In the realm of trading and investing, where dynamics are ever-evolving, staying abreast of current market trends and data is paramount for making well-informed decisions. This article delves into the market statistics of the preceding week, exploring their significance for traders and investors.

It encompasses a range of key factors, including notable earnings, trading statistics, and instruments, while also examining how the global market update influenced major currency pairs.

Top 5 Payouts:

During the previous week, noteworthy payouts were observed, reaching;

- $38,851 – 200K Account Size – 19.43%

- $32,167 – 180K Account Size (Scaled up) – 17.87%

- $30,984 – 150K Account Size (Merged) – 20.66%

- $28,704 – 200K Account Size – 14.35%

- $25,221 – 150K Account Size (Merged) – 16.81%

The noteworthy payout amounts exemplify the market’s volatile nature and the presence of numerous profitable opportunities for traders. These substantial payouts provide evidence that traders achieved success by taking advantage of these opportunities through wise investment decisions.

Weekly Trading Stats:

Traders received a payout of $ 1,003,267 last week, which was divided among 1,086 individuals. This demonstrates a notable level of trader engagement in the market, with those who made astute investment choices earning substantial profits.

Throughout this period, a total of 729,241 trades were conducted, involving a combined sum of 437,695 lots. These figures underscore the significant trading activity, indicating a market environment characterized by volatility and dynamic fluctuations.

Weekly Trading Instruments:

The week witnessed significant trading activity in notable pairs including XAUUSD, EURUSD, US30, GBPUSD, and NDX100. These pairs are popular among traders and investors due to their volatility, which adds to their appeal for investment. The substantial trading volume associated with these pairs indicates high demand throughout the week, presenting traders with potential profit opportunities.

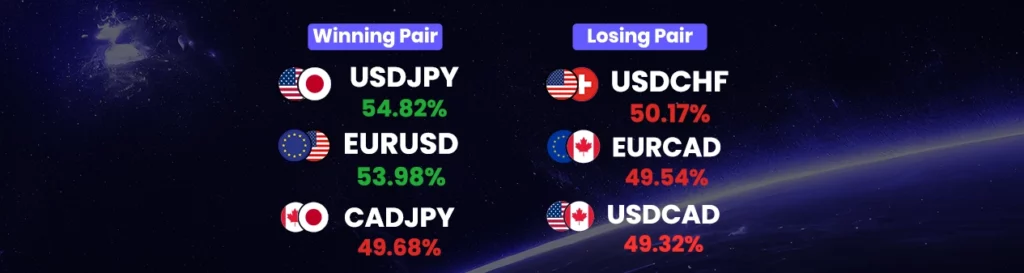

Among all currency pairs, USDJPY, EURUSD, and CADJPY demonstrated favorable performance, boasting winning percentages of 54.82%, 53.98%, and 53.37% respectively. This suggests that traders who engaged in these pairs potentially achieved noteworthy profits.

Conversely, the USDCHF, EURCAD, and USDCAD currency pairs did not perform well, reflecting losing percentages of 50.17%, 49.54%, and 49.32% respectively. This implies that traders who invested in these pairs might have encountered losses.

|| The Great Dollar Dilemma: Can the Greenback Escape Gravity and Soar Beyond 102.60? ||

Global Market Update:

- The US Dollar Index (DXY), after a recent power-packed performance that sent it climbing above 102.00, seems to be grappling with the chains of gravitational pull. Despite the momentary hiccup, its rally promises potential ascension, with 102.60 presenting the next fortress to be conquered.

Overcoming this imposing barrier, pegged at the transitory 55-day SMA, could liberate the index from its current downside entrapment and herald additional gains. However, the dollar’s future remains shrouded in uncertainty. While languishing beneath the 200-day SMA at 103.78, the DXY’s broader forecast is tinged with negativity, hinting at a potential plunge from the stratospheric highs.

The ultimate question remains – can the greenback muster enough strength to breach the looming fortresses, or is a fall from grace imminent?

- Interest rate conjectures continue to hold the reins of the Gold market, according to strategies highlighted by Commerzbank. The unexpected 2.4% surge in the US economy’s annualized growth for the second quarter has kept the specter of aggressive rate hikes by the US Federal Reserve at bay.

Consequently, the market’s perception of a possible ‘soft landing’ for the US economy has gained ground, further fueled by the Fed dismissing fears of an imminent US recession. This dynamic shift brings in a new dimension for gold pricing – the chance of imminent rate cuts diminishes if a recession stays off the horizon.

- Yet, the undercurrent of rate cut expectations for the upcoming year seems to be fostering a supportive environment for the precious metal. Gold prices are poised on a delicate balance between prospective rate changes and ongoing economic events.

Given this unique juxtaposition, US economic data takes center stage, with analysts and investors closely monitoring each release for potential price swings. Over the next few days and weeks, this data is set to play a crucial role in driving Gold’s price trajectory.

Will the precious metal be able to maintain its shine amidst the turmoil of economic data and interest rate conjectures? Only time will tell.

EUR/USD: EURUSD: The Euro-Dollar Tug of War: Are Deeper Trenches Ahead?

- EUR/USD recovers from 3-week lows near 1.0940, ending the week slightly above the 1.1000 mark.

- Further weakness could see the pair dive towards the 1.0900 region, contingent on breaching the weekly low of 1.0943.

- Despite short-term turbulence, a positive long-term outlook prevails for EUR/USD, as long as it remains above the 200-day SMA, currently at 1.0718.

GBP/USD: The Sterling Struggle: A Possible Retreat to the 55-DMA Amid Resilient Support

- GBP/USD experienced a significant fall, with initial resistance spotted at 1.2878/83 and more crucially at 1.2997.

- The pair could face a deeper setback to the 55-DMA and price support at 1.2676/58, however, fresh buyers are anticipated to step in, eventually reviving the broader uptrend.

- A closure below 1.2658 would trigger an immediate risk of further decline with the next support levels at 1.2631/27 and 1.2483/73. Above 1.2997, a reversal to the core uptrend could be signaled, potentially aiming for the 1.3143 high.

USD/CAD: USD/CAD in Balance: Elusive Strength Hinges on the 1.3250 Threshold.

- USD/CAD experiences modest gains towards the 1.3250 mark, with broader USD gains favoring a slight shift toward more USD strength in the short term.

- A clear breach through 1.3250 remains essential for a stronger USD drive.

- Intraday support resides at 1.3215/20; losses beyond this point could push the pair back to the upper 1.31 region.

AUD/USD: AUD/USD Tussles Near Three-Week Low: Stronger USD and US PCE Price Index on the Horizon.

- AUD/USD continues its losing streak, succumbing to a nearly three-week low as the USD gains momentum and applies additional downward pressure.

- With technical selling occurring beneath the 200-day SMA, the AUD/USD pair has remained under heavy selling pressure, with the downward trajectory heading towards the 0.6620 region.

- Market participants now eye the release of the US Core PCE Price Index and anticipate its potential influence on the Federal Reserve’s next policy move, which could further impact USD demand and create short-term trading opportunities for the AUD/USD pair.

NZD/USD: NZD/USD Under Pressure: Key Technical Levels and RSI Conditions Signal Trouble for Kiwi Below 0.6200.

- NZD/USD struggles at a three-week low, recording the third consecutive day of losses. The break below the 200-SMA and a key short-term support line spell trouble for Kiwi bulls.

- The market’s cautious sentiment ahead of the release of the Fed’s favorite inflation gauge, the Core PCE Price Index, limits the pair’s immediate fall.

- Despite the oversold RSI and the 61.8% Fibonacci retracement level near 0.6150 hindering further downside, recovery remains elusive. Ascending support from late May, around 0.6115, stands as the final defense for Bulls.

GOLD:

Gold Price Treads Water: Fed’s Inflation Signals and $1,975 Resistance Hurdle Impede XAU/USD Recovery.

- Gold Price experiences modest gains as it attempts to recover from its most significant daily loss in two months while grappling with mixed signals from the Federal Reserve and ongoing US-China tensions.

- Market sentiment remains tentative with stock futures recording slight gains and bond yields inching higher due to conflict between strong US growth data and the central bank’s inability to appease policy hawks.

- The Fed’s preferred inflation indicator, the Core PCE Price Index, along with anticipation of a potential September rate hike, remain critical factors impacting the future trajectory of XAU/USD.

SILVER:

Silver Price Analysis: XAG/USD Recovers Slightly but Bears Remain in Control:

- The Silver Price (XAG/USD) bounces back from its lowest level in two weeks, recording mild gains around $24.20.

- Despite this recovery, the commodity remains under bearish control, as it lingers below a previous support line from July 6 and shows an imminent bear cross on the MACD.

- Key upside resistance is spotted around $24.70, which intersects with the 23.6% Fibonacci retracement of the March-May period and the support-turned-resistance line.

- If the bears take control, the 50-DMA support of $24.00 is the next level to watch, with further downside potentially tested near $23.60.

- A significant confluence of resistance for the bears is around $23.00, marked by a rising trend line from March 10 and the 50% Fibonacci retracement level.

OIL:

WTI Nears Multi-Month High as US Economic Strength and Supply Curbs Drive Prices.

- Western Texas Intermediate (WTI) sees a rise, trading near the $79.40 mark, its highest level since mid-April, largely due to positive US economic data and anticipated tighter supply.

- Positive US GDP data indicating a robust economy, combined with supply reductions by OPEC+ and expectations of Saudi Arabia extending its 1 million-barrel oil supply cut, are key drivers of WTI’s upward trajectory.

- As investors keep a keen eye on the US Core PCE index and the upcoming OPEC+ group’s JMMC meeting, these events will likely have a significant impact on the WTI price in the upcoming sessions.

Watch out for Next Week’s Important Dates

- On 01 Aug, the United States S&P PMI report will come out. A higher-than-anticipated figure should be viewed as positive (bullish) for the USD, while a lower-than-anticipated figure should be viewed as unfavorable (bearish).

- On 03 Aug, the United States Initial Jobless Claims report will have a significant impact on US bond and stock markets. A higher-than-expected figure should be seen as negative (bearish) for the USD, while a lower-than-expected figure should be seen as positive (Bullish) for the USD.

- It is important to pay attention to the United States Nonfarm Payrolls Private report on 04 of Aug, as it may have significant impacts on major currencies. A higher-than-expected figure should be seen as Positive (bullish) for the USD while a lower-than-expected figure should be seen as negative (bearish) for the USD.