- Investors assessed whether monetary tightening to combat inflation in the US and Europe was getting closer to being priced on Friday, which led to an increase in Asian stocks and US share futures.

- During Friday’s Asian session, the price of gold regained its intraday high above $1,715 while consolidating its losses from the previous day. The current metal increase may be related to the paucity of significant data.

- After a choppy day, the US Dollar Index (DXY) is still down at 109.50 as Friday’s Asian session brings cautious optimism to the market and a light schedule. The European Central Bank’s (ECB) monetary policy pronouncements and Fed Chair Jerome Powell’s speech provided turbulence the day before, which helped the greenback gauge make modest gains.

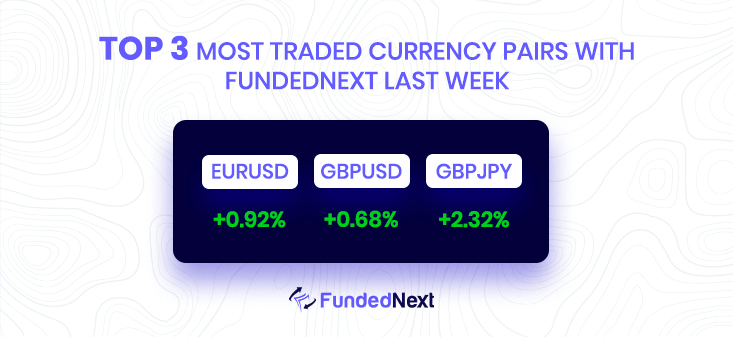

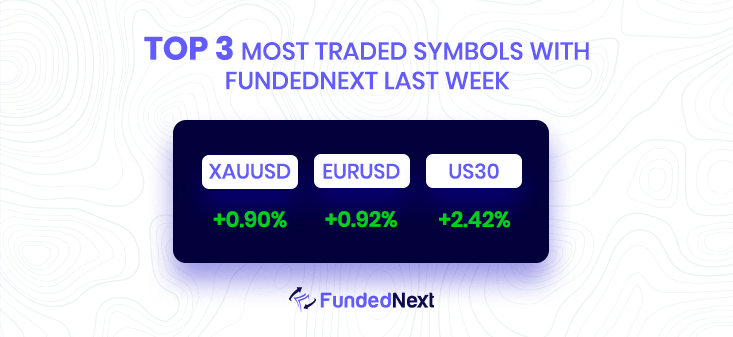

EUR/USD: As it advances to 1.0020 on Friday during the Asian session, EUR/USD continues its early-week recovery from a two-month-old support line. The major currency does this while remaining inside a downward-sloping trend channel that has been in place since early May.

- As DXY has fallen, EUR/USD seeks to kiss the round-level resistance of 1.0100.

- The Fed and ECB’s differing monetary policies have been reduced by the ECB’s decision to a 75 basis point rate hike.

- Bears have a number of supports to keep an eye on throughout the pullback, and a clear breach of the channel’s upper line is required to affirm additional height.

USDJPY: During Friday’s Asian trading session, USD/JPY was still under pressure near its intraday low near 143.60. This extends the mid-week fall from the 24-year high while printing the first daily loss in 11 days for the yen pair.

- USD/JPY resists a bullish chart pattern by maintaining its lower ground near the intraday bottom.

- Short-term selling is teased by the clear 50-HMA break, but bears may be tested by the 100-HMA’s two-week-old support line.

- Bulls can target a new multi-year high if the trade continues above 144.15 for an extended time.

GBPUSD: Bulls are active, the pound has pushed higher from a significant support ahead, and higher levels are anticipated for the next day. The pound is currently resting in the center of the week’s range.

- Bulls in the GBP/USD pair have entered and are attempting to overcome significant resistance.

- Price is correcting into the 1.1530s, and if they hold, there is substantial upside potential for the upcoming sessions.

- According to the structure of the 15-min chart, should bulls commit over 1.1530, a test of the highs may come sooner?

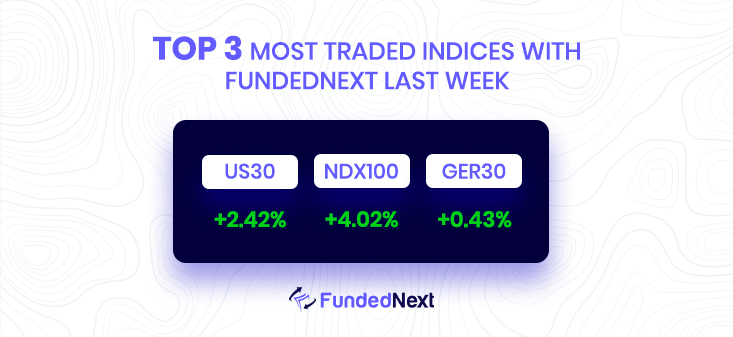

S&P500: The US 10-year Treasury rates are still hovering around 3.32% after having a good day, while the S&P 500 Futures are tracking Wall Street’s gains.

- DXY bears are optimistic that a daily close below the monthly support line, which is currently resistant at 110.20, will lead to a return to the two-month-old horizontal support near 109.30.

- After Powell of the Fed and the ECB called for higher rates, yields picked up speed to the upside.

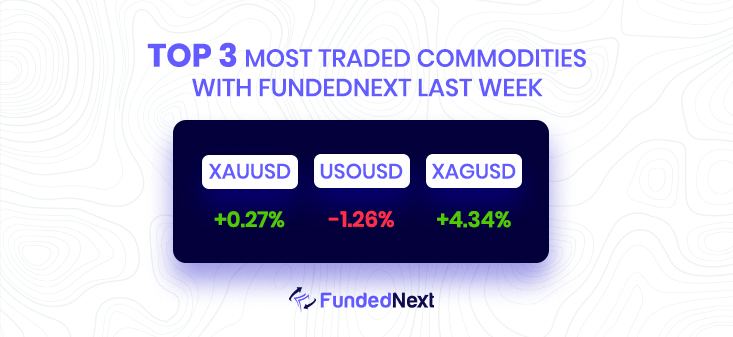

GOLD: At $1,688 at the time of publication, the price of gold is cheering a prolonged rebound off a seven-week-old rising support line while once more moving toward the 21-day EMA barrier at $1,730.

- Gold price takes up bids to renew its intraday high, reversing the previous day’s losses.

- More recent XAU/USD purchasers appear to be impressed by stronger US statistics and Sino-American stories.

CRUDE OIL: WTI crude oil prices are up for the second day in a row while trimming the weekly losses from the eight-month low on Friday during the Asian session. However, by the time of publication, black gold had reached a new intraday high of around $83.50.

- Unless WTI crosses a two-week-old declining resistance line, which was at $84.70 at the time of publication, a rebound appears unlikely.

- A US Treasury official suggests a ceiling on oil prices, and Kuwait lowers the cost of October crude for Asia.

- Despite the recent rise, concerns about a recession and central bank hostility could put black gold under pressure.

Watch Out This Week

- On September 12, UK Trade Balance news will come out, and this will be a piece of vital market-impacting news for the currency GBP and all related pairs. A higher than anticipated statistic should be considered good (bullish) for the pound, while a lower figure should be viewed as negative (bearish).

- On September 13, the US inflation rate will be released along with the monthly CPI. And for both news, a figure higher than anticipated should be viewed as good (bullish) for the USD, while a lower than anticipated should be viewed as unfavorable (bearish).

- 15th of September, the BoE will release its interest rate decision. In the United Kingdom, the Monetary Policy Committee of the Bank of England (MPC) sets the benchmark interest rate. The Bank of England’s official interest rate is known as the repo. A higher than anticipated statistic should be considered good (bullish) for the pound, while a lower figure should be negative.

2 Responses

I agree with your point of view, your article has given me a lot of help and benefited me a lot. Thanks. Hope you continue to write such excellent articles.

Thank you dear.