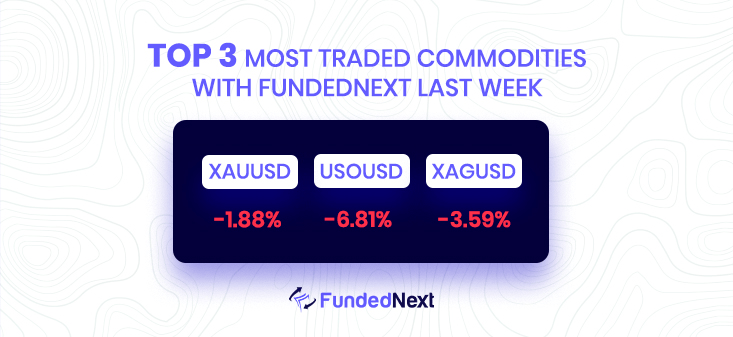

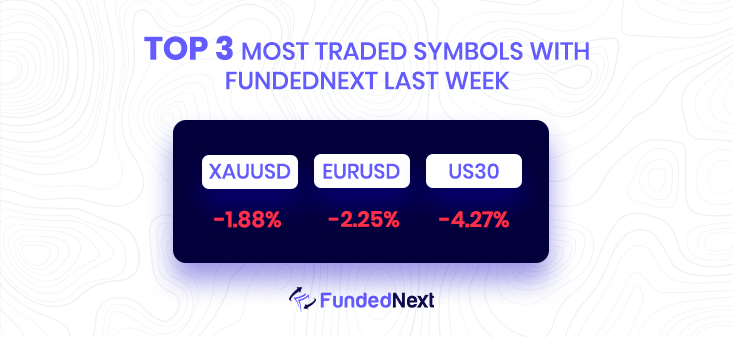

- The US inflation data came in hotter than anticipated, keeping pressure on the Federal Reserve to rapidly hike rates. Gold plummeted to its lowest level in over a month.

- When the consumer price index unexpectedly increased 0.1% in August compared to the previous month, the market expected a small fall. Following the data release, the dollar and Treasury rates soared, prompting gold to decline by as much as 1.6%, the highest since August 15.

- Prior to its meeting next week, the CPI report will keep the Fed on a hawkish course. Despite inflation slowing earlier in the summer, officials indicated that another 75 basis-point tightening was imminent, and the swaps market has now completely priced in the enormous increase.

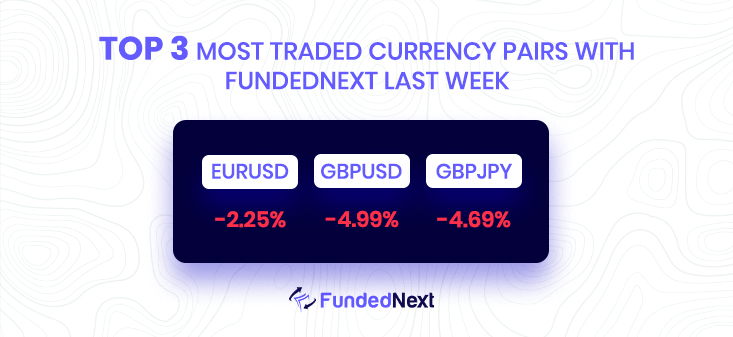

EURUSD: After bouncing back in the early Tokyo session from close to the crucial support of 0.9813, the EUR/USD pair has since moved around 0.9840. Multiple tests of Wednesday’s low were followed by a rebound move, demonstrating the stability of the support. It will be interesting to see how much the assets may fall after giving up the aforementioned support.

- After the aggressive Fed policy, weakness seems to be preferred as the EUR/USD oscillates around 0.9840.

- On the US PMI front, a mixed performance is predicted, while the Eurozone PMI will continue to decline.

- The ECB’s economic report shows that growth will be 3.1% in 2022.

USDJPY: According to the previous analysis, USD/JPY Price Analysis: Bears set to pounce as the US dollar reaches the 4-hour barrier, the yen persisted in defying the bears with further support from fundamentals.”

- Bears in the USD/JPY enter at a 61.8% ratio of about 142.20..

- If the bears decide to act, a break below 140.50 creates the possibility of a further down below 140.00.

GBPUSD: Following the Bank of England’s announcement of its interest rate decision, the pound bulls demonstrated erratic swings (BOE). Andrew Bailey, the governor of the BOE, increased interest rates by 50 basis points (bps), bringing the terminal rate to 2.25%. Since 2008, this is the cost of borrowing that is the highest.

- GBP/USD is maintaining its position above 1.1250 as the effects of the Fed’s aggressive policies have begun to subside.

- The BOE raised interest rates to 2.25 percent, which is the highest level since 2008.

- Although BOE denies it, the economy appears to be in poor shape on a basic level.

USD/CHF: Retail trader data reveals that, with a short-to-long ratio of 1.03 to 1, 49.22% of traders are net long. In reality, since Sep 09 when USD/CHF was trading at 0.96, traders have maintained a net short position; since then, the price has increased by 1.93%. While the number of net-long traders has decreased 38.51% by 34.03% from the previous week, the number of net-short traders has increased 11.36% by 6.52% from the previous week.

We frequently adopt a contrarian stance to the general consensus and the fact that traders are net short signals that USD/CHF prices may increase further.

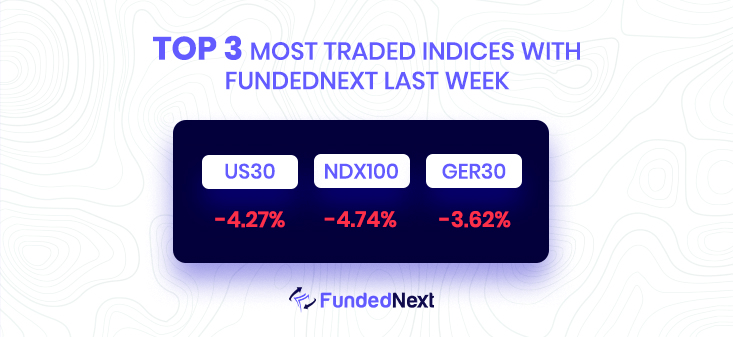

S&P500: As markets processed another sizable interest rate rise by the Federal Reserve, a most anticipated decision, major U.S. indexes ended the day in the negative. Additionally, the number of unemployment claims climbed by 5,000 to 213,000 from the anticipated 220,000.

- Despite aggressive Fed action and anxieties sparked by Russia, market sentiment is still negative.

- The Fed raised rates by 0.75% to match market expectations, but it foresees a difficult road ahead to control inflation.

- Leaders from around the world denounce Russia for its force mobilization plans.

- Some of the most influential central bankers still in the market are BOJ, SNA, and BOE.

GOLD: Following the completion of the Federal Open Market Committee’s two-day meeting, which saw the Federal Reserve’s board members unanimously decide to raise interest rates by 75 basis points, the price of gold has widened its bear cycle trend to a new low..

- Following the Fed, gold is fluctuating between daily highs and lows.

- Fed maintains its intention to raise rates further and raises rates by 75 basis points as anticipated.

- The Fed’s aggressive advice on interest rates has soured the market’s attitude.

- The DXY is moving upward toward its most recent two-decade high, now at 111.58.

SILVER: According to Credit Suisse, XAG/USD will fall towards the $15.56 support. According to Credit Suisse, XAG/USD will fall towards the $15.56 support.

- Silver has recovered above the critical $18.65/15 support level, which is the 61.8% retracement of the whole 2020–21 up-move. However, silver still retains a huge top below $21.39, and from a technical analysis standpoint, we anticipate additional declines from here until the $15.56 support.

- The next barrier is at $20.87, and a price over $21.39 is still required to negate the top, which is not what we expect to happen. To test bears before the annual low, there are several supports.

Watch Out This Week

- On September 20, the Canadian year-to-year inflation report will come out alongside the US building permits. These two reports will have a huge impact on the currencies. And as for what to expect: A figure higher than anticipated should be viewed as good (bullish) for the USD, while a lower than anticipated should be viewed as unfavorable (bearish). The same goes for CAD as well.

- The Day September 22, is almost like a D-day for the GBP and USD both currencies will get a high impact from these interest rates decision meetings. A statistic that is higher than anticipated should be viewed as good (bullish) for the pound, while a figure that is lower than anticipated should be viewed as negative (bearish). The same goes for USD as well.

- 23rd of September, the Global PMI report for EURO, GBP, and USD will come out and that will have an impact on the following region’s currencies. And this will eventually shake up the major pairs markets. A figure that is higher than anticipated should be viewed as good (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish). The same holds true for the other two currencies.