US firms added more jobs than anticipated, demonstrating a rock-solid labor market that allayed concerns about a recession and indicated that Federal Reserve will continue to raise interest rates sharply to combat inflation.

According to Labor Department figures released on Friday, nonfarm payrolls increased by 528,000 in July, a huge increase that was above all forecasts and was the greatest in five months. The increase in employment for June was revised up to 398,000.

At 3.5%, the jobless rate matched a five-decade low. The rate of labor force participation decreased as wages grew more quickly.

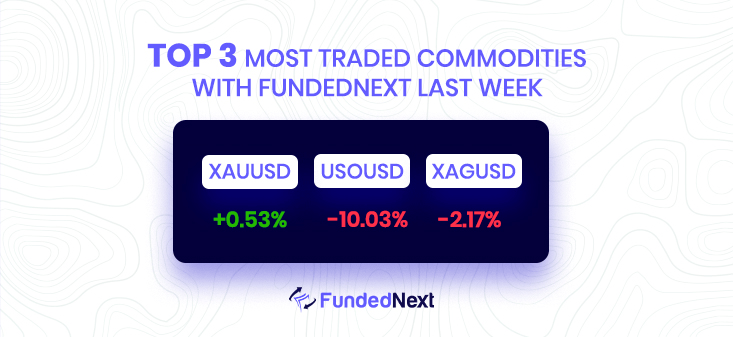

The upbeat macro data lifts market bets for a larger Fed rate hike move at the September meeting, which further contributes to driving flows away from the non-yielding yellow metal. The odds of a 75 bps hike jump to 70% from 40% before the jobs report and trigger a sharp spike in the US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond climbs back closer to the weekly high and exerts additional downward pressure on gold.

GBP/JPY: The BoE warned that a UK recession will begin in the fourth quarter and last all the way through next year and said that monetary policy is not on a pre-set path. This suggests that the UK central bank would adopt a more gradual approach to raising interest rates, which, in turn, weighs heavily on the British pound.

- GBP/JPY comes under intense selling pressure after the BoE warns of an economic downturn.

- The BoE now expects that a UK recession will begin in Q4 and last all the way through next year.

- Reviving demand for the safe-haven JPY also contributes to the intraday slide of nearly 250 pips.

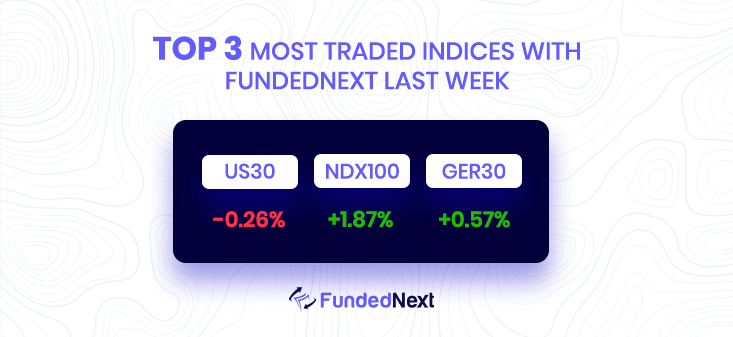

The heavily tech-focused Nasdaq continued its 3-week bull rally and gained a whopping 1.87% last week to settle at $13,184.80. GER30 also gained for consecutive 3-week and finished the week at 13629.67 with a 0.57% gain. The Dow Jones Industrial Average, meanwhile, decreased by -0.26%.

This week, the Nasdaq is expected to rise by around 3%. The S&P 500 should also increase by 2%, while the Dow is predicted to remain in a consolidation zone.

As a result of this week’s rise being driven by tech companies, investors kept switching their focus to them as Wall Street continued to look for undervalued assets in the wake of some excellent corporate earnings.

Silver price dives after US labor data crushed expectations, as traders scaled back their bets that a Fed pivot was a done deal while pouring cold water to recession fears. The greenback is rising, with the US Dollar Index, up almost 0.80% at 106.579, while the US 10-year bond yield soars 15 bps, up at 2.834%. Consequently, XAGUSD is trading at $19.91, losing 2.17%

GOLD comes under intense selling pressure during the early North American session and plummets to a fresh daily low, around the $1,775 area in the last hour

- Gold witnesses aggressive selling and tumbles to the daily low amid the post-NFP strong USD buying.

- The upbeat report lifts bets for a 75 bps Fed rate hike in September, which further weighs on the metal.

- The risk-off impulse could offer some support to the safe-haven XAU/USD and help limit further losses.

Watch Out This Week

- This week, the US economic calendar will feature inflation data, namely consumer and producer indices, initial jobless claims, and the University of Michigan’s Consumer Sentiment for August.

- On August 10, US CPI data will come out and A higher than expected figure should be seen as positive (bullish) for the USD, while a lower than expected figure should be seen as negative (bearish) for the USD.

- On the next day on Aug 11, First-time jobless claims have a significant impact on the financial markets since in contrast to continuous claims data, which monitors the number of people receiving unemployment benefits, first-time jobless claims measure fresh and developing unemployment. A higher than expected figure should be seen as negative (bearish) for the USD while a lower than expected figure should be seen as positive (bullish) for the USD.

- On 27th we are going to see some interesting data deriving from FOMC Statement and Federal Funds Rate which might impact the market. Actual grater then forecast is good for USD

- On August 12th, 3 major GBP news will come out with a probable impact on the market.

- The goods trade balance in the United Kingdom equals the difference between goods exports and goods imports.

- A higher than expected figure should be seen as positive (bullish) for the GBP while a lower than expected figure should be seen as negative (bearish) for the GBP.

- Another important news would be the GDP growth reports across various industries. A higher than expected figure should be seen as positive (bullish) for the GBP while a lower than expected figure should be seen as negative (bearish) for the GBP.

13 Responses

I was just searching for this information for a while. After six hours of continuous Googleing, at last I got it in your site. I wonder what’s the lack of Google strategy that do not rank this kind of informative websites in top of the list. Usually the top websites are full of garbage.

Thank you dear for your support. Even if we do not make it to google search now, traders and readers like you will always find us for the most appropriate information.

I like this post, enjoyed this one appreciate it for posting.

Thanks

I have been exploring for a bit for any high-quality articles or weblog posts on this kind of space . Exploring in Yahoo I ultimately stumbled upon this web site. Studying this info So i am happy to exhibit that I have an incredibly just right uncanny feeling I discovered exactly what I needed. I most undoubtedly will make certain to do not omit this site and provides it a glance regularly.

Thank you so much for your kind words dear. We will surely keep on uploading more quality works here. So keep following.

Thank you, I’ve recently been looking for information about this topic for ages and yours is the greatest I’ve discovered till now.

Thank you

Way cool, some valid points! I appreciate you making this article available, the rest of the site is also high quality. Have a fun.

Thank you dear.

I am not really excellent with English but I find this real leisurely to interpret.

Insightful!

Thanks