In this article, we are delving into the dynamic world of trading and investing, highlighting the importance of staying updated on current market trends and data to make informed decisions. We analyzed the market statistics of the previous week, exploring their relevance for traders and investors. The article covers various aspects such as notable earnings, trading statistics, and instruments. Additionally, it considers the impact of the global market update on major currency pairs.

Top 5 Payouts:

During the previous week, the top 5 payouts were;

- $33,806 – 200K Account Size – 16.90% Growth

- $28,373 – 150K Account Size (Scaled up) – 18.91 %

- $27,588 – 100K Account Size – 27.585 %

- $23,442 – 100K Account Size – 23.44%

- $21,442 – 65K Account Size (Scaled up) – 32.91%

These substantial payout figures exemplify the market’s volatility and the existence of multiple lucrative prospects for traders. The significant payouts serve as evidence that traders achieved success by capitalizing on these opportunities through prudent investment choices.

Weekly Trading Stats:

Last week, traders collectively received a payout totaling $1,430,317; which was distributed among 931 individuals. This indicates significant participation of traders in the market, with those who made wise investment decisions reaping substantial profits.

During this timeframe, a total of 311,741 trades were executed, involving a cumulative sum of 282,937 lots. These numbers emphasize the considerable level of trading activity, signifying a market environment characterized by volatility and dynamic movement.

Weekly Trading Instruments:

The most prominent trading pairs observed throughout the week encompassed XAUUSD, EURUSD, GBPUSD, US30, and NDX100. These pairs hold popularity among traders and investors, known for their volatility which adds to their investment appeal. The substantial trading volume associated with these pairs indicates their high demand throughout the week, presenting traders with profit-making opportunities.

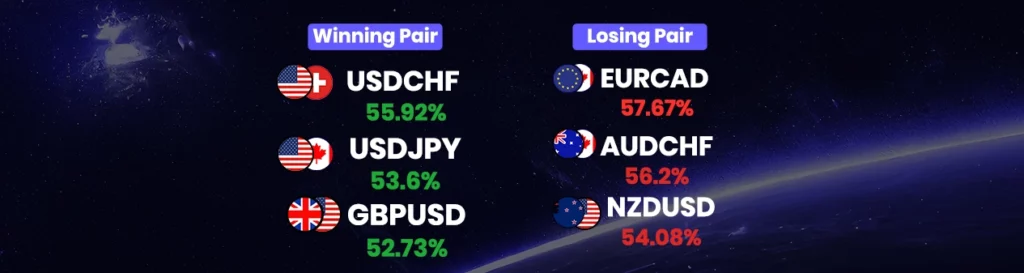

Among all the currency pairs, USDCHF, USDJPY & GBPUSD demonstrated favorable performance, boasting winning percentages of 55.92%, 53.6%, and 52.73% respectively. This suggests that traders who engaged in these pairs potentially achieved notable profits.

Conversely, the EURCAD, AUDCHF & NZDUSD currency pairs did not exhibit favorable performance, reflecting losing percentages of 57.67%, 56.2%, and 54.08% respectively. This implies that traders who invested in these pairs might have encountered losses.

|| Gold Surges Towards Resistance Amid Shaky USD Recovery and Anticipation of US CPI Release ||

Global Market Update:

- In a compelling turn of events, gold prices are rapidly approaching the critical resistance level of $1,970.00, propelled by the faltering recovery of the US Dollar Index (DXY) and mounting anticipation surrounding the release of the United States Consumer Price Index (CPI) data. As investors shift their focus to the inflation report, caution looms in the market, with expectations of its potential impact on the Federal Reserve’s policy for June.

Gold’s technical analysis further suggests a breakout from the Symmetrical Triangle chart pattern, enhancing the likelihood of heightened volatility and increased trading volume. With the precious metal trading above the 50-period Exponential Moving Average (EMA) and the Relative Strength Index (RSI) poised to enter a bullish range, the stage is set for a potentially momentous surge in gold prices.

- Amidst the pre-Federal Reserve (Fed) anxiety, the US Dollar Index (DXY) struggles near the mid-103.00s range, failing to gain traction after a two-week downtrend. While a light economic calendar and a reassessment of Fed rate hike expectations have provided some support to the greenback, bears remain optimistic. Recent US economic data has hinted at a pause in the Fed’s rate hike trajectory, but concerns over inflation persist, keeping hawkish sentiments alive.

As market participants await the release of the US Consumer Price Index (CPI) for May, which is expected to ease compared to the previous month, DXY traders find themselves in a state of anticipation, waiting for the outcome.

- The US Dollar’s performance has been dampened by downbeat economic indicators for May, including disappointing employment data and softer outcomes in the manufacturing and services sectors. United States Initial Jobless Claims reached their highest levels since September 2021, while indicators such as the US ISM Services PMI and Factory Orders also fell short of expectations. These developments have pushed back the Fed hawks, contributing to the decline in the US Dollar.

Moreover, concerns of an economic slowdown in Europe and China, coupled with a light economic calendar and lack of major data/events, have allowed US Dollar Index bears to take a breather. However, the rise in US Treasury bond yields continues to provide some hope for DXY bulls, despite the positive outcomes seen in Wall Street and S&P500 Futures.

EUR/USD: EUR/USD Grinds Lower Within Bearish Rising Wedge Formation as Fed and ECB Decisions Loom, 1.0720 Support Eyed

- EUR/USD is trading lower within a bearish rising wedge chart formation, signaling potential downside pressure.

- Impending bear cross on the MACD indicator and RSI’s retreat from overbought territory support the bearish bias.

- 1.0720 level, where the 50-SMA and the rising wedge’s bottom line converge, presents a strong support level for Euro sellers.

GBP/USD: GBP/USD Poised for Further Gains, Say UOB Group Analysts

- In the short-term, GBP/USD is expected to continue edging higher, according to Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

- The recent sharp rise in GBP/USD, reaching a high of 1.2562, was unexpected but could extend further, although the immediate resistance at 1.2680 is unlikely to be tested in the current session.

- To maintain the upward momentum, GBP/USD needs to hold above 1.2495, with minor support at 1.2520.

EUR/JPY: EUR/JPY Holds Firm Above 150.00 Despite Deepening Fears of Eurozone Recession

- EUR/JPY maintains its stability above the psychological resistance level of 150.00 in the early European session, indicating bullish momentum.

- The European Central Bank (ECB) remains committed to raising interest rates to tackle stubborn inflation, despite growing concerns of a recession in the Eurozone.

- The Eurozone’s Q1 GDP contracted by 0.1%, raising fears of a recession, particularly with the German economy already experiencing two consecutive quarters of contraction.

- The Bank of Japan (BoJ) is expected to keep its policy unchanged, as Governor Kazuo Ueda emphasizes the need for monetary stimulus to maintain inflation above 2% through higher wages and strong household demand.

AUD/USD: AUD/USD Could Challenge 0.6755 Level, Say UOB Group Analysts

- UOB Group analysts, Economist Lee Sue Ann, and Markets Strategist Quek Ser Leang suggest that the upside momentum in AUD/USD may lead to a retest of the 0.6755 regions in the coming weeks.

- In the short-term view, AUD/USD rose above the expected range, reaching a high of 0.6718. While further upward movement is possible, the likelihood of a clear break above 0.6755 in the current session is not high.

- Looking ahead, the solid resistance at 0.6755 remains, but the strong rise seen suggests an increased chance of AUD/USD breaking above this level. The next resistance above 0.6755 is at 0.6800. On the downside, a breach of 0.6645 would indicate a limitation to further advances.

NZD/USD: NZD/USD Targets Crucial Resistance at 0.6100 Amid Anticipation of Neutral Fed Policy

- NZD/USD is poised to surpass the key resistance level of 0.6100, taking advantage of a renewed decline in the USD Index.

- Investors are anticipating that the Fed will adopt a neutral stance on interest rates in June due to improving labor market conditions in the US.

- The pair is approaching the horizontal resistance of the Ascending Triangle chart pattern, with the 50-period EMA showing a non-directional performance.

- A break above 0.6110 would propel NZD/USD towards 0.6160 and 0.6200, while a downside move below 0.6015 may lead to a fresh six-month low.

GOLD:

Gold Approaches $1,970 Resistance as USD Index Pullback Falters, Focus on US CPI:

- Gold price (XAU/USD) is making significant strides towards the key resistance level of $1,970.00, capitalizing on the uncertain recovery of the US Dollar Index (DXY).

- Easing US labor market conditions have increased the likelihood of the Federal Reserve (Fed) adopting a neutral policy stance.

- Gold price is gaining strength and preparing for a potential breakout from the Symmetrical Triangle chart pattern.

- Market sentiment has turned cautious ahead of the release of the US Consumer Price Index (CPI) data, as it could influence expectations for the Fed’s policy in June.

SILVER:

Silver Price Slides Closer to 38.2% Fibonacci Level, Watch for Dip-Buying Opportunities:

- Silver continues its retracement from a nearly one-month high reached on Friday, sliding back toward the $24.00 mark.

- The technical setup suggests potential for dip-buying as the 38.2% Fibonacci retracement level acts as support.

- The $23.60-$23.55 confluence, consisting of the 200-period SMA on the 4-hour chart and the 23.6% Fibonacci level, is expected to provide a strong base and limit further downside.

OIL:

WTI Oil Price Consolidates Amidst Weak Global Demand and OPEC Production Cuts:

- West Texas Intermediate (WTI) oil price is in a consolidation phase around $71.00, as it grapples with the conflicting factors of weak global demand and OPEC’s production cuts.

- Oil prices experienced a sharp decline after a false report on the US-Iran nuclear deal was refuted by the White House, leading to market volatility.

- Concerns about bleak oil demand in China, the world’s largest oil importer, continue to weigh on the oil price, as deflation and weak demand indicators persist.

- WTI oil price has been trading in a range of $67.00 to $74.73 for over a month, with limited upside potential due to weak global demand and downside support from OPEC’s production cuts.

Watch out for Next Week’s Important Dates

- On 13th June,, the United States core inflation report will come out. A figure that is higher than anticipated should be viewed as positive (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- On 14th June, the United Kingdom Balance of Trade report will have a significant impact on British bond and stock markets. A higher-than-expected figure should be seen as positive (Bullish) for the GBP while a lower-than-expected figure should be seen as negative (bearish) for the GBP.

- It is important to pay attention to the United States Fed Interest Rate Decision report on 15th June as it may have significant impacts on major currencies. A higher-than-expected figure should be seen as negative (bearish) for the USD while a lower-than-expected figure should be seen as positive (bullish) for the USD.

2 Responses

I am from Lagos State Nigeria, and I love way you guys growing right now.

Thank You so much Christian.