- Gold price (XAU/USD) drops for the first time in five days while printing mild losses at around $1,750 during early Monday. In doing so, the yellow metal bears the burden of the market’s sour sentiment, as well as the cautious mood ahead of important data and events scheduled for publishing during the week.

- It should be noted that Fed Chairman Powell’s speech will be the first after the US central bank’s latest Monetary Policy Meeting and hence will be observed closely for clear directions, especially after the recently dovish Federal Open Market Committee (FOMC) Meeting Minutes.

- Federal Reserve Chairman Jerome Powell’s speech, United States Nonfarm Payrolls are crucial to watch for fresh impulse.

- Risk catalysts are the key to intraday moves of the XAU/USD price.

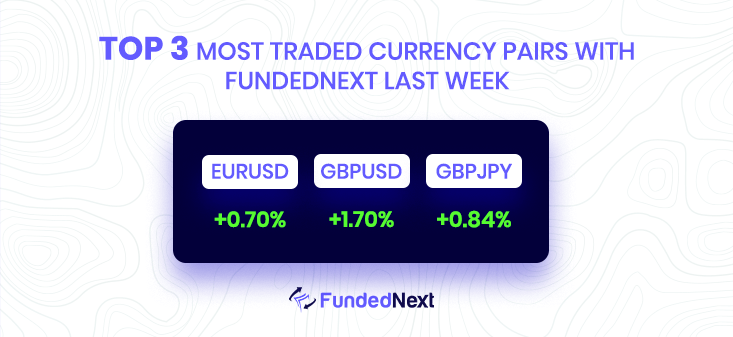

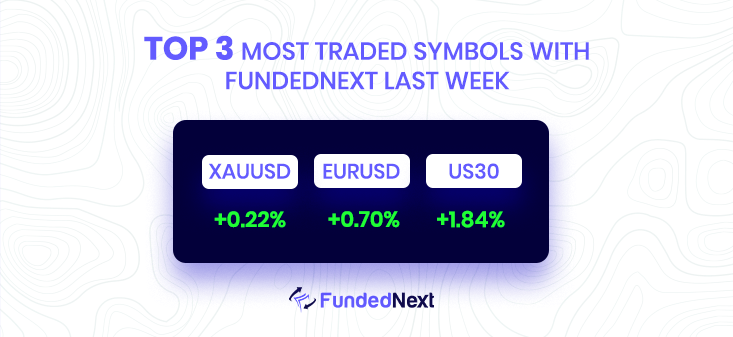

EURUSD: Weekly close above 200DMA at 1.0380 to reinforce bullish momentum.

- EUR/USD slips back to the sub-1.0400 area at the end of the week.

- Economists at Commerzbank have changed their EUR/USD forecast. The pair is now expected to reach the 1.10 level in the coming year.

- EUR/USD comes under pressure and returns to the sub-1.0400 area.

- Immediately to the upside emerges the November peak at 1.0481.

USDJPY: The rally of USD/JPY was capped by the 139.50/60 area. Near the end of the week, the pair holds firm above 139.00 supported by rising sovereign bond yields as Wall Street posts gains.

- Japanese yen weakens amid higher government bond yields.

- US Dollar Index rises 0.55% on a quiet low-volume session.

- USD/JPY heads for weekly loss despite Friday’s gains.

GBP/USD: The GBP/USD pair edges lower on Friday and moves away from its highest level since August 12, around the 1.2150-1.2155 region touched on Thursday.

- GBP/USD retreats from a multi-month high amid a modest pickup in the USD demand.

- An uptick in the US bond yields prompts some USD short-covering amid thin trading.

- Bets for less aggressive Fed rate hikes might cap the buck and lend support to the pair.

AUD/USD: With mixed feelings, the Australian Dollar (AUD) declines against the US Dollar (USD) as US shares fluctuate as a result of Federal Reserve (Fed) policymakers holding back on raising borrowing prices..

- The Australian Dollar is on the defensive due to mixed sentiment.

- Federal Reserve: US growth risks are skewed to the downside, capping the US Dollar gains.

- Next week: RBA and Fed officials’ speeches will give direction to the AUD/USD.

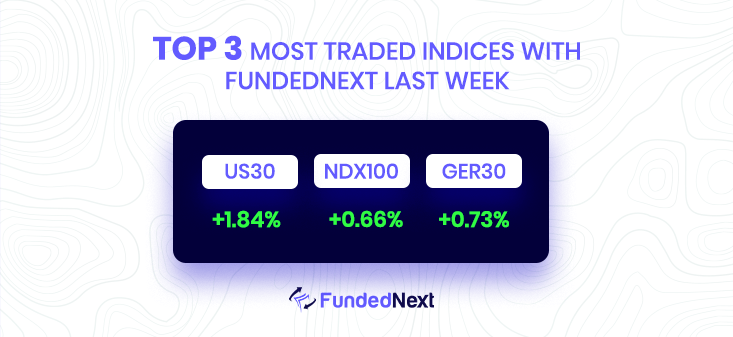

S&P500: The risk profile improves during early Thursday as a holiday in the US joins a light calendar. Also keeping the buyers hopeful are the expectations from the Chinese authorities, as well as chatters surrounding the Fed’s pivot and the easy monetary policy.

- Market sentiment remains cautiously optimistic despite the Thanksgiving holiday and light calendar.

- Fed Minutes propelled ‘pivot’ discussions, China brushes aside virus woes to ease zero-covid policy.

- Wall Street closed positive, and US Treasury bond yields refreshed their weekly low.

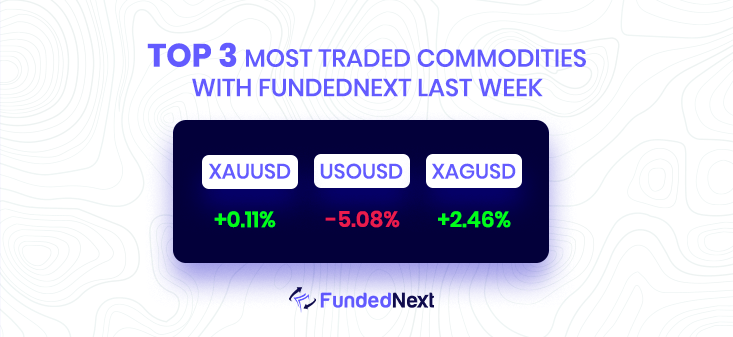

GOLD: Gold price consolidates gains amid subdued trading on Black Friday. The yellow metal could extend its rise toward the three-month high of $1,787, FXStreet’s Dhwani Mehta reports.

- Doors remain open toward the three-month high of $1,787 should bulls take out the intraday high at $1,761 and this week’s high near $1,770.

- On the downside, the psychological $1,750 level will test the bullish commitments. The next support will be seen at Monday’s low of $1,733.

- Physical demand for Gold is weakening, though central bank purchases remain strong.

SILVER: Silver edges lower on the last day of the week and moves further away from over a one-week top, around the $21.65-$21.70 region touched on Thursday. The white metal remains on the defensive through the early European session and is currently placed just below the mid-$21.00s.

- Silver comes under some selling pressure on Friday, though the downside remains cushioned.

- The technical setup supports prospects for the emergence of some dip-buying at lower levels.

- A sustained break below a trend-line resistance breakout point will negate the positive outlook.

OIL: WTI extends losses below $80.00 on buoyant US Dollar, China’s Covid woes.

- China’s coronavirus crisis weighs on WTI price, on speculations of lower demand.

- The Eurozone threatening to impose a cap on Rusian and a buoyant US Dollar keeps WTI defensive.

- WTI Price Analysis: A daily close below $80.00 could pave the way for a YTD low re-test.

Watch Out This Week

- For starters, on the 30th of November, job openings are all positions that are open as of the last business day of the month in the United States (and not filled). The Job Openings and Labor Turnover Survey includes information about available jobs (JOLTS). According to the survey findings, it gathers data from over 16400 nonfarm businesses, including retailers and manufacturers, as well as federal, state, and local government organizations in all 50 states and the District of Columbia. A higher-than-expected figure should be seen as positive (bullish) for the CAD while a lower-than-expected figure should be seen as negative (bearish) for the CAD.

- December 1, the US jobless claim report will come out along with the PMI news, giving vital information about the overall currencies (EUR, USD & GBP) value movements. A higher-than-expected figure should be seen as positive (bullish) for the currencies, while a lower-than-expected figure should be seen as negative (bearish) for the currencies.

- On December 2nd, the US NFP report will come out. Nonfarm Payrolls, monthly employment data released on the first Friday of each month, have a big impact on the US dollar’s value, the bond market, and the stock market. A higher-than-expected figure should be seen as positive (bullish) for the USD while a lower-than-expected figure should be seen as negative (bearish) for the USD.

2 Responses

please how can i be funded. i will like to be part of trading please. because i really lack fund.

Kindly knock on our customer support service.