- Gold prices have retreated to $2,000 after the recent Fed meeting, with economists at Commerzbank predicting a renewed downside pressure as the market corrects its expectations of rapid interest rate changes. This shift may put XAU/USD under increased pressure as investors reassess their positions.

- Meanwhile, the US Dollar Index (DXY) advances with a 1.58% increase, forming a “morning star” candle chart pattern that could potentially trigger a bullish resumption. Oscillators like the RSI and RoC indicate a mixed outlook, with the DXY needing to achieve a daily close above 103.26 to pave the way towards testing the 104.00 level.

- The relationship between the dollar and gold remains complex, as the strengthening dollar may further dampen gold’s appeal, while robust Swiss gold exports to Asia in February signal continued physical demand for the precious metal. As investors navigate these dynamic market forces, it’s essential to keep a close eye on economic indicators and global trends that could impact both the DXY and gold prices.

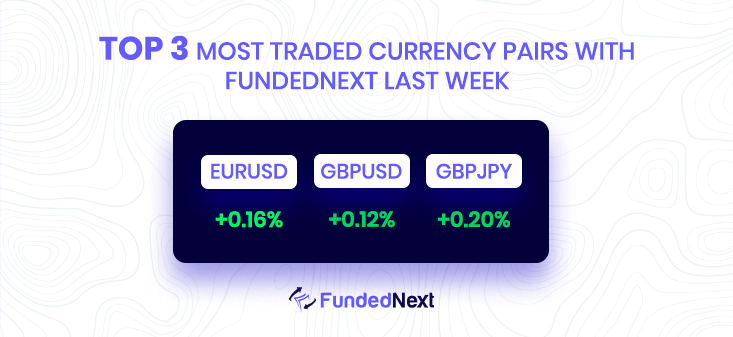

Forex:

EUR/USD: EUR/USD Faces Pressure as Triple Bottom Lingers: Banking Crisis Fears and Mixed Economic Data Impact Market:

- EUR/USD experiences a 0.64% drop, despite a risk-on impulse, as concerns over a potential banking crisis in the Eurozone weigh on the shared currency.

- Mixed US economic data indicates a deceleration of the economy, while investors speculate that the Fed will lower interest rates in 2023.

- ECB policymakers prioritize addressing high inflation levels in the Eurozone, with Bundesbank President Joachim Nagel emphasizing the need for action.

- S&P Global PMI data for March shows improvement in the US, while Euro area PMIs remain positive, except for the Manufacturing component, which stays in recessionary territory.

GBP/JPY: GBP/JPY Facing Downward Pressure, Heading Towards 159.20 Support:

- GBP/JPY extends the downtrend as it breaks the one-week-old ascending trend line.

- Reversal from key EMA confluence and downbeat oscillators favor sellers.

- Ascending support line from January 13, near 159.20, is the next key target for bears.

- Upside break of support-turned-resistance around 161.25 requires validation from EMA confluence to attract buyers.

GBP/USD: GBP/USD Slips Amid Mixed UK Data and Resilient US Dollar: Market Faces Uncertainty as Fed Officials Address Inflation:

- GBP/USD set to end the week with 0.40% gains, but retreated to 1.2228 after mixed UK economic data and a strong US Dollar.

- Federal Reserve officials emphasize commitment to bringing inflation back to the 2% target, with St. Louis Fed President James Bullard calling for rates in the 5.50%-5.75% range.

- US economic data presents a mixed picture, with S&P Global PMI improving in March, while the Manufacturing Index remains in contraction territory and Durable Good Orders decline by 1%.

- UK Retail Sales exceed estimates, but S&P Global PMIs disappoint, with Manufacturing PMI stagnating and Services and Composite PMIs showing a slight downturn.

AUD/USD: AUD/USD Under Pressure: Key Support Targeted Amid Bearish Sentiment:

- AUD/USD facing downside pressure, struggling below key 0.6720 area.

- Bearish trend dominates lower time frames, emphasizing potential deeper move into support.

- M-formation on the 4-hour chart, possible correction to the neckline aligns with 38.2% Fibonacci of prior bearish leg.

- Resistance at 0.6725 guards potential bullish breakout, but focus remains on downside for now.

NZD/USD: NZD/USD Weakening, Bears Target Key Trendline Support:

- NZD/USD trades lower as bears remain in control, eyeing key trendline support.

- Year-long breaks in structure signal potential downside correction.

- Critical support at 0.6064 eyed upon breaking dynamic trendline support.

- On the hourly chart, 0.6220 and 0.6200 are key structures if bears maintain control below counter-trendline resistance.

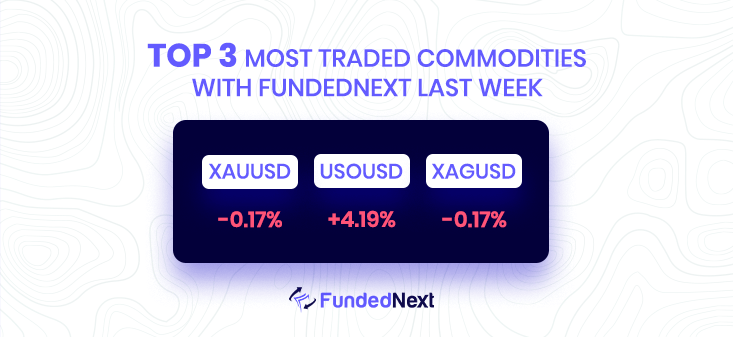

GOLD: Gold Struggles to Extend Rebound as Yields and USD Stabilize:

- XAU/USD hovers around $1,993-94, facing resistance from an upward-sloping trendline since August 2022.

- US Dollar and Treasury bond yields consolidate, influencing gold price movements.

- Mixed US economic data and fears of additional Fed rate hikes contribute to the pause in gold’s upward trajectory.

- Busy economic calendar, including US PMIs and Durable Goods Orders, expected to impact XAU/USD trading.

SILVER: Silver Price Retreats as Bearish Chart Formation Signals Potential Decline:

- Silver price drops to $23.00, snapping a two-day winning streak and forming a one-week-old rising wedge.

- Overbought RSI and sluggish MACD signals contribute to the downside bias.

- Key support levels at $22.80, $22.60, and moving averages may limit further decline.

- Bulls need to overcome the $23.20 hurdle to defy bearish chart formation, with $23.60 as a strong resistance level.

OIL: WTI Declines Below $67.00 Amid Banking Turmoil and Strong Dollar:

- WTI crude oil prices extend losses, reaching 3-day lows in the sub-$67.00 region.

- Banking concerns and potential contagion fears weigh on trader sentiment, driving prices down.

- A rebound in the US dollar and possible delays in restocking oil inventories by the Biden administration also contribute to the decline.

- Upcoming Baker Hughes report on US oil rig count will provide additional market insight.

Watch out for next week’s important dates:

- On 28th March, the US goods trade balance report will come out.. A figure that is higher than anticipated should be viewed as positive (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- On 29th March, the Australian PMI report will have a significant impact on Aud, bond and stock markets. A higher than expected figure should be seen as positive (Bullish) for the AUD while a lower than expected figure should be seen as negative (bearish) for the AUD.

- It is important to pay attention to the continuous jobeless report on 30th March as it may have significant impacts on major currencies. A higher than expected figure should be seen as positive (bullish) for the USD while a lower than expected figure should be seen as negative (bearish) for the USD.