- The USD Index continues to show strength, surpassing the 104.00 mark and targeting the year-to-date high of 105.63. With the momentum showing signs of further gains, investors are keeping an eye on a potential test of the 2023 top in the near future.

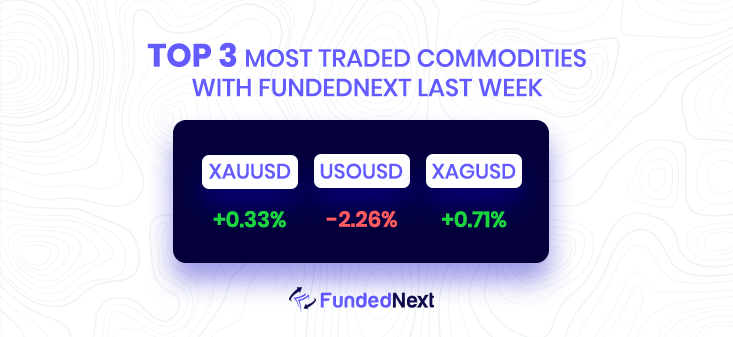

- Commerzbank’s strategists have lowered their mid-year forecast for gold prices to $1,800, down from $1,850, due to concerns about new interest rate hikes from the US Federal Reserve. The recent correction in gold prices has left investors hesitant, with hopes of an end to the rate hike cycle being premature. The strategists predict a lasting recovery in the second half of the year, with renewed expectations of rate cuts likely to follow a dip in the US economy. Therefore, they are sticking to their year-end forecast of $1,950 for gold prices. Overall, the recent concerns about interest rates have weighed on XAU/USD, leaving the outlook for gold prices uncertain in the short term.

- Commerzbank’s strategists have lowered their mid-year forecast for gold prices to $1,800, down from $1,850, due to concerns about new interest rate hikes from the US Federal Reserve. The recent correction in gold prices has left investors hesitant, with hopes of an end to the rate hike cycle being premature. The strategists predict a lasting recovery in the second half of the year, with renewed expectations of rate cuts likely to follow a dip in the US economy. Therefore, they are sticking to their year-end forecast of $1,950 for gold prices. Overall, the recent concerns about interest rates have weighed on XAU/USD, leaving the outlook for gold prices uncertain in the short term.

- The EUR/GBP cross continues to trade higher for the third consecutive day and has climbed to a one-week high above the 0.8900 mark, largely driven by the positive sentiment surrounding the euro. The upbeat UK Retail Sales report for January, released by the Office for National Statistics, failed to provide any meaningful impetus to the British Pound, which continues to struggle due to concerns that the Bank of England’s current rate-hiking cycle may be nearing its end. Meanwhile, bets for additional rate hikes by the European Central Bank (ECB) are supporting the prospects for further gains in the EUR/GBP pair. However, the broad-based strength of the US Dollar is exerting some downward pressure on the euro, which is capping the upside for the cross. Overall, the recent price action in the EUR/GBP cross suggests that the economies of Europe and the United Kingdom are facing some challenges, which are affecting their respective currencies.

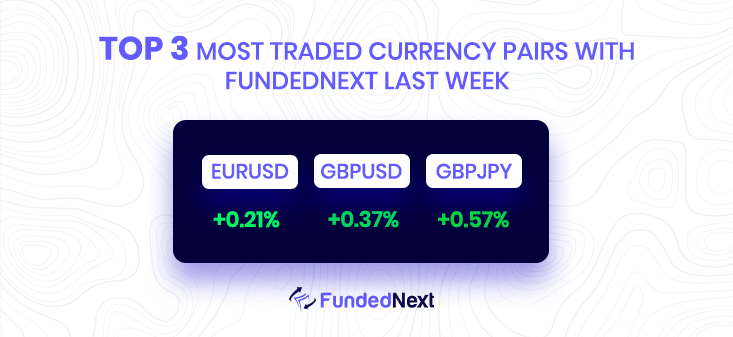

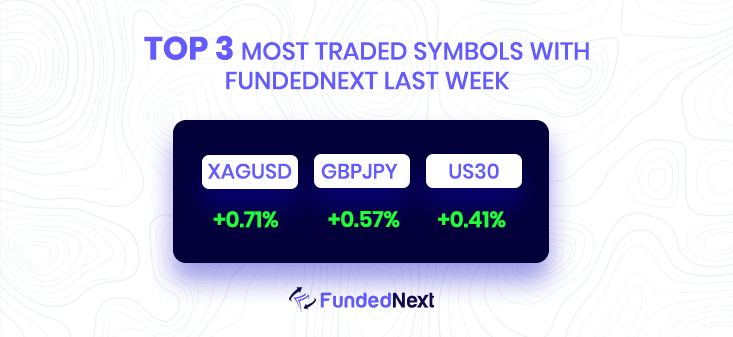

EURUSD: EUR/GBP Climbs to Over One-Week High on ECB Rate Hike Bets:

- EUR/GBP gains positive traction for the third straight day and reaches a one-week high.

- UK Retail Sales for January fail to impress GBP bulls or provide any impetus.

- Bets for additional rate hikes by the ECB support prospects for further near-term gains for the EUR/GBP cross.

GBPJPY: GBP/JPY gains modestly but lacks bullish conviction as BoJ policy uncertainty weighs on JPY:

- GBP/JPY snaps a two-day losing streak and gains around 161.00 on Friday.

- Uncertainty over the path of BoJ’s monetary policy under new Governor Kazuo Ueda weighs on JPY and supports the cross.

- Expectations that BoE’s rate-hiking cycle is near the end limit the upside for GBP/JPY, while a weaker tone in equity markets benefits JPY as a safe-haven currency.

GBP/USD: GBP/USD recovers above 1.2000 but prepares for weekly losses as Fed’s aggressive path pressures the BoE:

- GBP/USD is set to finish the week with losses of 0.16% as the Fed’s more aggressive rate-hiking path pressures BoE.

- Softer UK’s inflation data suggest BoE may not hike rates as aggressively, compared to the US Federal Reserve.

- Hotter-than-expected January US CPI and PPI figures justify Fed officials’ calls for a 50 bps increase in upcoming meetings, contributing to overall USD strength.

AUD/USD: AUD/USD finishes the week lower amid risk-off sentiment and Fed tightening expectations:

- AUD/USD ended the week with losses, reaching a daily high of 0.6884 before dropping on a risk-off impulse and Fed tightening expectations.

- US inflation data exceeded estimates, spurring hawkish commentary from Fed officials, including Cleveland and St. Louis Fed Presidents, who are advocating for a 50 bps rate increase.

- RBA Governor Philip Lowe stated that the board estimates additional rate increases will be needed in the coming months to bring inflation down, but worse than expected Australian labor market data weighed on the Australian dollar.

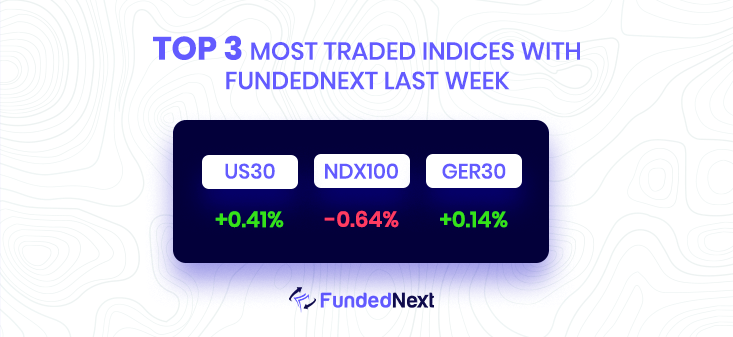

USD/CHF: USD/CHF Continues Uptrend on Broad USD Strength:

- USD/CHF rises for the fourth consecutive day, reaching a weekly high of around 0.9280-0.9285.

- Upbeat US data, hawkish Fed talks, and strong yields support the general strength of the US Dollar.

- Risk-off sentiment adds to the bullish bias ahead of Swiss Q4 Industrial Production, but technical analysis suggests strong support around 0.9235.

GOLD: New interest rate concerns weigh on the gold price forecast, – Commerzbank:

- Gold price correction has led to investor hesitancy in the market.

- Mid-year Gold price forecast lowered to $1,800 due to Fed’s steeper rate hikes.

- The Year-end Gold price forecast remains at $1,950, as a dip in the US economy is expected to spark renewed rate cut expectations.

SILVER: XAG/USD Poised to Test Multi-day Low Near $21.00

- Silver price hits an 11-week low amid a five-day losing streak.

- Bearish signals from the MACD and oversold RSI point to further downside, but the 200-DMA level around $21.00 may offer support.

- If XAG/USD falls below $21.00, a convergence of a previous resistance line and an ascending trend line close to the $20.00 psychological level may provide a significant challenge for sellers.

OIL: WTI Price Analysis: Mildly Bid Above $78.00 Within Weekly Triangle:

- WTI crude oil snaps a four-day downtrend and posts the first daily gains in five while staying within a one-week-old symmetrical triangle formation.

- The 50-SMA hurdle around $78.50 and the bearish MACD signals challenge the oil buyers.

- The weekly top of $80.75 appears to be the last defense of oil sellers, while a downside break of the symmetrical triangle’s lower line could trigger a fresh fall in the oil price towards $72.50.

Watch Out This Week

- On 21st February, the EURO Global PMI report will come out. A figure that is higher than anticipated should be viewed as positive (bullish) for the EURO, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- On February 23rd, the Continuous Initial Jobless Claims report has a significant impact on USD, bond, and stock markets. A higher-than-expected figure should be seen as negative (bearish) for the USD while a lower-than-expected figure should be seen as positive (bullish) for the USD.

- It is important to pay attention to the report on US New home sales on 24th Feb, as it may have significant impacts on major currencies. A higher-than-expected figure should be seen as positive (bullish) for the USD while a lower-than-expected figure should be seen as negative (bearish) for the USD.

3 Responses

I agree with you and your work

Kamoru you have a good day today

You too.