Contributor – Rean

The Smart Money Concept is a financial approach that helps traders and investors understand market dynamics and make informed decisions. The concept is based on the idea that professional traders and market makers, or “smart money,” have more information and resources than individual traders, and thus have an advantage in the market. These investors are often seen to have access to better information and insights, and their actions can be used to forecast market trends and gauge the overall direction of the market. By observing the actions of the smart money, traders can gain insights into market sentiment, trends, and price movements, and use this information to their advantage.

The Smart Money Concept is divided into several parts to give a comprehensive understanding of the approach. When it comes to making investment decisions, it is crucial to keep an eye on the moves made by smart money investors, who are known for their expert insights and market knowledge. These investors often have access to a greater wealth of information and resources, making their decisions a good indicator of market trends and potential investment opportunities.

1. For instance, if smart money investors are observed buying a certain asset, it could be an indication that the asset is undervalued and is poised to increase in value in the near future.

2. On the other hand, if they are observed selling an asset, it could be a sign that the asset is overvalued and likely to decline in value.

Thus, aligning with the decisions of smart money investors can be a wise move for investors looking to maximize their returns and minimize their risk. An example of this is in 2008, when a group of smart money investors, including George Soros, Carl Icahn, and others, sold off their holdings in financial stocks and moved into gold, predicting the subprime mortgage crisis that was about to hit the global financial market. This move not only saved them from huge losses but also helped them reap significant profits.

……..

How to Determine the Price Action While Trading

Order Block and Imbalance:

In the world of trading, there are two key concepts that can greatly impact market trends and price action: Order Blocks and Market Imbalances.

Order Block: Order Blocks, also known as large trades, are usually placed by large institutional investors or professional traders to express their confidence in a specific asset and potentially influence the market. By making a large investment in an asset, these smart money investors signal to the market that they believe the asset is undervalued or has strong potential for growth. A proper order block can indicate a market reversal after tapping or mitigating a certain level. This can attract more buyers to the asset and drive up its price.

One well-known example of an order block in the market is the 2010 “flash crash” in the US stock market. On May 6, 2010, a large institutional investor placed an order block for a substantial amount of exchange-traded funds (ETFs). This sudden influx of sell orders caused a rapid decline in the market, leading to the Dow Jones Industrial Average plummeting nearly 1,000 points in a matter of minutes. The use of order blocks in this instance caused a temporary but significant drop in the stock market, highlighting the impact large institutional trades can have on market prices.

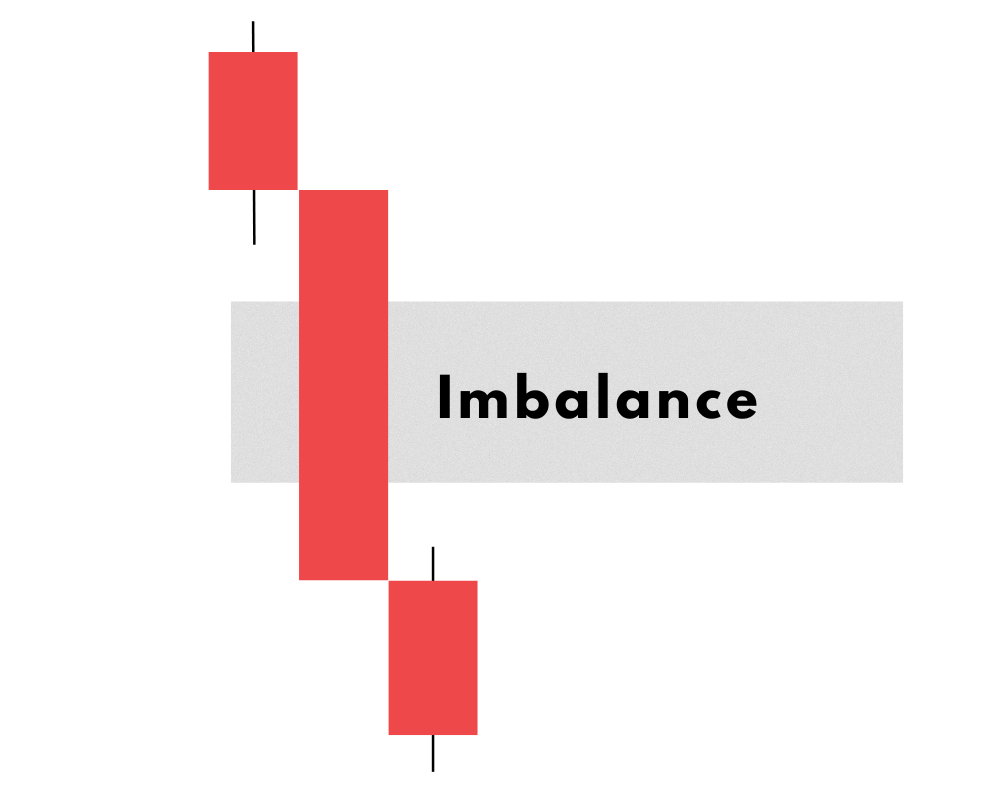

Imbalance: Market Imbalances, on the other hand, refer to situations where more people are buying or selling a particular currency than its counterpart. This creates a gap in the market and can provide trading opportunities. For example, if more people are buying the euro than are selling it, the demand for the currency will increase, and its price will go up, creating a market imbalance that can be taken advantage of by traders.

Giving an example of the past, the GameStop Short Squeeze has been widely seen as a demonstration of market order imbalances. The surge in GameStop’s stock price was driven by a large number of retail investors buying the stock, which created an imbalance in supply and demand. This buying pressure caused the stock price to soar, which forced short sellers to cover their positions, leading to a further increase in the stock price. This phenomenon is known as a “short squeeze,” and it’s an example of how market imbalances can have a significant impact on the market.

……..

Market Structure:

Market structure is an important aspect of technical analysis that traders use to determine the direction of market trends. Market structure refers to the way that price levels, trends, and patterns develop over time in a market. Traders use tools such as trend lines and chart patterns to identify the structure of a market and determine the direction of its trend.

To determine the current trend in a market, traders follow these steps:

1. Determine the time frame: Traders should first decide whether they want to analyze the market on a short-term or long-term basis. This will help them determine the most relevant data to analyze.

2. Mark high and low points: The next step is to mark all the high and low points in the market, whether it’s over hours or days for a short-term trend or over weeks or months for a long-term trend.

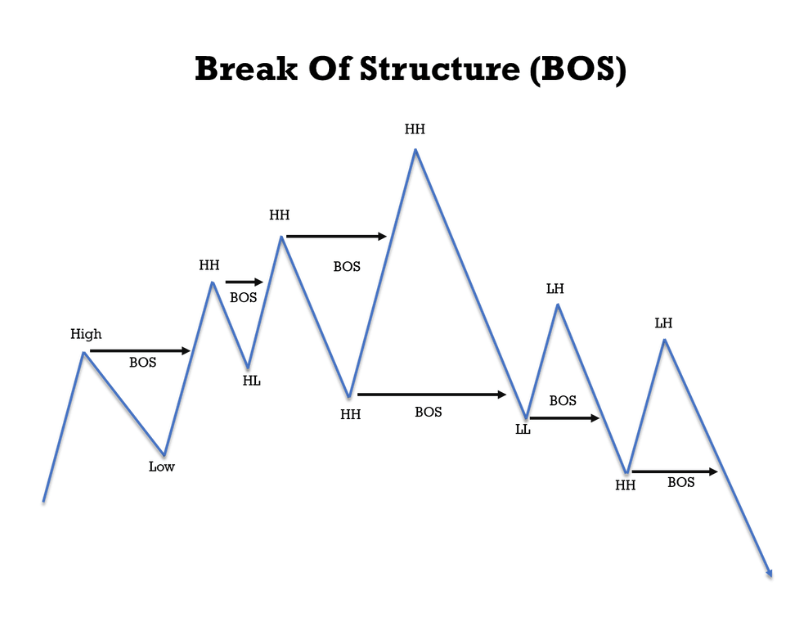

3. Identify the trend: Based on the highs and lows marked, traders can identify the trend in the market. If the market is making higher highs (HH) and higher lows (HL), it is in an uptrend. If the market is making lower highs (LH) and lower lows (LL), it is in a downtrend.

4. Observe Break of Structure (BOS): A significant price movement that disrupts the current trend in the market is known as a Break of Structure (BOS). This could be an opportunity for traders to trade, especially when a change in the market trend is identified.

For example, if the stock market was in an uptrend and making higher highs and higher lows, a sudden significant drop in price could be considered a Break of Structure and indicate a change in the market trend. Traders who are able to identify this change in market structure can adjust their trading strategies accordingly.

……..

Supply & Demand:

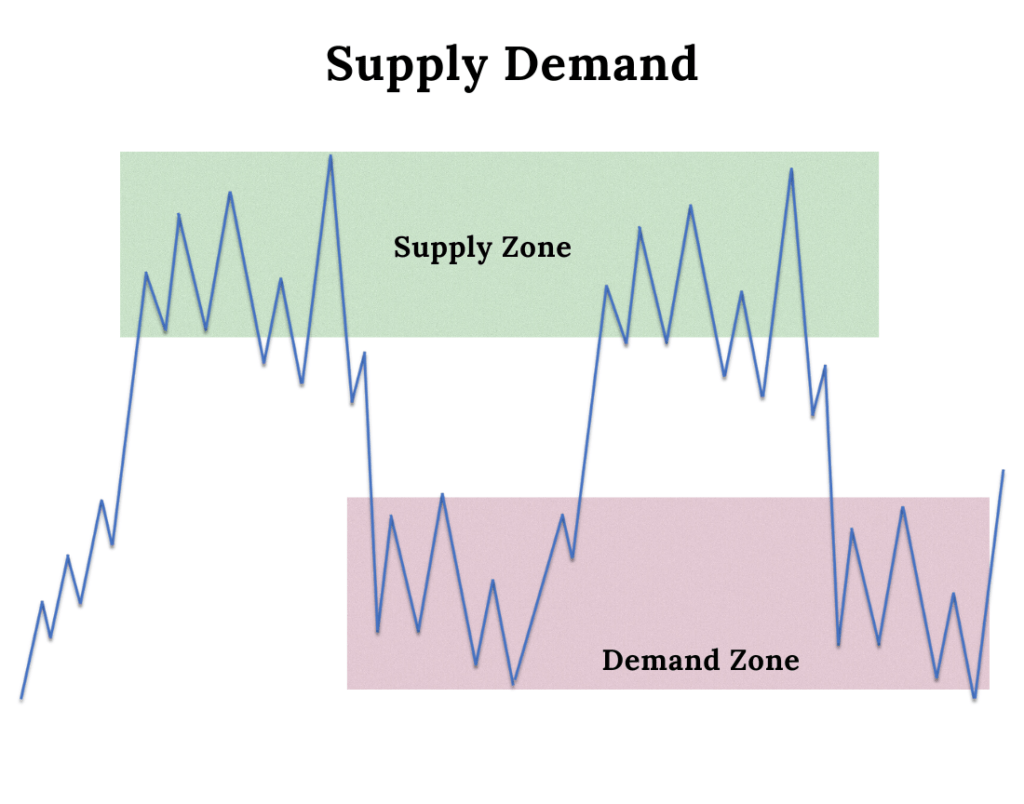

The concept of supply and demand is an integral part of the forex market and is considered the cornerstone of price determination in any market. The interplay of these two forces – supply and demand – is what ultimately determines the price of a currency. If demand is high, prices tend to rise, and if there is a surplus of supply, prices tend to fall.

It is crucial for traders to keep an eye on the balance of supply and demand in the market, as this can have a significant impact on the price movement of a currency. Tools like order flow analysis and volume analysis can be used to help traders determine the balance between supply and demand. Traders should also be aware of zones where the price is rejected as this may indicate an area of supply and demand imbalance and can be ideal for entering trades.

An example of this in action can be seen in the 2008 financial crisis, where the global demand for the US dollar skyrocketed as a safe-haven asset. This led to a surge in its price and a fall in the prices of other currencies.

By taking these principles of supply and demand into consideration, traders can make more informed investment decisions and potentially benefit from the market trends.

……..

Liquidity:

Liquidity refers to how easily an asset can be turned into cash without affecting its price. This means that if an asset is considered “liquid,” it can be bought or sold quickly and at a stable price. It is a crucial aspect of financial markets as it determines the efficiency and effectiveness of buying and selling operations. Liquidity is vital for market participants, as it determines the value of their investments, and their ability to access their funds when needed.

Here are some key points to better understand liquidity:

1. Equal Highs/Lows: This form of liquidity refers to the stability of the asset’s price, as it remains unchanged despite frequent buying and selling activity.

2. Buy-side/Sell-side Liquidity: This form of liquidity refers to the availability of buyers and sellers in the market. A market with high buy-side liquidity will have plenty of buyers, while high sell-side liquidity means that there are many willing sellers.

3. Trendline Liquidity: This form of liquidity refers to the trend of the asset’s price and its ability to move up or down without significant impact.

Traders can use liquidity analysis to evaluate market conditions and identify areas of high liquidity, which can offer potential trade opportunities. For example, during the 2008 financial crisis, the lack of liquidity in the real estate market made it challenging for homeowners to sell their properties, leading to a decline in housing prices.

……..

What Happens When You Follow the Rules of Smart Money Trading?

The concept of “smart money” is centered around the idea that certain traders have access to superior information and analysis, allowing them to make more profitable trades and better manage risk. To fully understand the potential benefits of following the smart money rules, it is important to consider the following points:

1. Superior Information and Analysis: Smart money traders often have access to proprietary information or in-depth analysis that provides a competitive edge over other traders and investors. By leveraging this information, they may be able to identify market trends and conditions earlier and make more informed trades.

2. Profitable Trades: With their superior information and analysis, smart money traders may be able to make more profitable trades than other traders. This can result in increased returns on investment, particularly over the long term.

3. Insights into Market Trends and Conditions: Observing the trades and investment decisions of smart money traders can provide valuable insights into market trends and conditions. This information can be useful for other traders and investors who are looking to make more informed investment decisions.

4. Better Risk Management: Smart money traders typically have better risk management strategies in place, which can help to reduce the overall risk of their trades. This can include the use of order blocks and imbalances in the market structure, as well as an understanding of liquidity, supply and demand.

In summary, by following the rules of smart money trading, traders and investors may be able to enjoy the following benefits:

1. Access to superior information and analysis

2. More profitable trades

3. Insights into market trends and conditions

4. Better risk management strategies.

……..

The Smart Money Concept is a comprehensive approach to understanding market dynamics and making informed trading decisions. keeping an eye on the moves of smart money investors can provide valuable insights into market trends and help investors make informed decisions that can lead to better returns on investment. The Smart Money Concept is a powerful tool for traders and investors looking to stay ahead of the curve.

4 Responses

Quite interesting! I would like to be part of this!

Thanks dear

Awesome! Its actually amazing paragraph, I have got much clear idea concerning from this piece

of writing

Glad it helped