The Forex market presents enticing opportunities for traders, particularly during high-impact news events when prices exhibit rapid fluctuations, providing potential for swift profits. However, akin to any endeavor, trading during news releases comes with its share of challenges.

Traders must contend with execution delays, slippage, and the widening of spreads, all of which introduce unique dynamics compared to regular trading conditions. In this article, we will delve into these challenges and their significance in forex trading.

What Happens During News Event?

News events in the forex market lead to increased market volatility, often resulting in sharp price movements. These events can cause rapid price movements, create liquidity surges, and potentially lead to wider spreads and unexpected execution prices.

Effective risk management is crucial as news events bring greater uncertainty and the possibility of whipsaw effects. The exact impact of news events varies based on their significance and market expectations, guiding traders’ decisions and strategies.

In order to harness the potential benefits of news events, it’s crucial to keep these key considerations in mind prior to initiating any trades.

1. Rapid Price Movements: During high-impact news events, the market can experience rapid and substantial price fluctuations. Traders endeavor to react swiftly to breaking news, but the swiftness of these price shifts can surpass the speed of order execution, resulting in slippage.

2. Liquidity Surge: Significant news events often draw a considerable number of market participants, resulting in heightened liquidity levels. As an influx of buyers and sellers converges, trading volumes experience a substantial increase, contributing to heightened market volatility.

This heightened activity can sometimes lead to a significant imbalance in trading positions, which, in turn, can impact the execution of orders and price stability. because of these traders will have execution delays.

3. Widening Spreads: Enhanced liquidity and heightened volatility can result in widened bid-ask spreads.

In such scenarios, a trader might experience the execution of their order at the expanded spread, which can lead to unforeseen slippage.

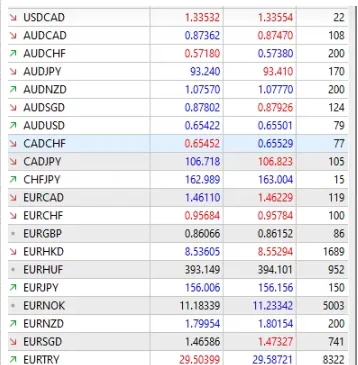

See the difference between spreads during regular time & during news events here:

4. Unexpected Execution Price: During news events, the combination of increased volatility and rapid price movements can induce slippage in various currency pairs, irrespective of their classification as major (e.g., EUR/USD and USD/JPY) or minor (e.g., EUR/NOK). Consequently, traders may observe their orders being executed at prices that diverge from their initially anticipated levels.

Endnote

Slippage, particularly during high-impact news events in the Forex market, represents a significant challenge that traders need to be aware of and proactively plan for. While it’s an inherent part of the trading landscape, comprehending the factors that contribute to slippage and the potential consequences can empower traders to formulate effective strategies for mitigating its adverse impact.

In the dynamic and often unpredictable realm of Forex trading, equipping oneself with knowledge and being well-prepared is a reliable anchor, preventing your trading activities from veering off course.