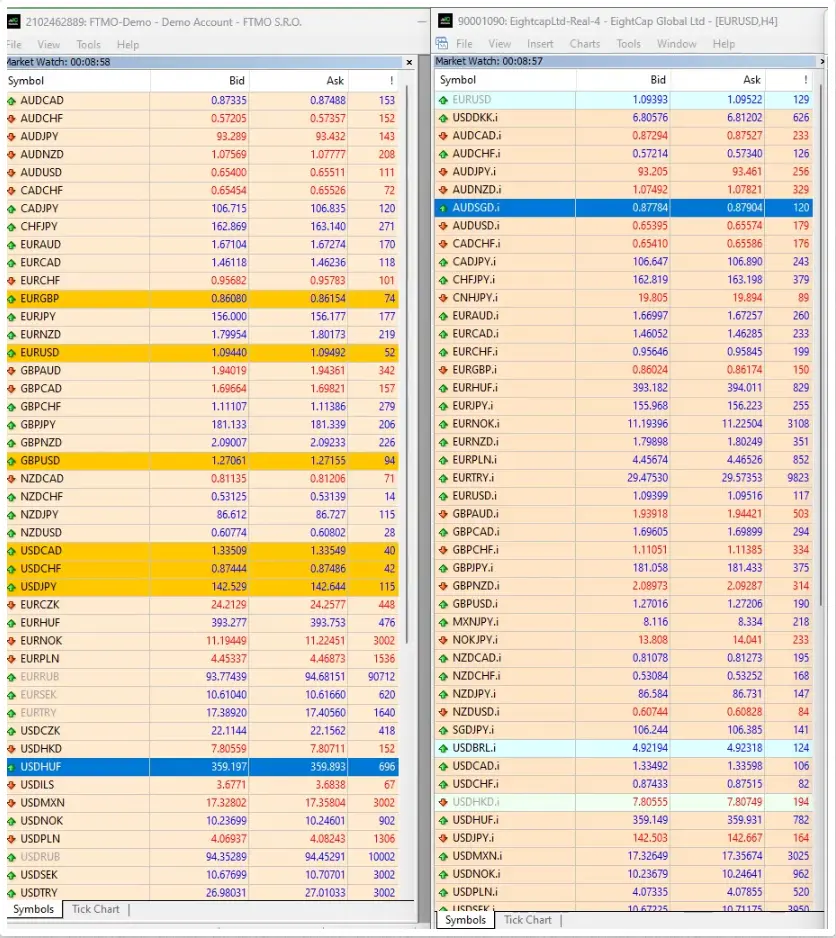

Lack of Market Participants

During the midnight market opening hours, there are fewer market participants actively trading compared to later in the trading day. Most active institutions, hedge funds, and banks that engage in trading are based in Europe and the USA. Recently, Singapore and some banks from Japan have become increasingly active during the Asia Session.

The lack of market participants creates a low-liquid market

The increase in volume you observe usually starts after 4:00 (GMT+3) due to their participation. Many of these participants are absent during the midnight market opening hours, intensifying the low liquidity in the market. This scarcity of liquidity drives price volatility in the market.

Lack of Liquidity

Low liquidity in the market indicates that there are fewer buyers and sellers actively participating. As already established, most active participants are absent during the midnight market opening hours, which are described as periods of low liquidity.

Low liquid AUDCHF market at the very beginning of the market open

Therefore, when traders attempt to open or close a position, they might discover that their order isn’t filled instantly or at the desired price. This scarcity of liquidity can lead to wider bid-ask spreads, heavily affecting a trader’s execution.

Widened Spread

As traders navigate the intricate landscape of the Forex market, understanding the factors behind spread dynamics becomes crucial.

One of the primary reasons for the widened bid-ask spread during the midnight market opening hours in the Forex market is the activity of large institutions and banks as they liquidate their positions or adjust their exposure.

During these hours, numerous Forex spot transactions take place.

A foreign exchange spot transaction, or FX spot, represents an agreement between two entities to buy one currency and sell another at a predetermined price for settlement on the spot date.

During the time when certain financial centers are closed, institutional traders, banks, and hedge funds may accumulate positions based on events and news that occur outside of regular trading hours.

When the market opens, they reassess their positions and may decide to close or adjust those based on the latest information.

This process can lead to an increased volume of orders, but with limited liquidity available in the market at that moment, the bid-ask spread widens.

With a wide spread, your stop losses may get triggered sometimes without any candle’s presence.

Such conditions underscore the importance of traders being vigilant and informed during these specific market hours.

Delayed Order Execution

Amidst reduced liquidity, order execution might get delayed, causing traders to miss out on opportunities or unfavorable entry and exit prices. These unfavorable entry and exit prices are widely considered “Slippage”. There are instances where traders find that their order isn’t immediately processed, leading to frustration and potential losses.

Price Gaps

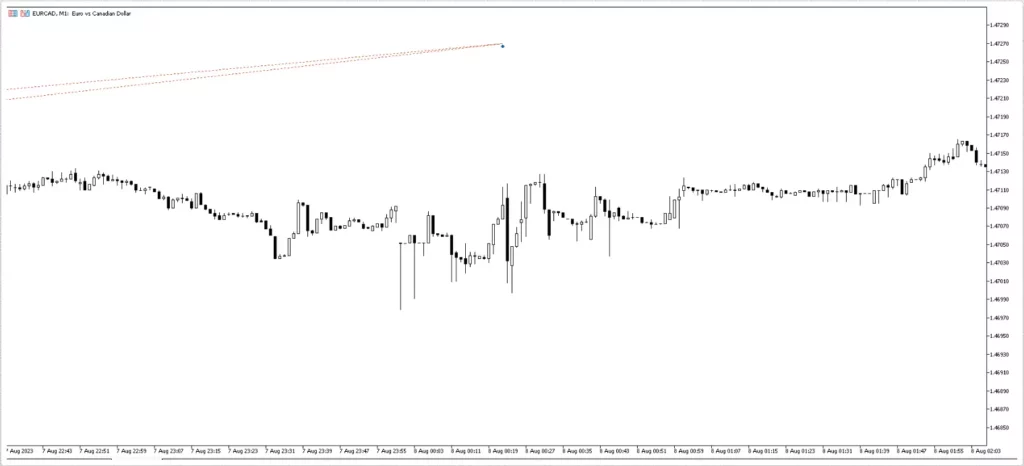

Gaps are unexpected price jumps where the current price of a currency pair or symbol skips over several price levels, leaving a gap on the chart. Gaps often occur during market open hours, especially after weekends or major news events.

A gap occurs when the market opens for a particular symbol

If you have open positions and the market opens with a gap against your trade, it can lead to significant losses or trigger your stop-loss orders at unexpected price levels. At times, pending orders might remain inactivated due to such gaps.

Conclusion

Trading during market open hours can be an unforgiving experience for traders. At this time, the market has fewer participants which creates low liquidity. Low-liquid market offer wide spread, sudden volatile spikes, and delayed order executions.

With all of these factors combined, a trader may experience unexpected slippage and stop-loss triggers at unfavorable price levels. To safeguard against slippage and stop-loss triggers due to widened spreads, experienced traders avoid trading during these periods and exercise patience until market conditions become more stable and liquid.