- The US Dollar suffered a brutal blow on Friday as investors flocked to the stock market and gold, leaving the Greenback at its lowest point in weeks. The EUR/USD rose above 1.0630 while GBP/USD surged above 1.2000, fueled by a surge in risk appetite and a recovery in Treasuries. The move comes after a positive February for the Dollar, which had held steady even as US yields hit monthly highs and economic data remained upbeat. However, Friday’s low liquidity environment was too much for the Greenback, which fell below 104.50 and added to its weekly losses in the American session.

- As the Dollar plummeted, gold broke above $1,850 to reach its highest level in two weeks, with silver also rising to $21.25, the strongest level since February 24. US yields also pulled back further, with the 10-year yield dropping to 3.96%. Meanwhile, emerging market currencies appreciated during Friday’s American session, with USD/MXN dropping below 18.00 to test 2018 lows. The Pound gained momentum, with GBP/USD soaring toward 1.2050, while EUR/GBP trimmed weekly losses and fell below 0.8830. Despite the upbeat economic data and strong yields, investors appeared to be turning away from the Dollar and toward stocks and commodities as the global economic recovery gained steam.

- The Gold market remains vulnerable to market expectations around the Fed’s monetary policy. Strong economic data from the US with sticky inflation raise the risk of more rate hikes; this is likely to be a headwind in the short term.

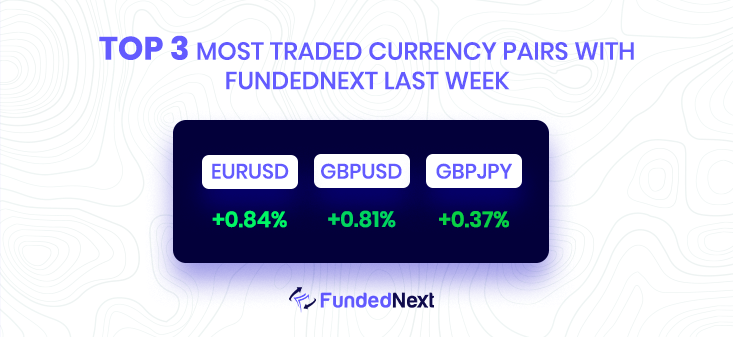

EUR/USD: EUR/USD gains on a weak USD and a resilient US economy.

- EUR/USD set to finish the week with gains of more than 0.80%.

- Soft US Dollar due to speculations that the Fed won’t hike rates beyond market expectations.

- US ISM Non-Manufacturing data shows business activity in the US remains strong.

GBP/USD: GBP/USD Rises Closer to 1.2000 Mark Amid USD Weakness.

- GBP/USD finds support near 200-day SMA and gains positive traction on Friday.

- Retreating US bond yields lead to some selling around the USD, providing support to the pair.

- Rising bets for additional rate hikes by the BoE and the Fed call for caution among aggressive traders.

GBP/JPY: GBP/JPY bulls set sights on breaking trendline resistance

- GBP/JPY sees a slight uptick, reaching a high of 163.62 in Asia.

- Prospects of a move into the 163.70s fueling bullish sentiment.

- Trendline support on a daily basis is under scrutiny as the market questions its durability.

AUD/USD: AUD/USD downside momentum easing, say UOB economists,

- UOB economists see diminishing bets for further weakness in AUD/USD in the short term.

- AUD/USD is expected to trade sideways between 0.6700 and 0.6760 today.

- Downward momentum is waning rapidly, but only a breach of the strong resistance at 0.6800 would confirm an end to the AUD weakness that started two weeks ago.

NZD/USD: NZD/USD Extends Recovery, Finds Acceptance Above 200-EMA as USD Weakens,

- NZD/USD extends recovery above 0.6230 as USD Index incurs losses and drops below critical support level of 105.00.

- Kiwi asset scales above the 200-period Exponential Moving Average (EMA) at 0.6220, indicating a bullish trend.

- Buying opportunity in NZD/USD will emerge if it surpasses March 1 high at 0.6276, with next resistance at 0.6300 and 0.6389, while a breakdown of January 6 low at 0.6193 may expose the asset to more downside.

Commodities:

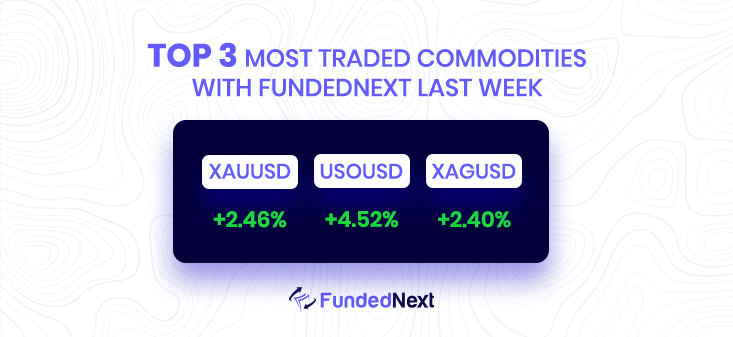

GOLD: Gold Price Forecast: XAU/USD to struggle near term as Fed set to remain hawkish – ANZ

- Gold is likely to track shifting market expectations around the Fed tightening in the short term, according to strategists at ANZ Bank.

- USD is likely to weaken in the second half of 2023.

- The Gold market remains vulnerable to market expectations around the Fed’s monetary policy. Strong economic data from the US with sticky inflation raise the risk of more rate hikes; this is likely to be a headwind in the short term.

- Nevertheless, we see limited upside in the USD, which is a tailwind for gold prices. Even with higher terminal rates, the USD is likely to weaken in H2 2023.

SILVER: XAG/USD Consolidates Near YTD Low, Bearish Bias Remains Intact

- XAG/USD enters a bearish consolidation phase and is vulnerable to further losses.

- Failure to breach the $22.00 resistance level triggers bearish sentiment among traders.

- The relative Strength Index (RSI) shows oversold conditions, suggesting a potential for a modest bounce.

- A downward trajectory could lead to a fall toward the $20.00 psychological mark, while a move beyond $22.15 could trigger a short-covering rally.

OIL: WTI Hits Multi-Week High Above $79.00 on China’s Data and Weaker USD:

- WTI rises more than 2% to trade above $79.00, boosted by China’s data indicating increased crude demand after its reopening.

- A report by the Wall Street Journal about the United Arab Emirates (UAE) seeking to leave OPEC initially led to a 3% fall in WTI but the rumors were later dismissed.

- US Dollar’s weakness amid the release of US ISM Services PMI is supporting the USD-denominated oil price.

Watch out for Next Week:

- On 10th March, The upcoming NFP report on Friday is highly anticipated due to strong job growth last month. FOMC member Waller suggests that rates may need to rise above 5.4% if data does not improve. A strong employment report could increase odds of a 50bp March hike, raise US yields and the dollar, and negatively impact Wall Street.

- On 8th march, the Employment Change report had a significant impact on EURO, bond and stock markets. A higher than expected figure should be seen as negative (bearish) for the EURO while a lower than expected figure should be seen as positive (bullish) for the EURO.

- It is important to pay attention to the report on Australia’s Balance of Trade report on 7th March as it may have significant impacts on major currencies. A higher-than-expected figure should be seen as positive (bullish) for the USD while a lower-than-expected figure should be seen as negative (bearish) for the AUD.