- US Nonfarm Payrolls report added more jobs to the economy than expected and the unemployment rate fell to 3.4%.

- US dollar index advanced 0.58% and reached a new two-week high at 102.63.

- XAU/USD is dropping below the 20-day Exponential Moving Average (EMA) at $1891.70.

- US Treasury bond yields, mainly the 10-year benchmark note rate, climbed 12.5 bps to 3.521%.

- Gold’s technical analysis shows it is trapped within the 20-day EMA and 50-day EMA and needs to reclaim January’s 18 swing low to challenge $1900.

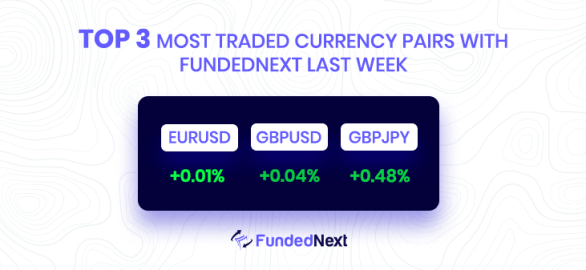

EURUSD: Impact of the US NFP Report on EUR/USD:

- US Nonfarm Payrolls showed the US economy added 517K jobs during January, surpassing estimates.

- Unemployment Rate decreased to 3.4% and Average Hourly Earnings rose 0.3% MoM.

- EUR/USD lost 0.37% and is now at 1.0866, with the next barrier at 1.1032.

USDJPY: Impacts of Upbeat NFP Report on USD/JPY:

- The US economy added 517K jobs in January, surpassing expectations.

- The unemployment rate dropped to 3.4% in January.

- The mostly upbeat NFP report boosts the US Dollar, but a weaker risk tone and hawkish BoJ expectations cap gains for the USD/JPY pair.

GBP/USD: GBP/USD Plummets on Robust US Economic Data:

- GBP/USD drops 200 pips after strong US jobs report and services activity.

- US economy adds 517K jobs and unemployment rate drops to 3.4%.

- US Federal Reserve expected to tighten rates as US economy remains solid.

- Next week’s key events for GBP/USD include UK GDP and US Fed speakers.

AUD/USD: Positive Prospects for AUD/USD Forecasted by Societe Generale:

- AUD/USD has been recovering strongly since October 2021 low

- Economists at Société Générale expect further gains for the pair

- China’s growth is benefiting Australia

- China’s reopening remains dominant macro theme in FX market

- AUD/USD performance linked to Chinese equities

- Both China and Australia’s trade surpluses have increased

USD/CHF: USD/CHF Price Analysis:

- The USD is strengthening across the FX space, driving the USD/CHF higher.

- The USD/CHF has shifted to a neutral bias once buyers clear the 20-day EMA.

- The first resistance for USD/CHF is the January 31 daily high at 0.9288, with a potential target of the 50-day EMA at 0.9307.

- The first support for USD/CHF is the 20-day EMA at 0.9210, with a potential fall below 0.9200 if bears reclaim it.

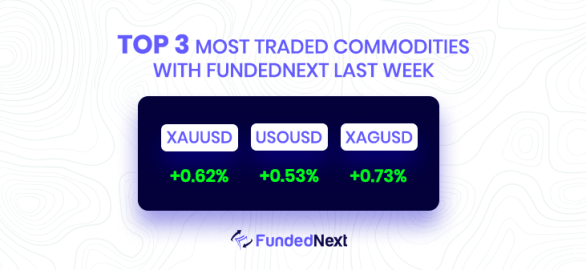

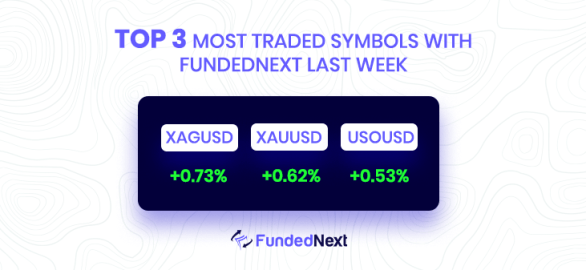

GOLD: Gold Price Correction Expected by Commerzbank:

- Gold rose above $1,950 after the Fed meeting.

- Commerzbank economists expect a correction in the next few weeks.

- Short-term investors are pricing in end to rate hike cycle and rate cuts.

- Commerzbank shares the skeptical view of ETF investors.

SILVER: Silver Price Tumbles to 8-Week Lows:

- Silver drops by over 3% on Friday, down 8% from Thursday’s peak

- US labor market and service sector show improvement in January

- US Nonfarm Payrolls rose by 517K, surpassing expectations

- ISM Service PMI rises from 49.2 in December to 55.2, in expansion territory

- Silver hits fresh monthly lows near $22.50, technical analysis suggests more losses likely

- Interim support around $22.50, strong barrier at around $22.00

OIL: WTI Climbs on Positive US Jobs Data and European Embargo:

- WTI is up after positive US job report showing creation of 517,000 jobs in January

- European embargo on Russian oil-related products and reopening of China add to the positive outlook

- WTI is forming a bullish engulfing candle pattern and could test the 20-day EMA at $78.42

- Once past the 20-day EMA, the next resistance levels are the 50-day EMA at $79.19 and $80.00 per barrel.

Watch Out This Week

- On 7th February, the US Trade Balance report will come out. A figure that is higher than anticipated should be viewed as positive (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- On February 9th, Initial Jobless Claims report has a significant impact on USD, bond and stock markets. Higher than expected figures seen as positive for USD, lower than expected figures seen as negative for USD.

- It is important to pay attention to the report on continuous Jobless Claims on 9th Feb, as it may have significant impacts on major currencies. An above average figure is considered negative for the USD, while a below average figure is considered positive for the currency.

2 Responses

Exelent beautifull

Thanks