- Silicon Valley Bank, one of the largest banks in California, has been shut down by the California Department of Financial Protection and Innovation. The bank’s equity prices had collapsed during the week, and it announced that it needed to raise $2.25 billion in stock, triggering concerns. As a result, the Federal Deposit Insurance Corporation (FDIC) has been appointed as receiver, and insured depositors will have full access to their deposits by Monday, March 13, 2023. The FDIC will also pay uninsured depositors an advance dividend within the next week, and uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds. Silicon Valley Bank had approximately $209.0 billion in total assets and about $175.4 billion in total deposits as of December 31, 2022, and is the first FDIC-insured institution to fail this year.

- The USD Index drops to 3-day lows near 104.60 as US yields fall in the wake of a mixed US jobs report for February. The report shows that the US economy created 311K jobs, surpassing the consensus estimate of 205K jobs, while the December print was revised upwards to 504K from 517K. However, the Unemployment Rate increased to 3.6%, and the Average Hourly Earnings rose only 0.2% MoM and 4.6% YoY, a proxy for inflation via wages. The Participation Rate also increased marginally to 62.5%. Following the release of the February Payrolls, investors now see a 25 bps rate hike as the most likely scenario at the Fed’s gathering on March 22, which weighs on the mood surrounding the greenback and props up the corrective decline.

- Gold price rallied on Friday after the US Nonfarm Payrolls report missed the mark in some key areas, causing markets to price out the likelihood of a 50 basis point rate hike from the Federal Reserve this month. While prospects of further interest rate hikes dented the precious metal’s allure, traders awaited the report. Gold price bulls are now eyeing a break of $1,850 to take back control, even though the yellow metal was on track for a weekly fall.

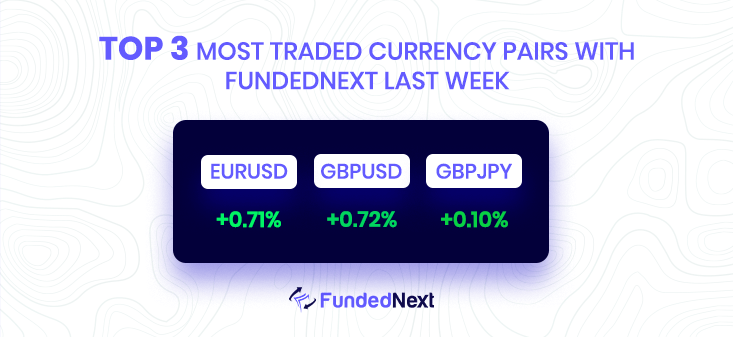

EUR/USD: EUR/USD Rises on Inflation Data as USD Sinks Post US NFP.

- EUR/USD reaches a two-week high at 1.0700 and finishes the week with minimal gains.

- Sentiment shifts sour on a default by the Silicon Valley Bank in the US, risking spillover in the sector.

- US jobs data is mixed but flashes signs of cooling down.

- Germany’s inflation is unchanged and warrants further tightening by the ECB.

GBP/JPY: GBP/JPY faces rejection at 200-day SMA after BoJ keeps policy settings unchanged.

- JPY weakens on BoJ decision, while better-than-expected UK GDP print supports GBP/JPY bounce.

- UK Manufacturing and Industrial Production contracted, capping bullish bets around the British Pound.

- Prevalent risk-off environment drives some haven flows towards JPY, limiting upside for GBP/JPY cross.

GBP/USD: GBP/USD struggles at 200-DMA despite Friday rally.

- GBP/USD rallied nearly 1% on Friday, post US NFP report.

- Bulls struggled to surpass the 200-day EMA, resulting in a fall of 60 pips.

- Bias for GBP/USD remains bearish, with downside risks ahead.

- To shift the trend, GBP/USD needs to reclaim the 50-day EMA and surpass 1.2100 resistance level.

AUD/USD: AUD/USD hits four-month low as investors await US NFP release:

- AUD/USD falls to 0.6563 as anxiety among investors increases ahead of US NFP release.

- Australian Dollar struggles amid fading optimism about China’s economic recovery.

- S&P500 futures extend losses as higher tax burden proposed by US President Joe Biden discourages investors.

- US Nonfarm Payrolls (NFP) data to be keenly watched, with estimates suggesting addition of 203K payrolls in February and steady unemployment rate at 3.4%.

NZD/USD: NZD/USD slides below 0.6100 ahead of US Employment data.

- NZD/USD struggles to hold above 0.6100 as the USD Index attempts a rebound ahead of the US NFP data release.

- Increment in labor cost index could confirm Fed Chair Powell’s fears of persistent inflation and lead to more aggressive rate hikes.

- Weak China CPI data indicates lower demand in China, which could weaken NZ exports and impact the New Zealand Dollar.

- The market is expected to remain on edge as investors wait for the release of US Nonfarm Payrolls data and Average Hourly Earnings data.

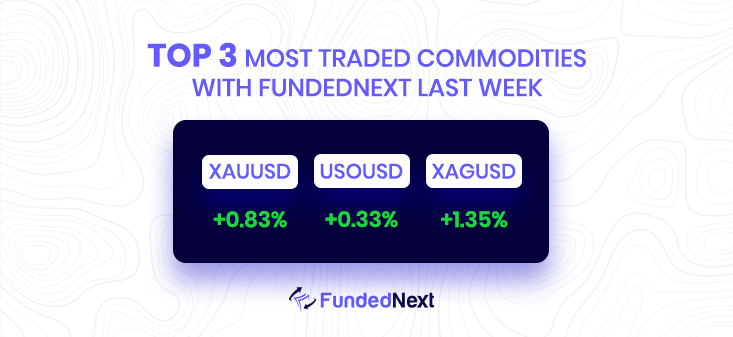

GOLD: Gold price rallies on NFP disappointments, eyes $1,850.

- Gold price jumps to a fresh corrective high near $1,845 as markets price out the odds of a 50 basis point rate hike from the Federal Reserve this month.

- Nonfarm Payrolls report missed the mark in some key areas, potentially slowing down the labor market, despite a historically high vacancies-over-unemployed ratio.

- Jobless Claims jumped to above the 200k level for the first time in 8 weeks, taking some sting out of the Federal Reserve chair’s hawkish tones.

- Gold price aims to break the $1,850 level and take back control amid prospects of further interest rate hikes denting the precious metal’s allure.

SILVER: Silver Price Rallies as Traders Rush to Safety Ahead of US Inflation Data:

- XAG/USD rises over 2% amid uncertain US economic outlook and upcoming inflation data.

- Mixed US jobs report sees more Americans added to the workforce but with higher unemployment rate signaling weaker labor market.

- Wall Street extends losses with investors rushing into precious metals and punishing the US Dollar.

- Federal Reserve expected to hike gradually, but market participants predict rate cut by end of 2023 based on US jobs data.

OIL: WTI Oil Price Slides Below $75 as China Struggles to Boost Domestic Demand.

- Weak China CPI and PPI figures highlight the failure of the government to spur domestic demand despite reopening measures.

- Lack of recovery in domestic demand suggests a loss of consumer confidence in the Chinese administration.

- Anticipation of a bigger rate hike from the Federal Reserve (Fed) due to expected inflationary pressures in the United States.

- The release of the US Nonfarm Payrolls (NFP) data will provide more clarity on the economic outlook.

Watch Out This Week

- On 14th March, the United States CPI report will come out. A figure that is higher than anticipated should be viewed as positive (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- On 14th march, the unemployment rate report will have a significant impact on GBPUSD, bond and stock markets. A higher than expected figure should be seen as negative (bearish) for the GBPUSD while a lower than expected figure should be seen as positive (bullish) for the GBPUSD.

- It is important to pay attention to the report on Retail Sales report report on 15th March as it may have significant impacts on major currencies. A higher than expected figure should be seen as positive (bullish) for the USD while a lower than expected figure should be seen as negative (bearish) for the USD.