In the ever-fluctuating world of trading and investing, it’s vital to keep up-to-date with the latest market trends and data in order to make knowledgeable decisions. This article delves into the significant market figures of the previous week, elucidating their implications for traders and investors.

The article covers a plethora of critical aspects such as significant earnings, trading figures, and financial instruments, whilst also scrutinizing the effects of the global market update on major currency pairs.

Top 5 Payouts:

Last week, the highest payouts recorded were;

- $40,187 – 280K Account Size (Scaled Up) – 14.35%

- $33,523 – 200K Account Size – 16.76%

- $29,167 – 180K Account Size (Scaled Up) – 16.20%

- $25,984 – 200K Account Size – 12.99%

- $16,221 – 100K Account Size – 16.22%

These substantial payout amounts demonstrate the volatility of the market and the presence of numerous profitable opportunities for traders. The significant payouts indicate that traders were successful in capitalizing on these opportunities by making astute investment decisions.

Weekly Trading Stats:

Last week, traders were paid a sum of $1,502,908, which was distributed among 795 participants. This showcases a considerable level of trader involvement in the market, with those making shrewd investment choices reaping considerable earnings.

Over this time span, a whopping total of 911,976 trades were executed, involving a combined volume of 532,815 lots. These numbers highlight the remarkable trading activity, suggesting a market landscape typified by volatility and constant shifts.

Weekly Trading Instruments:

The week saw substantial trading activity involving notable pairs such as XAUUSD, EURUSD, US30, NDX100, and GBPUSD These pairs typically appeal to traders and investors due to their inherent volatility, thereby enhancing their investment attractiveness. The sizable trading volume associated with these pairs demonstrates their high demand throughout the week, offering traders prospective avenues for profit.

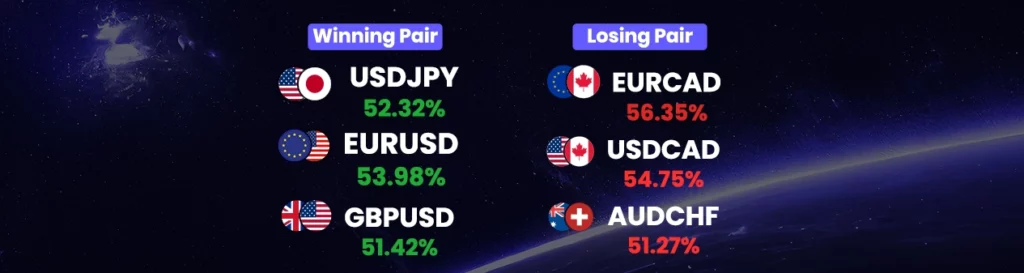

Among all the currency pairs, USDJPY, EURUSD, and GBPUSD performed exceptionally well, achieving winning percentages of 52.32%, 52.11%, and 51.42% respectively. This indicates that traders engaged with these pairs might have reaped impressive gains.

On the other hand, the currency pairs of EURCAD, USDCAD, and AUDCHF did not fare well, posting losing percentages of 56.35%, 54.75%, and 51.27% respectively. This suggests that traders who ventured into these pairs may have sustained losses.

|| Financial Markets on the Edge: USD Index, EUR/USD, and Gold Set to Make Big Moves – Get Ready for Roller Coaster Rides! ||

Global Forex Market Update:

- The USD Index is facing intense pressure as it battles to breach the resistance at 103.50. Recent drops have raised concerns among traders, and the key support level at 102.00 is now crucial. With the 200-day SMA acting as a formidable barrier, will the index manage to regain its strength, or is a further downside in store?

- EUR/USD has made an impressive rebound, crossing the critical level at 1.1000. The focus now shifts to the weekly peak at 1.1149, and a breakthrough could signal a potential rally toward the 2023 high of 1.1275. As positive sentiment prevails while the 200-day SMA supports at 1.0743, traders are eager to see if the euro can sustain its momentum.

- Gold is proving its resilience by maintaining the key support at $1,900/$1,891 amid its ongoing pullback. Credit Suisse predicts a potential record high at $2,063/$2,075, and if achieved, it may pave the way for even higher gains at $2,150 and $2,355/$2,365. Investors are eagerly watching for any signs of a weekly close below $1,891, which could alter the longer-term trajectory and signal a drop to $1,810/$1,805.

EUR/USD

- The EUR/USD pair is on a bullish trajectory as it rebounds sharply and reclaims the area above 1.1000. The next target for the pair is the weekly top around 1.1150. Further gains could lead to a potential move toward 2023 high at 1.1275. The positive outlook remains intact as long as the pair stays above the 200-day SMA, currently at 1.0743.

GBP/USD

- GBP/USD is facing downward pressure as it breaks below the 1.2590 late June low, indicating a potential decline ahead. A move above the resistance at 1.2762 is needed to ease the immediate downside bias.

However, the key support lies at the 1.2590 level, and a break below it could pave the way for a more significant decline, possibly testing the rising 200-day SMA and the May low at 1.2312/07. To reassert the broader uptrend, the pair needs to break above 1.2997, with further strength targeting the 1.3143 high and eventually 1.3400/14.

USD/CAD

- USD/CAD is in a holding pattern as it oscillates in a wider range ahead of labor market reports from the US and Canada. The market sentiment remains upbeat despite volatility triggered by Fitch’s downgrade of the US government’s long-term debt rating.

The pair is currently near the horizontal resistance at 1.3387, with the bullish bias supported by the upward-sloping 20-period Exponential Moving Average (EMA) at 1.3322. A decisive break above 1.3387 could lead to further upside towards the June 7 high at 1.3427 and the psychological resistance of 1.3500. On the downside, a move below the July 18 high at 1.3288 may push the pair toward the support levels around 1.3160 and slightly below 1.3100.

AUD/USD

- For the next 1-3 weeks, the analysts maintain their view from the previous day (03 Aug) when the spot was at 0.6535. Although the AUD has been in a severely oversold condition since the beginning of the previous week, they anticipate further weakness with a potential move toward the year’s low near 0.6460.

To invalidate this bearish outlook, a decisive break above 0.6620 is required, with strong resistance noted at 0.6635. A breach of this level would indicate a halt to the AUD’s weakening trend.

NZD/USD

- NZD/USD struggles to maintain gains after a Doji candlestick formation, hinting at a potential trend reversal from its bearish trajectory. The RSI below 50.0 adds to hopes of recovery, but resistance levels at 0.6135, 0.6180, and 0.6230 pose challenges for bullish momentum.

On the downside, support lies at 0.6050, followed by 0.6030, while a break below may target the psychological level of 0.6000 and the yearly low at 0.5985.

Commodities Market Update:

GOLD:

- Gold continues its pullback but is expected to hold key support at $1,900/$1,891, according to analysts at Credit Suisse. The view remains positive for a potential retest of major resistance at the record highs of $2,063/$2,075. If the bullish momentum persists, a move to new record highs is likely, leading to a further rally to $2,150 and $2,355/$2,365.

However, a weekly close below $1,891 could reinforce a longer-term sideways range, potentially leading to a fall to support at $1,810/$1,805. Traders are closely monitoring these critical levels to gauge the precious metal’s future direction.

SILVER:

- Silver remains under selling pressure for the fourth straight day, hovering near a multi-week low of around $23.40. The technical setup favors bears, and a sustained break below the 61.8% Fibonacci retracement level of the June-July rally at $23.35 could pave the way for further downside.

The XAG/USD pair might then test the crucial 200-day Simple Moving Average (SMA) around $23.00 and potentially revisit the multi-month low near $22.15-$22.10 touched in June. On the upside, resistance lies at $23.70, followed by the confluence support-turned-resistance at $24.00-$24.10, comprising the 100-day SMA and the 38.2% Fibo. level.

A sustained break above these levels might trigger a short-covering rally, with potential targets at $24.45-$24.50 and $24.75 before heading towards the psychological level of $25.00 and the next significant barrier near $25.25.

OIL:

- WTI crude oil prices have surged above $83.00 to the highest point since mid-April, gaining over 1.70%. The upward trajectory is driven by expectations of oil production cuts by Saudi Arabia and weakness in the US Dollar. Mixed data from the US, with lower-than-expected Nonfarm Payrolls but higher-than-expected Average Hourly Earnings, has weakened the USD and boosted WTI prices.

The focus now shifts to next week’s Consumer Price Index (CPI) figures from the US for further clues on the direction of oil prices. Technical analysis indicates a bullish outlook for WTI in the short term, but the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) nearing overbought conditions may signal a potential correction in the near future.

Key resistance levels are at $84.00, $85.30, and $86.00, while support levels lie at $79.50, $79.00, and $78.00 (20-day SMA).

Watch out for Next Week’s Important Dates

- On 10th Aug, the United States CPI report will come out. A higher-than-anticipated figure should be viewed as positive (bullish) for the USD, while a lower-than-anticipated figure should be viewed as unfavorable (bearish).

- On 10th Aug, the United States Initial Jobless Claims report will have a significant impact on US bond and stock markets. A higher-than-expected figure should be seen as negative (bearish) for the USD, while a lower-than-expected figure should be seen as positive (Bullish) for the USD

- It is important to pay attention to the United States Core Inflation on the 10th of August, as it may have significant impacts on major currencies. A higher-than-expected figure should be seen as Positive (bullish) for the USD while a lower-than-expected figure should be seen as negative (bearish) for the USD.