In volatile markets, breakout trading can be a profitable approach, but it’s loaded with falsified signals and false breakouts that can put even the most experienced traders off. In this article, we’ll be going over what a fake breakout is and how to prevent them in our trading.

What Is A False Breakout?

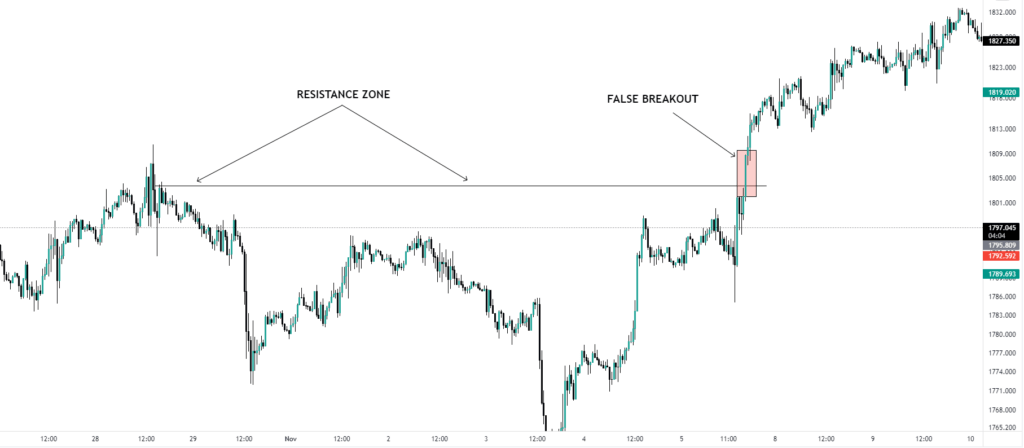

When the price rises above or below a significant support or resistance level for a brief period of time before returning to the same side from which it began, this is known as a false breakout. This is the worst-case situation for a breakout trader who enters a trade immediately after the price breaks. On our chart, we are immediately confronted with a red arrow, and the breakout we traded is beginning to look less and less credible.

It’s difficult to watch breakout trades crash in front of our eyes, and we’re left to decide whether to stay in and “ride it out” or close the deals for a rapid loss. Neither of those alternatives appears to be very appealing. To prevent this from happening again, we’ll need to add a new rule to our existing breakout trading strategy.

How to Avoid a False Breakout

The solution to this issue is actually rather straightforward. Rather than acting on a trade right away when the price breaks a significant level, we should wait until the candle closes to verify the strength of the breakout. Setting entry orders above or below a support or resistance level in order to automatically enter a breakout trade is not a good idea. We can use entry orders to get “wicked” into breakout trades that never materialize.

On the surface, this would lead us to conclude that the only way to trade breakouts efficiently is to be ready to execute as soon as the candle closes in the breakout area at our trading terminals. After the candle has closed, we can open our position, which has a better chance of succeeding. But what if we don’t have the entire day to wait for breakouts?

Using the Close Prices of the Candles to Set Alerts

So, if physically waiting for a breakout at your computer isn’t an option, I recommend setting up a price alert that uses the closing price of each candle as its trigger. To put it another way, you’ll only get an alert if support or resistance is breached and remains broken until the candle closes. You’ll be able to receive your alert, log in to your PC or mobile app, and place the trade that way.

Once we’ve chosen a price level, we’ll only be notified if a candle closes above or below it, rather than being notified every time the price is broken in real-time. For an hourly chart, this means we’d only be notified after each bar closed at the beginning of the hour. We were seeking something similar to this.

22 Responses

There is perceptibly a bundle to know about this. I consider you made certain nice points in features also.

Way cool, some valid points! I appreciate you making this article available, the rest of the site is also high quality. Have a fun.

Thanks. You too.

It’s really a great and helpful piece of information. I’m glad that you shared this useful info with us. Please keep us up to date like this. Thank you for sharing.

Thank you so much

I really like your writing style, fantastic info , appreciate it for posting : D.

Thank you

Fantastic blog!

Thank you

I think this web site has got some very great info for everyone : D.

I really like your writing style, superb info , thankyou for posting : D.

Excellent post. I used to be checking constantly this blog and I am impressed! Extremely helpful information specially the closing section 🙂 I take care of such info a lot. I used to be looking for this certain info for a very long time. Thanks and good luck.

Thank you for sharing excellent informations. Your web-site is so cool. I’m impressed by the details that you’ve on this website. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for extra articles. You, my pal, ROCK! I found simply the info I already searched everywhere and simply couldn’t come across. What an ideal site.

Thank you so much for your appreciation.

Oh god, finally I have found one great blog.

Good work Mr Haberman.

As a novice trader, I found this article to be incredibly informative and helpful. The author does an excellent job of explaining complex concepts in a way that is easy to understand, and they provide concrete examples and practical tips that I can apply to my own trading. I appreciate that they don’t assume that I know everything about trading and breakouts, and instead provide a clear and accessible introduction to the topic. Overall, I feel much more confident about my ability to navigate volatile markets and avoid false breakouts thanks to this article.

Thank you for your kind words! We’re glad to hear that our article was helpful to you as a novice trader and that you found the concepts easy to understand. It’s our goal to make trading accessible to everyone and provide concrete examples and practical tips that can be applied by traders of all levels. We’re happy to hear that you feel more confident in navigating volatile markets and avoiding false breakouts. Best of luck in your trading journey!

I was really struggling with false breakouts in my trading, and this article has been a game-changer for me. The author’s suggestion to use closing prices to set alerts is brilliant, and it’s something that I’ve already started implementing in my own trading. I also appreciate that the author acknowledges that not everyone has the luxury of sitting in front of their computer all day waiting for breakouts, and provides a practical solution that works for people with busy schedules.

Thank you for your positive feedback! We’re thrilled to hear that our article has had a significant impact on your trading and that you’ve already started implementing our suggestions. We understand that not everyone has the time to sit in front of their computer all day, and we strive to provide practical solutions that can be applied by traders with busy schedules. Best of luck in your trading journey!

After reading this article, I feel much more confident about my ability to avoid false breakouts in my trading. The author does an excellent job of explaining what false breakouts are and why they occur, and they provide a clear and concise strategy for preventing them. I appreciate that they don’t just tell me what to do, but also explain why it works and how it fits into a larger trading strategy.

Thank you for taking the time to read our article on avoiding false breakouts in trading! We’re glad to hear that you found the information helpful and that it has boosted your confidence in navigating volatile markets. It’s always our goal to provide clear and concise strategies that are backed up by sound reasoning and that can be applied in a practical way. Best of luck in your trading endeavors!