In the realm of trading and investing, where dynamics are ever-evolving, staying abreast of current market trends and data is paramount for making well-informed decisions. This article delves into the market statistics of the preceding week, exploring their significance for traders and investors.

It encompasses a range of key factors, including notable earnings, trading statistics, and instruments, while also examining how the global market update influenced major currency pairs.

Top 5 Payouts:

During the previous week, noteworthy payouts were observed, reaching;

- 41,311 – 280k Account Size (Scaled Up) – 14.75%

- $34,451 – 280k Account Size (Scaled Up) – 12.30%

- $31,668 – 200k Account Size – 15.83%

- $28,823 – 200k Account Size – 14.41%

- $23,913 – 140k Account Size (Scaled Up) – 17.08%

The noteworthy payout amounts exemplify the market’s volatile nature and the presence of numerous profitable opportunities for traders. These substantial payouts provide evidence that traders achieved success by taking advantage of these opportunities through wise investment decisions.

Weekly Trading Stats:

Traders received a payout of $1,601,132 last week, which was divided among 968 individuals. This demonstrates a notable level of trader engagement in the market, with those who made astute investment choices earning substantial profits.

Throughout this period, a total of 640,838 trades were conducted, involving a combined sum of 419,510 lots. These figures underscore the significant trading activity, indicating a market environment characterized by volatility and dynamic fluctuations.

Weekly Trading Instruments:

The week witnessed significant trading activity in notable pairs including XAUUSD, EURUSD, US30, GBPUSD, and NDX100. These pairs are popular among traders and investors due to their volatility, which adds to their appeal for investment. The substantial trading volume associated with these pairs indicates high demand throughout the week, presenting traders with potential profit opportunities.

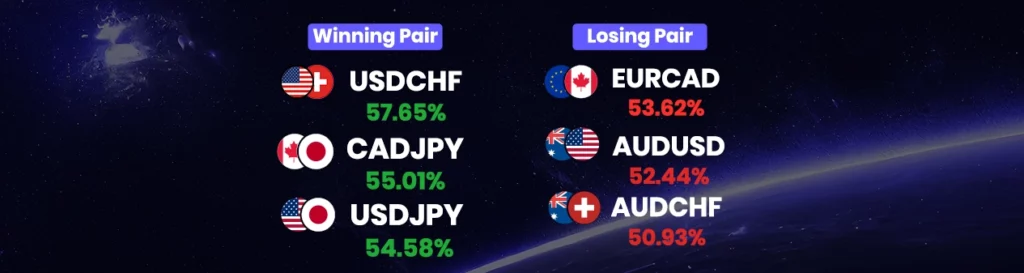

Among all currency pairs, USDCHF, CADJPY, and USDJPY demonstrated favorable performance, boasting winning percentages of 57.65%, 55.01%, AND 54.58% respectively. This suggests that traders who engaged in these pairs potentially achieved noteworthy profits.

Conversely, the EURCAD, AUDUSD, and AUDCHF currency pairs did not perform well, reflecting losing percentages of 53.62%, 52.44%, and 50.93% respectively. This implies that traders who invested in these pairs might have encountered losses.

|| Gold Market ALERT: A Major Breakout Imminent! You Won’t Believe What’s Driving It! ||

Global Market Update:

- The upcoming release of the June 13-14 FOMC meeting minutes has investors on edge as they seek clarity on the future direction of the US central bank’s monetary policy. The hawkish dot plot from the June meeting, indicating the possibility of two more rate hikes in 2023, has caused conflicting views among Fed officials. This has left market participants eagerly awaiting the minutes to discern the balance between hawkish and dovish policymakers.

Depending on the tone of the minutes, gold prices may witness significant movement. A more dovish stance from cautious policymakers expressing concern over high-interest rates negatively impacting the US economy could push gold prices higher.

Conversely, a more hawkish tone emphasizing rate hikes to tackle inflation may lower gold prices.

- Another crucial factor that could potentially trigger a major breakout in gold prices is the upcoming US nonfarm payrolls report for June. Market expectations are set at 225,000 new jobs added, with a slight decrease in the unemployment rate to 3.6%.

However, if the report defies these expectations, it could lead to heightened volatility across the financial markets. A weaker-than-expected NFP report, along with a higher unemployment rate, may weaken the US dollar and increase speculation about the Fed pausing future rate hikes. In such a scenario, gold prices are likely to appreciate as investors turn to the safe-haven metal.

On the other hand, if the NFP report exceeds market forecasts, accompanied by a lower unemployment rate, the US dollar could strengthen, and the argument for further rate hikes by the Fed may gain traction, potentially leading to a depreciation in gold prices.

- The UK100_m, which tracks the FTSE 100 index, has experienced a significant upswing above the psychologically-important 7500 level following lower-than-expected UK inflation data. This data has led to reduced expectations for future rate hikes by the Bank of England (BOE), causing the Pound to fall.

The weaker GBP, in turn, has improved the earnings outlook for FTSE 100 companies, driving the UK100_m higher. The technical analysis further supports this upward trend, pointing to four potential upside targets for the UK100_m. The latest UK CPI data revealed a notable slowdown in inflation, with June’s CPI growth at 7.9%, the first time it has dropped below 8% since March 2022.

The market’s reduced bets for future BOE rate hikes indicate a shift in monetary policy to combat inflation. Before the release of the CPI data, markets had predicted a higher probability of rate hikes, but the current data has altered those expectations significantly.

EUR/USD: EURUSD: 4 Crucial Factors to Monitor

- Fed Meeting: Investors watch for hints on future rate hikes, impacting EURUSD accordingly.

- ECB Meeting: A hawkish or cautious tone from the ECB influences the euro’s direction against the dollar.

- Top-Tier Data Dump: Key economic reports from US and Eurozone can rock the EURUSD.

- Technical Forces: Recent downtrend may lead to a rebound or further selling pressure.

GBP/USD: GBPUSD: 3 Key Factors to Watch

- UK June CPI: Inflation report may influence BoE hike expectations. Higher inflation may push GBP/USD beyond 1.3200, while cooling inflationary pressures may weaken it towards 1.3000.

- Dollar Volatility: Fed hike expectations and US data will impact the dollar, affecting GBPUSD. Weak US data may strengthen GBP/USD, while strong data could weaken it.

- Technical Forces – Bulls: GBP/USD remains heavily bullish on daily and weekly timeframes. An incline towards 1.3700 is possible but watch for potential pullbacks as RSI is overbought.

USD/CAD: USD/CAD Bracing for a Potential Breakout.

- Bank of Canada Rate Decision: BoC’s rate announcement may impact USDCAD. A rate hike surprise could boost CAD, pushing USD/CAD lower.

- Volatile Oil Prices: Oil market fluctuations affect the commodity-linked CAD. Rising oil prices support CAD, while weak demand may weaken it.

- Dollar Performance: Strong US jobs report influences the dollar’s outlook. Dollar strength may lift USD/CAD, while a weaker dollar could drag it lower.

- Technical Forces: USDCAD trapped in a wide range with support at 1.3250 and resistance at 1.3850. The daily timeframe shows a narrower range with support at 1.3300 and resistance at 1.3650. A breakdown below 1.3400 may lead to further decline, while a push above 1.3500 could target 1.3560 and 1.3650.

AUD/USD: AUD Rises on Weaker USD, While US Economy Signals Slowdown.

- Softer USD: AUD gains strength amid a weaker US dollar following a drop in the ISM Services Index, indicating a slowdown in the US economy.

- Challenging Conditions: ISM Services Index at 50.3, close to the boom/bust line, and the worst reading since May 2020.

- USD Index Decline: USD index holds losses from Monday’s drop, potentially leading to a sideways pattern until next week’s US inflation data and Fed rate decision.

NZD/USD: NZDUSD Poised for a Major Breakout: 3 Key Drivers to Watch.

- RBNZ Rate Decision: Expectations of a 25-basis point rate hike and potential hawkish bias may boost NZD bulls, pushing NZD/USD towards 0.6380 resistance. A surprise 50-basis point hike could propel NZD/USD beyond 0.6830.

- Extreme Dollar Volatility: US debt limit negotiations, Fed minutes, speeches, and economic data could result in heightened dollar volatility. Dollar strength may lead NZDUSD back towards 0.6150, while a weaker dollar increases the potential for a bullish breakout.

- NZD/USD Range Bound: The currency pair has been trapped within a wide range. A breakout above 0.6310 and 0.6380 could lead to a further incline toward 0.6460. On the other hand, if 0.6310 proves to be reliable resistance, NZDUSD may target 0.6150 and 0.6100 support levels.

GOLD:

Impending Gold Breakout: 3 Key Factors to Watch

- FOMC Meeting Minutes: Investors closely scrutinize the June FOMC meeting minutes for clarity on the split between hawkish and dovish policymakers. A more dovish tone could boost gold prices, while a hawkish tone may lead to a decline.

- US Jobs Report: The US nonfarm payrolls report holds the potential to rock gold prices if it defies market expectations. A weaker-than-expected report, coupled with a higher unemployment rate, may drive gold prices higher, while a stronger report could lead to depreciation.

- Technical Forces Favor Bears: Gold’s bearish channel on daily charts, combined with trading below key SMAs, signals potential downward movement. A significant drop below the $1900 level could open a path toward lower support levels at $1893 and $1858.

SILVER:

Navigating Silver’s Potential: A Guide to Analysis and Trade Decisions:

- Silver’s susceptibility to conjecture and supply and demand dynamics.

- Traders closely monitor silver due to its volatility and hedging potential.

- Understanding the correlation with gold and variations in the ratio between the two metals.

OIL:

Crude Oil Rebounds from Trendline Support: What Lies Ahead.

- Oil Price Decline: Brent experienced its worst week since early April, falling over 7% in the last week due to concerns over the macro outlook despite constructive fundamentals.

- G-7 Meeting: Discussions about potentially limiting Russian oil prices are on the agenda, but reaching an agreement may take time and require the renegotiation of EU sanctions.

- OPEC+ Ministerial Meeting: OPEC members to meet to confirm larger supply increases for August, already agreed upon in the previous meeting.

- Technical Indicators: Brent found support at the upward trendline, backed by the 100-day simple moving average. Currently trading above the 50-day simple moving average, bulls are targeting the $114 resistance level.

Watch out for Next Week’s Important Dates

- On 24th July, the United States S&P PMI report will come out. A higher-than-anticipated figure should be viewed as positive (bullish) for the USD, while a lower-than-anticipated figure should be viewed as unfavorable (bearish).

- On 27th July, the United States Initial Jobless Claims report will have a significant impact on US bond and stock markets. A higher-than-expected figure should be seen as negative (bearish) for the USD, while a lower-than-expected figure should be seen as positive (Bullish) for the USD.

- It is important to pay attention to the United States Michigan Consumer Sentiment report on the 28th of July as it may have significant impacts on major currencies. A higher-than-expected figure should be seen as Positive (bullish) for the USD while a lower-than-expected figure should be seen as negative (bearish) for the USD.