- According to figures released by the US Bureau of Labor Statistics on Friday, nonfarm payrolls increased in the US by 263,000 in September. This number is above the market consensus of 250,000 and follows the growth of 315,000 in August.

- Following the report’s further details, the unemployment rate decreased from 3.7% to 3.5% and from 62.4 to 62.3%, respectively.

- Finally, average hourly earnings, which are used to evaluate wage inflation, decreased from 5.2% to 5% annually.

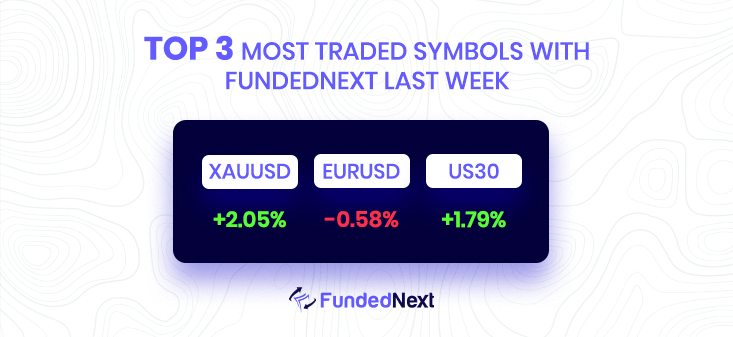

- After the US Labor Department released employment numbers that were higher than expected and supported the Fed’s need for additional tightening, the gold price fell, supporting the US dollar. Consequently, XAU/USD is currently trading below its initial price at about $1690.

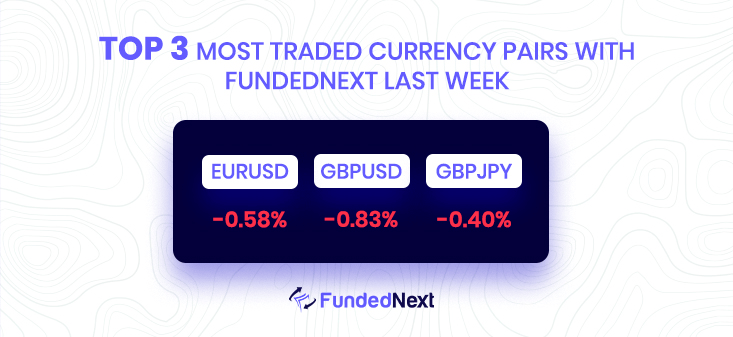

EURUSD: Although EUR/USD recovered a sizable chunk of its daily losses, it ran out of steam before reaching 0.9800. The pair’s price stood at 0.9780 as of the writing, down 0.1% daily. The recent market movement indicates that the EUR/USD currency pair will end the week flat.

- With the initial reaction to the US jobs news, the EUR/USD plummeted significantly.

- In the US, nonfarm payrolls increased by 263K in September.

- The two are still on track to have little change by the week’s end.

USDJPY: The US employment report unexpectedly startled market players, with the US economy adding more jobs than economists anticipated. USD/JPY has remained underwhelming since. The USD/JPY is currently trading below its initial price at roughly 144.90s.

- While the unemployment rate decreased somewhat, the US economy added 263K jobs.

- Following the release of the US NFP, the USD/JPY fell to 144.66 before making some gains.

- The US 10-year T-bond yield is moving towards 3.90%, which is typically positive for USD/JPY traders, who are still wary in the wake of the BoJ intervention in September.

- The USD/JPY benefits from the difference in interest rates and the divergence in monetary policy between central banks.

GBPUSD: In response to the positive US job data, the GBP/USD pair encounters fresh supply in the early North American session and declines toward the daily low, below the mid-1.1100s.In response to the positive US job data, the GBP/USD pair encounters fresh supply in the early North American session and declines toward the daily low below the mid-1.1100s.

Following the release of the main NFP report, which revealed that the US economy added 263K new jobs in September, the US dollar recovered from a day-to-day decline and rose to a new weekly high. The number exceeds consensus expectations for a reading of 250K, but it represents a noticeable decrease from the 315K reported in the previous month.

- As new USD buying starts to surface, the GBP/USD exchange rate retreats toward its daily low.

- The positive US NFP report reinforces Fed rate rise predictions and boosts the dollar.

- The GBP has fallen due to worries about the UK’s budgetary policy.

USD/CHF: The area around 0.9950/60 has been a crucial support, limiting the advance last week and Friday. More gains for the dollar could result from a consolidation above. The Swiss franc could gain ground as long as it stays below. The weekly low is at 0.9780, followed by 0.9875 and 0.9915 as the immediate supports.

- Non-farm payroll increased by 263K in September, as anticipated.

- As US yields surge, the US dollar increases everywhere.

- USD/CHF surges to hit recent highs at 0.9950 before falling back.

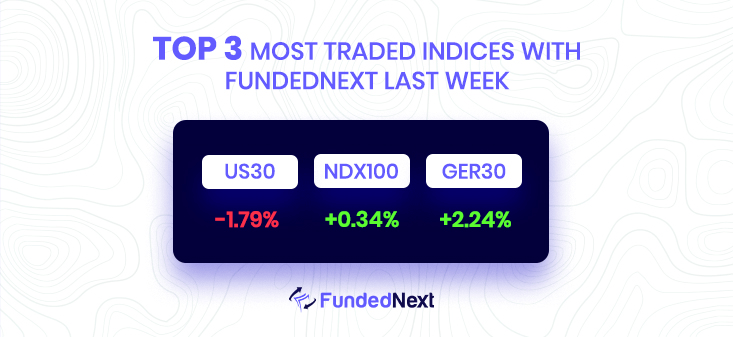

S&P500: There will likely be a recovery phase for the S&P 500. However, a final sustained breakdown is anticipated in Q4, with the level of 3235/3195 being the focus of the Credit Suisse analyst team.

Despite our overall perspective being pessimistic, we anticipate that the first quarter of Q4 will see a brief recovery phase, particularly in light of positive momentum divergences.

- After this predicted strength, however, we watch for a continued decline below 3595 in due course, with our main goal of a cluster of supports at 3235/3195 as the final destination.

- A triple weekly RSI momentum divergence suggests early Q4 should see a temporary recovery phase.

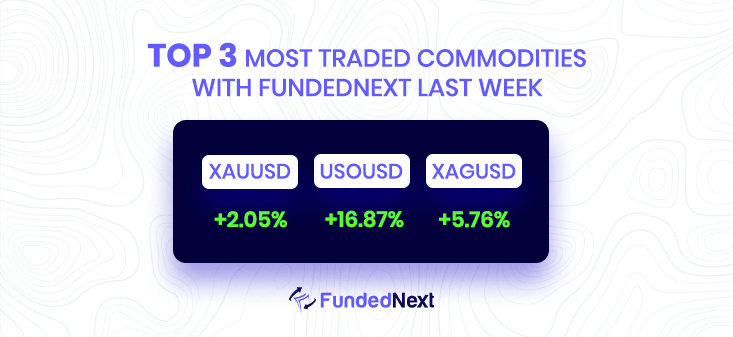

GOLD: After the US Labor Department released employment numbers that were higher than expected and supported the Fed’s need for additional tightening, the gold price fell, supporting the US dollar. Consequently, XAU/USD is trading below its initial price at about $1690.

The price of the yellow metal fluctuated around $1710 before the publication of the US Nonfarm Payrolls report. Gold first reacted by sliding towards $1700 as the headline hit the newswires, but the initial move was short-lived. However, it extended its losses below $1700 in a dramatic reaction while I was typing.

- Following the release of the US jobs report, the price of gold fell below $1700.

- US Nonfarm Payrolls surpassed expectations by 263K; further Fed rate increases are expected.

- Following the release of the US jobs report, the price of gold fell below $1700.

- US Nonfarm Payrolls surpassed expectations by 263K; further Fed rate increases are expected.

- The yields on US Treasury bonds increased and remained over 3.80%.

SILVER: Through the first half of trading on Thursday, silver maintains a slightly positive bias and is currently trading in the $20.75-$20.80 range, up more than 0.40% on the day.

- On Thursday, silver increased slightly, but there wasn’t any further buying.

- The configuration favors bullish traders and encourages the possibility of more gains.

- Any decline that brings the price closer to $20.00 may still be viewed as a buying opportunity.

OIL: Increased supply concerns following OPEC+’s announcement of the largest output cut since the Covid-19 outbreak have given oil bulls a jolt of adrenaline. Beginning in November, the oil cartel will reduce all of its daily production by two million barrels (BPD). It is important to note that several OPEC members have struggled to reach their mandated quotas due to insufficient production capacity; as a result, the impact may lessen.

- Despite rising supply concerns, oil prices are anticipated to continue rising.

- The Biden administration might use the SPR oil to lessen the effects of OPEC’s output cuts.

- The Fed’s projected rate of rate increases will continue, which will slow the increase in rates.

Watch Out This Week

Now that the US Nonfarm Payrolls report is in the rearview mirror, the next important events in the US calendar would be September CPI figures and the University of Michigan Consumer Sentiment in the next week. This week the GBP and USD have major news on the calendar.

- For starters, on October 11th, The unemployment rate in the UK is described as the number of people actively seeking work as a percentage of the population, all of whom are considered to be labor force participants. A higher-than-expected figure should be seen as negative (bearish) for the GBP while a lower-than-expected figure should be seen as positive (bullish) for the GBP.

- Oct 13, Consumer prices for a basket of items, excluding volatile food and fuel costs, are tracked by the core inflation rate in the United States. A higher-than-expected figure should be seen as positive (bullish) for the USD, while a lower-than-expected figure should be seen as negative (bearish) for the USD. On the same day, the US CPI report will come out, giving vital information about the overall production capacity of the country.

4 Responses

Your article helped me a lot, thanks for the information.

Thank you so much dear.

I think the figures were overstated last time and that we will see a downward revision which is partially why I took down my expectations from the start. I don’t care about the headline anyway. When it comes to the uptick in the unemployment rate I think we will see an increase as some will re-enter the workforce which means they have to be counted. They way the government counts unemployed people is not accurate to start with and our real unemployment rate is almost twice what the NFP reports states.

Thanks for your insights. We would love to have a comprehensive conversation if you are up for it.