In the realm of trading and investing, where dynamics are ever-evolving, staying abreast of current market trends and data is paramount for making well-informed decisions. This article delves into the market statistics of the preceding week, exploring their significance for traders and investors.

It encompasses a range of key factors, including notable earnings, trading statistics, and instruments, while also examining how the global market update influenced major currency pairs.

Top 5 Payouts:

During the previous week, noteworthy payouts were observed, reaching;

- $39,163 – 280K Account Size (Scaled Up) – 13.99%

- $35,564 – 280K Account Size (Scaled Up) – 12.70%

- $31,075 – 200K Account Size – 15.54%

- $28,347 – 200K Account Size – 14.17%

- $19,674 – 140K Account Size (Scaled Up) – 14.05%

The noteworthy payout amounts exemplify the market’s volatile nature and the presence of numerous profitable opportunities for traders. These substantial payouts provide evidence that traders achieved success by taking advantage of these opportunities through wise investment decisions.

Weekly Trading Stats:

Traders received a payout of $2,163,114 last week, which was divided among 1,411 individuals. This demonstrates a notable level of trader engagement in the market, with those who made astute investment choices earning substantial profits.

Throughout this period, a total of 940,696 trades were conducted, involving a combined sum of 547,594 lots. These figures underscore the significant trading activity, indicating a market environment characterized by volatility and dynamic fluctuations.

Weekly Trading Instruments:

The week witnessed significant trading activity in notable pairs including XAUUSD, EURUSD, US30, GBPUSD, and NDX100. These pairs are popular among traders and investors due to their volatility, which adds to their appeal for investment. The substantial trading volume associated with these pairs indicates high demand throughout the week, presenting traders with potential profit opportunities.

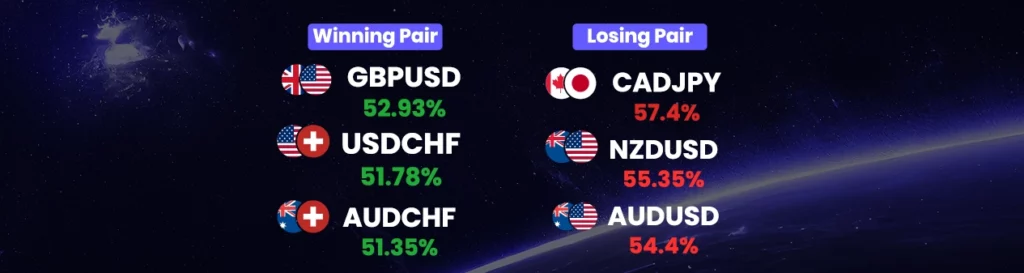

Among all currency pairs, GBPUSD, USDCHF, and AUDCHF demonstrated favorable performance, boasting winning percentages of 52.93%, 51.78%, and 51.35% respectively. This suggests that traders who engaged in these pairs potentially achieved noteworthy profits.

Conversely, the CADJPY, NZDUSD, and AUDUSD currency pairs did not perform well, reflecting losing percentages of 57.4%, 55.35%, and 54.4% respectively. This implies that traders who invested in these pairs might have encountered losses.

|| Market Dynamics Unveiled: Gold’s Slide, Dollar’s Surge, and Fed’s Outlook! ||

Global Market Update:

- Gold price hits multi-week low, around $1,910 region, due to rising bets on more Federal Reserve rate hikes strengthening the US Dollar. China’s economic troubles and geopolitical risks might offer some support to the safe-haven metal.

- US Dollar Index reaches a five-week high at 102.90, benefiting from concerns about China’s economic issues and positive US economic data. Rising US Treasury bond yields contribute to the dollar’s gains, while caution prevails before key US data releases and FOMC meeting minutes.

- That said, Federal Reserve (Fed) Governor Michelle Bowman backed additional rate hikes and defended the Fed hawks. However, San Francisco Fed Bank President Mary Daly, Philadelphia Fed Bank President Patrick Harker, and New York Fed President John Williams signaled rate cuts in 2024 but also highlighted data dependency and kept the policy doves looking for more details to confirm the bias.

EUR/USD:

- EUR/USD drops to a one-week low at 1.0930 as it breaks key support – a short-term trend line and the 100-day moving average. Bearish MACD signals and risk-off sentiment add to the downward momentum. US Dollar gains strength from firmer US Treasury yields.

A close below 1.0930 could further decline toward 1.0910 and 1.0880 support levels. Upside potential if it breaks above 1.1040 resistance.

GBP/USD:

- GBP/USD trades at about 1.2665, down 0.23%, as concerns over potential rate hikes weigh on the Pound despite positive UK economic data. Investors await UK inflation stats and US Retail Sales, along with FOMC Minutes, for direction.

USD/CAD:

- USD/CAD climbs, surpassing 200-DMA and a four-month trend line. Bullish MACD signals support buyers. Resistance near 1.3460 and monthly high at 1.3500 targeted. Support lies at 200-DMA (1.3450) and the four-month trend line (1.3400).

AUD/USD:

- AUD/USD records first daily gains in four, up 0.20% near 0.6530. RBA Governor Lowe supports further gradual policy tightening for inflation targeting. Positive sentiment about China adds to the Aussie pair’s corrective bounce. Cautious optimism prevails before US inflation data.

NZD/USD:

- The NZD/USD pair is hovering just above 0.60 as the week concludes. ANZ Bank forecasts a mild and gradual appreciation throughout 2023. However, this prediction depends on markets returning to fair value around 0.65, and the risks are skewed against this outcome.

The possibility of FX markets continuing to perceive the US as capable of managing inflation without inducing a recession is influencing sentiment. In the short term, if the pair breaks below 0.60, attention would shift to the June low of 0.5985, followed by the 2022 low of 0.5512.

Commodities:

Gold:

- Gold continues its pullback but is expected to hold key support at $1,900/$1,891, according to analysts at Credit Suisse. The view remains positive for a potential retest of major resistance at the record highs of $2,063/$2,075. If the bullish momentum persists, a move to new record highs is likely, leading to a further rally to $2,150 and $2,355/$2,365.

However, a weekly close below $1,891 could reinforce a longer-term sideways range, potentially leading to a fall to support at $1,810/$1,805. Traders are closely monitoring these critical levels to gauge the precious metal’s future direction.

Silver:

- Silver price bounces near $22.75, challenges at $23.25-30 resistance with 200-DMA and bearish MACD. Upside targets $24.00 and $24.55 levels. A downside breach of $22.60 support could lead to $22.10 and $22.00.

Oil:

- WTI crude oil holds near $82.30, consolidating after retreating from the yearly high. Support at $82.20, followed by $82.00 and 200-Hour Moving Average around $81.75. Price remains within a two-week rising trend channel between $80.70 and $84.75.

Upside confirmation above $82.70 could target Year-To-Date high at $84.35 and the channel’s top line near $84.75.

Watch out for Next Week’s Important Dates

- On 15th Aug, the United States Retail Sales report will come out. A higher-than-anticipated figure should be viewed as positive (bullish) for the USD, while a lower-than-anticipated figure should be viewed as unfavorable (bearish).

- On 17th Aug, the United States Initial Jobless Claims report will have a significant impact on US bond and stock markets. A higher-than-expected figure should be seen as negative (bearish) for the USD, while a lower-than-expected figure should be seen as positive (Bullish) for the USD

- It is important to pay attention to the United States FOMC minutes on the 10th of August, as they may have significant impacts on major currencies. A higher-than-expected figure should be seen as Positive (bullish) for the USD while a lower-than-expected figure should be seen as negative (bearish) for the USD.