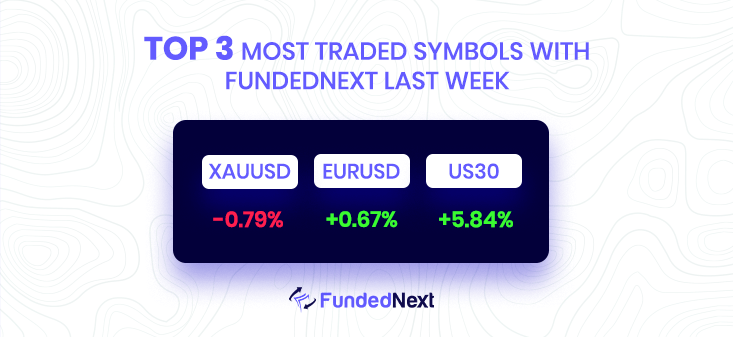

- Gold price (XAU/USD) remains pressured towards $1,638 horizontal support during Monday’s Asian session, mildly offered by the press time. The yellow metal’s latest weakness could be linked to the US dollar’s broad strength amid the market’s risk-off mood, as well as anxiety ahead of the Federal Open Market Committee (FOMC) meeting results and the US jobs report for October.

- The EUR/GBP pair has witnessed fresh demand from 0.8610 in the Tokyo session. The asset delivered a north-side break of the consolidation formed in a narrow range of 0.8610-0.8620 ahead of the German Gross Domestic Product (GDP) data.

- WTI crude oil prices extend the previous day’s pullback from a fortnight high while printing mild losses around $88.00 during Friday’s Asian session. In doing so, the black gold snaps the previous three-day uptrend while consolidating the first weekly gain in three.

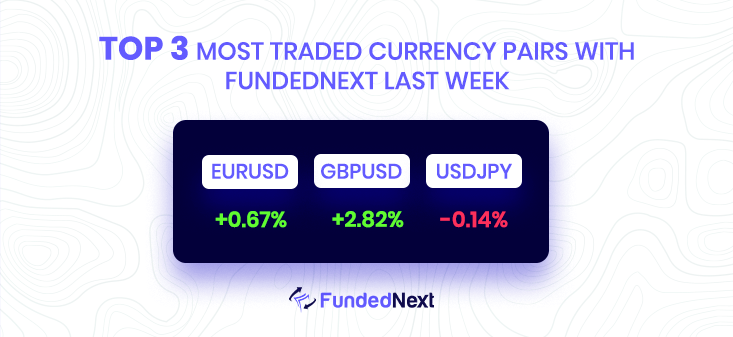

Forex:

EURUSD: EUR/USD extends the corrective downside to the 0.9930/25 band on Friday.

- In case bulls regain the upper hand, the surpass of the 1.0100 zone could spark a more serious recovery in the short-term horizon.

- The resumption of the bid bias targets the October top near 1.0100.

- EUR/USD comes under renewed downside pressure well below parity.

USDJPY: USD/JPY eyes more gains above 148.00 despite solid Japan Retail Sales data.

- BOJ failed to impress traders but Kuroda could favor sellers.

- Sustained trading below 21-DMA, two-month-old resistance line favor bears amid downbeat oscillators.

- Convergence of 50-DMA, 38.2% Fibonacci retracement restricts short-term downside.

- USD/JPY remains volatile but bears keep the reins.

GBP/USD:

The pound bounced up right above 1.1500 earlier on Friday to regain lost ground during the European and US trading sessions and reach the 1.1600 resistance area. In a bigger picture, the pair remains trading in a range for the second consecutive day, consolidating gains after a two-day rally from levels below 1.1300 earlier this week.

Investors have already priced in a 0.75% hike in December, but the increasing rumors about the possibility of scaling down monetary tightening in December are curbing demand for the dollar.

- The pound reverses its previous downtrend and returns to the 1.1600 area.

- Rumors of Fed pivoting are keeping USD bulls on a leash.

- GBP/USD remains firm, likely to retest 1.1760 – UOB.

USD/CHF: From a technical perspective, the USD/CHF remains upward biased following the pullback from the YTD high at 1.0147 towards October’s 27 low at 0.9841 due to sellers failing to extend the USD/CHF losses below the 50-day EMA at 0.9809, which, could have exacerbated a fall towards the 100-day EMA at 0.9722.

- USD/CHF advances sharply, eyeing a break of the 200-hour EMA, which could expose parity.

- During the last two days, the USD/CHF has advanced more than 1% after bouncing from the weekly lows of around 0.9841.

- Further upside is expected as November’s Fed meeting looms.

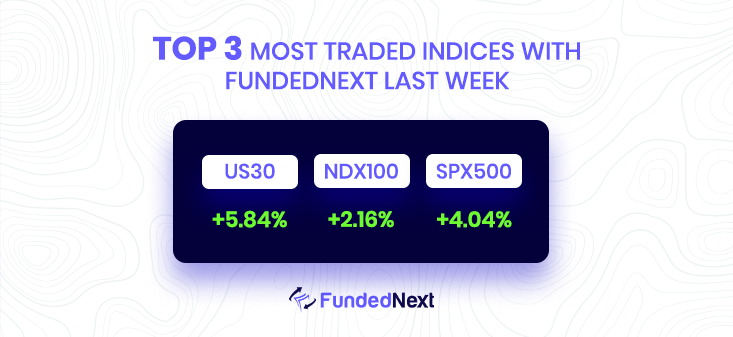

Indices:

The Fed is winning thanks to poor S&P 500 earnings. But not everyone belongs to such audiences. Another is people being concerned that there are no longer any effective ways to control inflation. One of them is Jerome Powell, whose Federal Reserve is making every effort to stop the rise in prices.

S&P500: Poor S&P 500 earnings are giving the Fed exactly what it wants.

- The Fed is winning thanks to poor S&P 500 earnings. But not everyone belongs to such audiences. Another is people being concerned that there are no longer any effective ways to control inflation. One of them is Jerome Powell, whose Federal Reserve is making every effort to stop the rise in prices.

- However, if the market contours from the previous week were slightly altered, they might support the hypothesis that investors as a whole did not view the earnings struggles as terrible news. Bond yields decreased over the course of the five days, with one of the biggest drops happening around the time that Amazon released its earnings, while the Dow industrials and an equal-weighted version of the S&P 500 also experienced significant gains.

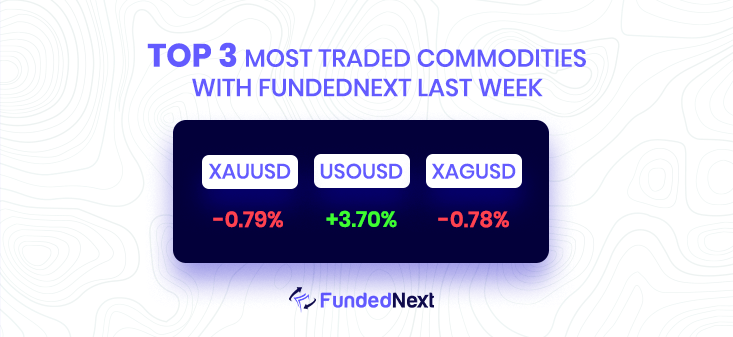

Commodities:

GOLD: Gold Price Forecast: XAU/USD slides towards $1,638 support on firmer DXY ahead of Fed’s verdict, US NFP. XAUUSD pressured as core PCE jumps, justifying further Fed action.

- Gold price records a fresh three-day low spurred by a strong US Dollar.

- The Fed’s preferred gauge for inflation, the Core PCE, smashed estimates, justifying additional action.

- Fed’s 75 bps move is price-in but clues for December will be crucial to watch for XAU/USD bears.

OIL: WTI teases sellers around $88.00 amid mixed concerns over demand-supply matrix.

- WTI prints mild losses to pare the first weekly gain in three.

- Hopes of economic recovery battle with China-linked concerns, and geopolitical headlines to trouble oil traders.

- Risk catalysts are the key for near-term directions, US Core PCE Inflation eyed as well.

Watch Out This Week

- Like for starters, on the first day of November, S&P Global PMI will be one important news to look at for 3 of the major currencies USD, CAD, and GBP. A higher-than-expected figure should be seen as negative (bearish) for the currencies , while a lower-than-expected figure should be seen as positive (bullish) for the currencies.

- November 03 , the USD interest rate will come out, giving vital information about the overall currency value movements. A higher-than-expected figure should be seen as positive (bullish) for the USD, while a lower-than-expected figure should be seen as negative (bearish) for the USD.

- On November 04, the NFP news will come out. This week the USD is anticipated to get proper movements as 2 important back-to-back news will keep the short-term bulls and bears on edge.

4 Responses

Focus on solution not a problem believe it and do it all about and everything is doing a one Man I know and every business is the best way to you up to your level you grow in and get it only one thing is your mind my teacher to much best other one but i said it only one teacher is All about all over the world 🌍 and he is the best he is time I think you should be good and understand time is tech everyone else is or you should get a name and everything is you do a rong work than you do a rong work than he is the best way to you do a great and trust only God I love you All my sweet friend

I don’t know what to say and understand that but my mind is trust only God and life is game to play with your mind and trust only

Do you mind if I quote a couple of your articles as long as I provide credit and sources back to your website?

Yes please, You can.