The world of trading and investing is constantly changing, and staying on top of the latest market trends and data is crucial for making informed decisions. This post analyzes the previous week’s market statistics and their implications for traders and investors.

It covers top payouts, trading stats, and instruments, as well as the impact of the global market update on major currency pairs.

Top 5 Payouts:

Last week, the highest payouts recorded were;

- $42,752 – 300K Account Size (Merged) – 14.25%

- $36,124 – 280K Account Size (Scaled Up) – 12.90%

- $32,122 – 220K Account Size (Scaled Up) – 14.60%

- $26,643 – 200K Account Size – 13.32%

- $22,564 – 150K Account Size (Merged) – 15.04%

These substantial payout amounts demonstrate the volatility of the market and the presence of numerous profitable opportunities for traders. The significant payouts indicate that traders were successful in capitalizing on these opportunities by making astute investment decisions.

Weekly Trading Stats:

During the week, traders received a total payout of $1,466,537, distributed among 1,723 individuals. This suggests that a considerable number of traders actively engaged in the market, and those who made sound investments were able to achieve substantial profits.

Throughout this period, a total of 873,942 trades were executed, involving a total of 506,900 lots. These figures highlight a notable level of trading activity, indicating a market environment characterized by volatility and movement.

Weekly Trading Instruments:

The top trading pairs during the week were XAUUSD, EURUSD, NDX100, US30 & GBPUSD. These pairs are popular among traders and investors and are known to be volatile, which makes them attractive for investment. The high trading volume of these pairs indicates that they were in demand during the week, and traders were able to make profits by investing in them.

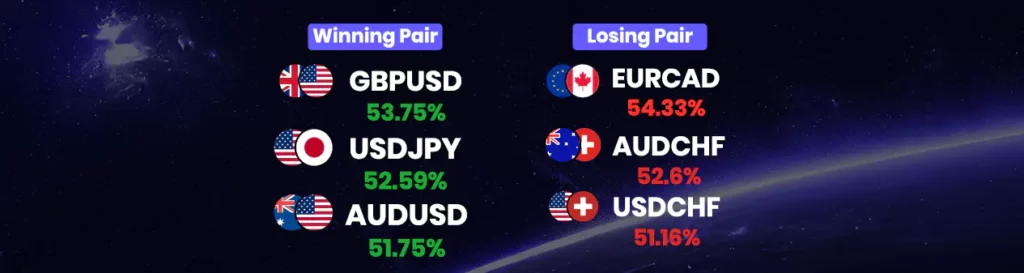

During the week, the GBPUSD, USDJPY, and AUDUSD currency pairs performed well and had winning percentages of 53.75%, 52.59%, and 51.75% respectively. This implies that traders who traded these pairs potentially made notable profits.

On the other hand, the EURCAD, AUDCHF, and USDCHF currency pairs did not perform as well and had losing percentages of 54.33%, 52.60%, and 51.16% respectively. This suggests that traders who invested in these pairs might have experienced losses.

|| US Dollar Defies Global Conspiracy: BRICS, China, and the Shocking Gold Twist You Didn’t See Coming! ||

Global Market Update:

- The US Dollar remains robust despite challenges, including the BRICS convention, which focused on reducing their US Dollar dependency, and the People’s Bank of China issuing its strongest Yuan fixing against the USD.

Meanwhile, the annual Jackson Hole Symposium in Wyoming, where global central bank leaders discuss monetary policy, is anticipated to be a significant event that could influence the US Dollar’s direction.

- Equity markets globally are experiencing a downturn, with Asian equities and the Hong Kong Exchange notably affected. The US futures, however, show a slight positive trend.

The CME Group FedWatch Tool indicates an 88.5% probability that the Federal Reserve will maintain the current interest rates in September. The US Dollar Index (DXY) technical analysis suggests a potential for both growth and decline, with key levels highlighted at 104.00 and 103.26 respectively.

- Gold prices have seen a slight recovery, reaching $1,890, but are on track for their fourth consecutive weekly decline. The bankruptcy protection filing by China’s real estate behemoth, Evergrande, in a US court has stirred market concerns, given its previous debt default in 2021.

This uncertainty, combined with fluctuating US Treasury yields, has influenced gold’s price movements. The technical outlook for XAU/USD remains cautiously bearish.

EUR/USD:

- EUR/USD is currently stable in the upper 1.08s, with a trading range roughly between 1.0850-1.0900.

- Key levels to watch are support at 1.0835 (June’s low) and resistance at 1.0920.

- Multiple financial institutions, including ING and Commerzbank, predict continued sideways trading for the EUR/USD pair.

GBP/USD:

- UK Retail Sales for July saw a significant drop of -1.2% MoM, surpassing the expected -0.5% decline. However, strong UK GDP and wage growth continue to support the Bank of England’s (BoE) potential rate hike, with expectations of a 6% peak on the Bank Rate.

- GBP/USD experienced a retreat, trading at 1.2740 after reaching a daily high of 1.2766. Despite the decline in Retail Sales, the GBP/USD is anticipated to appreciate due to the interest rate differential favoring the Sterling when compared to the US Federal Funds Rates.

USD/CAD:

- The USD/CAD pair is currently trading within an ascending trend channel observed since August 10 on the one-hour chart. As of the early European session on Friday, the pair is positioned slightly above the 1.3540 mark, with a minor decline of 0.01% for the day.

- Factors bolstering the US dollar include the Federal Reserve’s inclination towards another interest rate hike due to persistently high inflation and the safe-haven appeal of the Greenback amidst concerns over China’s property crisis, particularly following Evergrande’s bankruptcy filing.

- From a technical standpoint, the pair’s bullish momentum is evident as it remains above the 50- and 100-hour Exponential Moving Averages (EMAs) with an upward trajectory.

The Relative Strength Index (RSI) also supports this bullish sentiment, standing above 50. Immediate resistance and support levels are pegged at 1.3550 and 1.3500, respectively.

AUD/USD:

- The AUD/USD pair is experiencing a positive shift, moving past the 0.6400 mark, breaking the eight-day decline that saw it hit a year-to-date low.

This change in trajectory is influenced by expectations of more economic stimulus from China, especially in light of concerns surrounding the country’s property sector, exemplified by Evergrande’s recent bankruptcy protection filing.

- The US Dollar (USD) is currently in a consolidation phase, slightly below its highest level since July 12. This is due to a slight pullback in US Treasury bond yields.

However, the Federal Reserve’s stance on maintaining higher interest rates for an extended period, as indicated by the recent FOMC meeting minutes, is likely to support the USD and limit significant gains for the AUD/USD pair.

- The Australian economic landscape also plays a role in the AUD’s performance. Recent job data showed a loss of 14,600 jobs and an unexpected rise in the Unemployment Rate to 3.7% in July.

This data, combined with the anticipation of the Reserve Bank of Australia (RBA) maintaining its current rate in September, suggests that traders might be cautious about making aggressive bullish moves on the Aussie.

NZD/USD:

- The NZD/USD pair is experiencing a modest recovery from its year-to-date low of 0.5900, currently trading around the 0.5935 mark. This recovery is influenced by concerns surrounding China’s property sector, particularly after Evergrande’s recent bankruptcy protection filing, which has spurred hopes for more economic stimulus from China.

Additionally, the Reserve Bank of New Zealand’s (RBNZ) hawkish stance on interest rates provides support to the New Zealand Dollar (NZD).

- The US Dollar (USD) is seeing a slight decline, influenced by a minor pullback in US Treasury bond yields. However, the Federal Reserve’s inclination towards maintaining higher interest rates, as indicated by the recent FOMC meeting minutes, is expected to limit the USD’s losses and subsequently cap significant gains for the NZD/USD pair.

- While there are no significant US economic data set for release on Friday, the broader market sentiment and USD dynamics will likely influence the NZD/USD pair’s movement.

The pair is on track for its fifth consecutive weekly loss, with upcoming flash PMI data and the Jackson Hole Symposium being key events to watch in the coming week.

Commodities:

Gold:

- The XAU/USD Gold spot price has seen a slight recovery, reaching $1,890 by the week’s end. However, it’s on track for a 1% weekly decline, marking its fourth consecutive weekly loss.

This decline is attributed to rising US Treasury yields, which are viewed as the opportunity cost of holding gold. The yields increased primarily due to the Federal Open Market Committee’s (FOMC) hawkish stance.

- The bankruptcy protection filing of China’s real estate giant, Evergrande, in a US court has raised concerns about the health of the Chinese economy.

Given Evergrande’s history of defaulting on significant debts in 2021, which had a considerable market impact, investors might seek refuge in gold in the upcoming sessions.

- From a technical perspective, the XAU/USD’s daily chart indicates a neutral to bearish outlook. Despite some signs of a potential recovery, the gold price remains in a negative zone.

The Relative Strength Index (RSI) points to a possible increase in buying pressure, while the Moving Average Convergence (MACD) shows neutral red bars. The price is also below the 20, 100, and 200-day Simple Moving Averages (SMAs), suggesting that bears dominate the broader market trend.

Silver:

- Silver prices experienced a slight uptick of 0.07% on Friday, influenced by a decrease in US Treasury bond yields and a mixed market sentiment. The XAG/USD is currently trading at $22.74, having touched a daily low of $22.64.

Despite this recovery, the metal-faced challenges near the weekly high of $23.00, with the 200-day Moving Average (DMA) acting as a significant barrier.

- The technical outlook for XAG/USD suggests that while there are potential gains for the week, the price action on Thursday provided sellers with a more favorable entry point, especially near the weekly highs.

The inability of buyers to push beyond and reclaim the 200-day DMA at $23.29 indicates potential vulnerability to selling pressures.

- On an intraday basis, XAG/USD’s movement is relatively sideways with a slight upward tilt. There are still risks on the upside, especially as the metal tests a descending resistance trendline. If this trendline is breached, the next resistance level to watch is $22.80, followed by a convergence of the weekly high and Friday’s R1 daily pivot around $23.00 per ounce.

A significant breakthrough at this level could lead to a test of the June 15 daily low turned resistance at $23.22, and subsequently, the June 8 low at $23.42.

Oil:

- The West Texas Intermediate (WTI) barrel experienced a rise of over 1% by the week’s end, surpassing the 20-day Simple Moving Average (SMA) and reaching around $81.30.

This increase is attributed to the recent report indicating a decline in the weekly Baker Hughes Rig Counts, suggesting a potential drop in US Oil production, which could intensify global supply constraints and push oil prices higher.

- However, economic challenges in China, particularly the bankruptcy protection filing of real estate giant Evergrande, may hinder WTI’s upward momentum. Given that China is the world’s largest oil importer, economic instability in the country could reduce energy demand, thereby limiting potential gains for WTI.

- The US Dollar (USD), as indicated by the DXY index, reached a daily peak of 103.60, its highest since mid-June. This surge is due to market expectations of a hawkish stance by the Federal Reserve (Fed), especially after the recent Federal Open Market Committee (FOMC) minutes highlighted concerns about inflation and the possibility of another rate hike.

A strengthened USD and higher interest rates could pose challenges for oil prices in future sessions.

Watch out for Next Week’s Important Dates

- On 23rd Aug, the United States S&P Global Manufacturing PMI report will come out. A higher-than-anticipated figure should be viewed as positive (bullish) for the USD, while a lower-than-anticipated figure should be viewed as unfavorable (bearish).

- On 24th Aug, the United States Initial Jobless Claims report will have a significant impact on US bond and stock markets. A higher-than-expected figure should be seen as negative (bearish) for the USD, while a lower-than-expected figure should be seen as positive (Bullish) for the USD

- It is important to pay attention to the United States JOLTs Job Openings on the 29th of August, as they may have significant impacts on major currencies. A higher-than-expected figure should be seen as Positive (bullish) for the USD while a lower-than-expected figure should be seen as negative (bearish) for the USD.