A Guide to Find Low Forex Spread

In the journey of learning forex, the term “spread” is a fundamental concept. Traders always look for low forex spreads when it comes to choosing the perfect broker. Analyzing the market is the core of forex trading, but without inspecting the spread, the outcome will always be different than calculated. If it is still unknown to you, this guide will give you a brief overview of spreads in forex and how to find the lowest forex spreads and gain the maximum profit opportunity.

What is a Forex Spread?

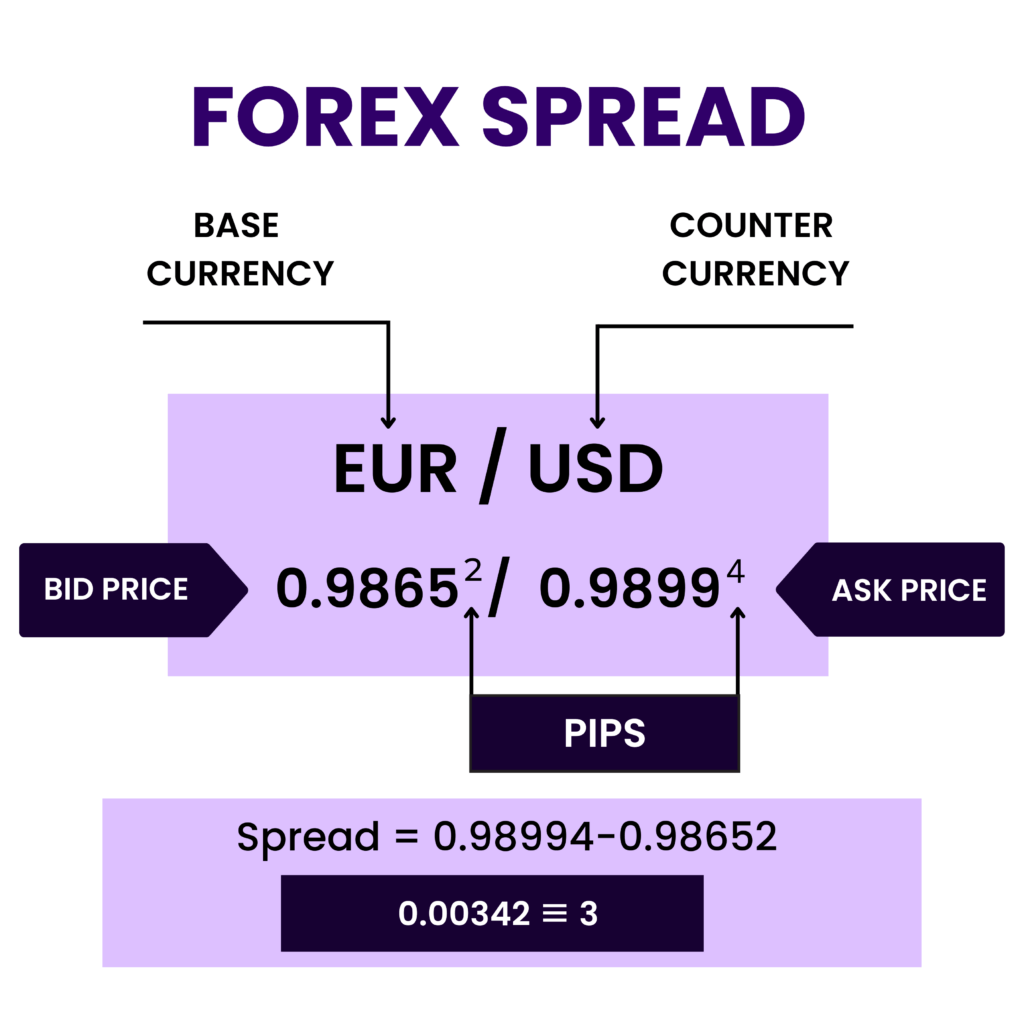

A spread is the difference between the asking price and the bidding price in the foreign exchange market. Spreads are given by the brokers according to their perception of the current market status. Brokers have the power to increase or widen the bid-ask spread.

For instance, if you trade GBP to USD with an asking price of 1.34011 and a bid price of 1.34001, the difference stands at 0.0001, which is 1 pip. So, the equation of spread is,

SPREAD = ASK PRICE-BID PRICE.

Types of Forex Spread

There are different types of spreads that need evaluation depending on the trading style. If you are a scalper or a day trader, a wide spread should be avoided. This leads to different types of spread:

1. Tight Spread: Also spelled as Narrow Spread. It is a small spread, meaning the difference between the ask and the bid price is low. This is good for short-term traders.

2. Wide Spread: The reverse of the Tight Spread, good for long-term traders.

3. Floating/Variable Spread: This refers to when the spread fluctuates.

How are Spreads Determined?

There are some factors that impact forex spreads.

1. The greater the market volatility, the narrower the spread. Geopolitical and economic factors are highly influential in terms of controlling market volatility.

2. The time of day a session opens;

3. Hours of session overlap;

4. It depends on the broker. Spreads are a way to earn money for the brokerage. A wider spread means traders have to pay more while buying and receive less while selling a currency.

What is Low Forex Spread?

Spreads are measured in pips, with 0 pips being the smallest. It is called zero spread. However, due to market fluctuations, the spread almost never remains at zero, ever. Forex markets with high volatility and low spreads are the optimum positions you should consider as opportunistic. The most volatile pair is EUR/USD as it consists of huge market volume. A spread of 0.09 to 2 would be good for short-term trades.

Traders want consistent growth for their trading careers in forex. However, not all trade with bigger investments to profit. The best way to succeed in forex is to have a small and consistent profit portfolio. This way, even if the spread is bigger, the probability of losing big is very minimal. But, to earn a consistent profit, a low forex spread is what traders should always look for.

How Does Low Spread Help to Earn Big?

If you use the right method, you can make about a 2.0% profit every day on some major pairs. However, you might still earn a large profit thanks to the extremely liquid market pairs and solid risk management strategies. All the USD pairs are good (not paired with the exotics) to trade with a narrow spread. Because of the high market liquidity, you can earn well with a wide spread. Nevertheless, taking a preventable risk is not wise.

Aside from the spread, the best way to identify the right pair in forex trading is to examine the charts to determine which ones have the greatest potential. Spread is unquestionably beneficial because it helps to reduce risks. Many experts agree that picking the appropriate spread for a forex pair is crucial since it will affect your gains and losses. However, focusing on one aspect of trading will delay your chances of earning rather than increase them.

Being a good trader is more than just the theory of the market. You need to craft and backtest your strategies as you go. It is up to you how you balance knowledge and strategy.