- After posting gains versus the Euro, the Dollar, and the majority of other currencies over the last week, the British Pound appeared poised to close the month on a more solid foundation.

- Data showing that the UK economy increased in the second quarter, defying expectations for a contraction, will aid the rebound from the substantial lows recorded on Monday.Additional information released on Friday revealed that the nation’s second-quarter current account deficit was less than anticipated.

- ETF investors are still pulling out of gold ETFs, which is putting more pressure on the price of gold. The majority of financial speculators are currently betting on further price decline.

- When speculators last held net short positions in July, a price rebound started soon after. However, for this to occur, the USD would most likely need to temporarily stop appreciating, as it did around two months ago.

Forex

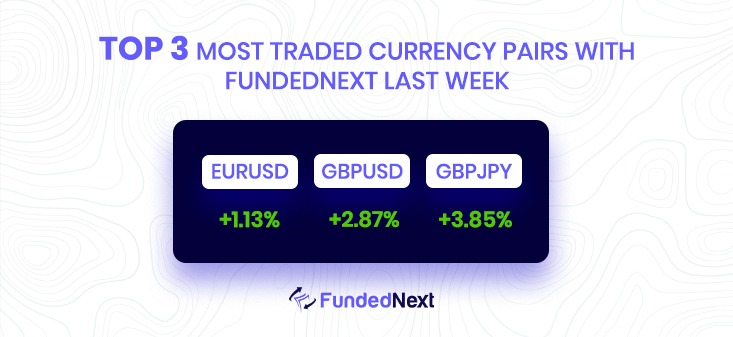

EUR/USD: As the US central bank fights strong inflationary pressures beyond the 6% mark, as demonstrated by the Fed’s preferred inflation gauge on Friday, the EUR/USD retraces from daily highs of approximately 0.9853. Fed officials expressed the requirement for higher rates for longer. At the time of writing, the EUR/USD is trading at 0.9788, which is 0.29% less than its initial price.

- Prior to the end of the week, month, and third quarter, the EUR/USD declines.

- Officials from the US Federal Reserve kept up their “restrictive policy” language while concurring that further increases are imminent.

- Analysts’ predictions for US Core PCE were exceeded, opening the door for another 75 bps Fed boost.

- The inflation rate in the EU surpassed the 10% level, and money market futures anticipate an additional 0.75 percent rise.

USD/JPY: The USD/JPY is range-bound from a technical analysis perspective, but it still has an upward tilt based on where the daily moving averages (DMAs) are situated. Any break below would likely send the major towards the 140.00 mark since the USD/JPY trading range for the week was in the 143.50-144.90 region. On the other hand, a retest of the 145.00 level is feasible, but given the BoJ’s close attention to it, traders are not defying the central bank.

- As traders get ready for the weekend, USD/JPY stays quiet around the 144.40-80 region.

- The USD/JPY is benefited by the difference in interest rates and the divergence in monetary policy between central banks.

GBP/USD: After a very tumultuous week, the pound closed the week on a high note. The GBP/USD strengthened by about a thousand pips, returning to the 1.1000 level. The negative in cable has not yet ended, according to analysts at MUFG Bank, and the current rebound presents a chance to short the stock once more.

- Despite the UK’s bond problem, the GBP/USD is expected to end the week up close to 3%.

- As Fed policymakers reaffirmed their hawkish tone, US PCE numbers raised the probability that the Fed will go to 75 basis points.

- The GBP/USD exchange rate is still trending south, and once it clears 1.1050, it may drop as low as 1.0800.

USD/CHF: Due to Federal Reserve officials appearing on newswires on Friday and emphasizing that the Fed would not make a pivot in the near future and would maintain high rates in order to contain inflation, the USD/CHF concluded the week with significant gains, rising by 1.20% on the day. The USD/CHF exchange rate was 0.9870 at the time of writing.

- The USD/CHF is getting ready to end the week with respectable gains of 0.65%.

- The pair is neutral to upward leaning on the weekly chart, continuing the climb but failing to break through 0.9900.

- The major is upward inclined, according to the USD/CHF daily chart, and after it clears the 0.9886 mark, the 0.9900 mark would come next.

Indices

In contrast to the 0.1% decline experienced in July, the indicator is expected to increase by 0.3% for the current month. It is predicted that the annual rate will increase from 6.3% to 6.6% in August. The Fed’s favored inflation indicator, the Core PCE Price Index, is expected to have increased to a YoY rate of 4.7% in August from 4.6% in July.

S&P500: The forward price-to-earnings ratio for the S&P 500 dropped from 20 in April to its current level of 16.1, and this decline coincided with a 140 basis point increase in the benchmark 10-year Treasury yield, which moves counterclockwise to prices.

- Meanwhile, according to the Stock Trader’s Almanac, the fourth quarter has traditionally been the strongest time for major U.S. stock index returns, with the S&P 500 increasing by an average of 4.2% year since 1949.

- Naturally, dip buying has had a bad year. This year, the S&P 500 has launched four recoveries of 6% or more, but each recovery fizzled out and was followed by new bear market lows.

Commodities

GOLD:

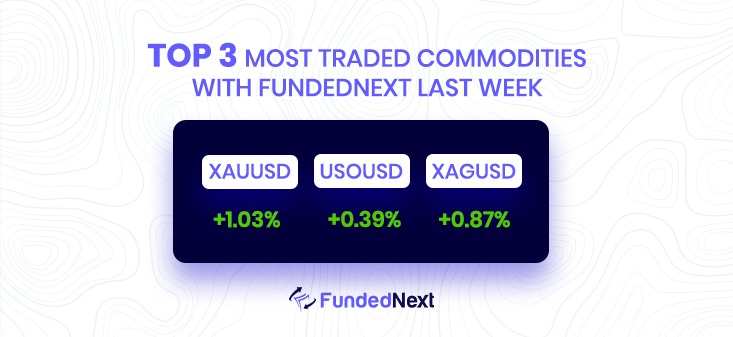

Gold gives up a significant portion of its intraday gains and drops below $1,665 during the early North American session after hitting a new weekly high earlier on Friday.

The safe-haven XAU/USD has been struggling to gain any significant traction despite mounting recession fears and geopolitical risk due to the Federal Reserve’s commitment to bringing inflation under control.

Investors have priced in the prospect of another massive 75 basis point rate hike in November because they appear to be confident that the US central bank will continue its aggressive rate-hiking cycle.

The wagers were confirmed by the US Personal Consumption Expenditures (PCE) data that was released on Friday. This data continues to operate as a headwind for the non-yielding gold price.

SILVER: According to Credit Suisse, XAG/USD will fall towards the $15.56 level.

- Silver has recovered above the critical $18.65/15 support level, which is the 61.8% retracement of the whole 2020–21 up-move. However, silver still retains a huge top below $21.39, and from a technical analysis standpoint, we anticipate additional declines from here until the $15.56 support.

- The next barrier is at $20.87, and a price over $21.39 is still required to negate the top, which is not what we expect to happen.

Oil: On Thursday, the price of a barrel of WTI had an unresolved session. The move, which came about as a result of dropping open interest and volume, reveals some lack of direction in the very near term, however it shouldn’t be ruled out that the previous decline would resume. In contrast, a return to the September low at $76.28 (September 26) is still anticipated.

Watch Out This Week

Next week is all about USD and GBP as these two major currencies will have highly impactful news. The markets are expected to shift according to the news impact.

- Like for starters, on october the 3rd Global PMI report will come out for both USD and Sterling. As traders are expecting a proper move following the news. A figure that is higher than anticipated should be viewed as positive (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- On October 05, the ADP employment change report will come out. The United States’ nonfarm private employment is being tracked, according to the ADP National Employment Report. Based on actual payroll information from about 24 million employees, it was created by Automatic Data Processing, Inc. A figure that is higher than anticipated should be viewed as positive (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

On the same day, the US trade balance report will come out, giving out vital information about the overall import and export of the country. - On October 7th, the NFP report will come out, and like every previous month, it is expected that the news will eventually result in aggressive market movements among all the pairs intertwined with the USD. A result that exceeds expectations should be seen positively (bullish) for the USD, while a figure that falls short of expectations should be viewed negatively (bearish) for the USD.