Fed Chair: The extent of the rate hike in September will depend on the data.

Powell: History warns against easing policy too soon.

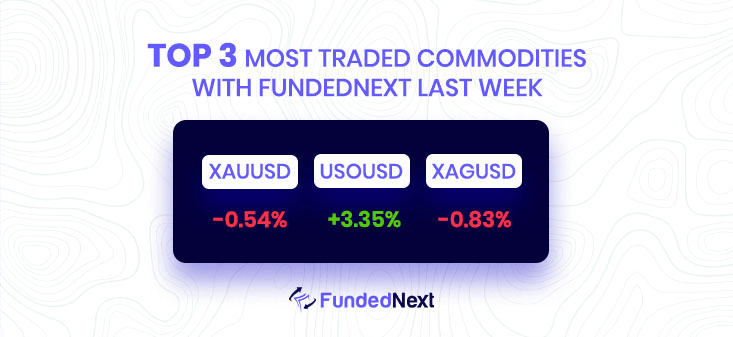

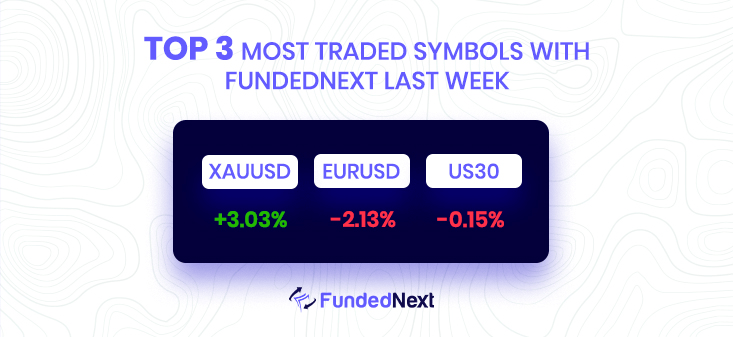

After Powell’s speech, XAUUSD is still under pressure and is unable to recover $1,750. Gold is experiencing a tumultuous session and continues. Trending downward after failing to overcome significant short-term resistance levels. It hit rock bottom at the start of Powell’s address before recovering.

Investors’ opinions on the expected remarks made by Federal Reserve (Fed) chair Jerome Powell at the Jackson Hole Economic Symposium are conflicting, according to investors. Without a doubt, the figures on inflation show that price pressures are set to reach their peak, and the Fed should moderate its rate of interest rates as a result of a decline in private sector activity.

However, the inflation rate continues to be above 8%, and the Fed’s onerous task of raising borrowing rates is still not finished in order to control the same.

Following Saudi Arabia’s vocal intervention this week, oil prices have increased significantly. The price rebound, according to Commerzbank economists, will continue.

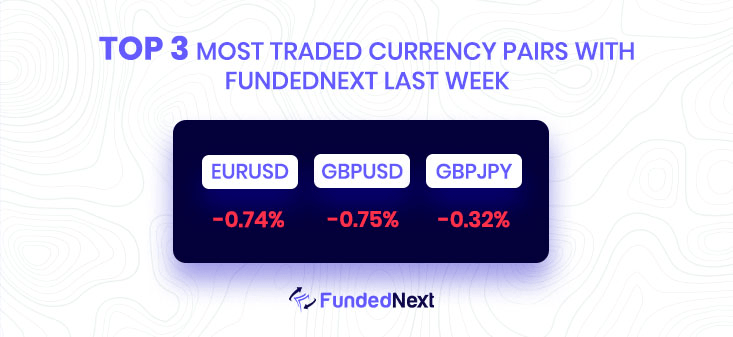

EUR/USD: Despite Powell’s hawkishness, the EUR/USD bulls are still in the game. If 1.0000/0.9980 holds, the bulls may aim for 1.0120/50.

The 4-hour charts show that the euro was initially rattled but has not officially been bent out of shape. The EUR/USD is still above a crucial support level of 1.0000. The charts depict the upside bias, focusing on 1.0120 on a breach of 1.0080 as long as this support holds for the ensuing days.

USD/JPY:

- USD/JPY edged higher by 0.56% on Friday.

- Fed’s Powell: “Restoring price stability will likely require maintaining a restrictive policy stance for some time.”

- Money Market Futures odds of a 75 bps Fed rate hike, at 56.5%.

The USD/JPY started off close to the day’s lows, at approximately 136.19, but in the final hour, past Powell’s remarks, the major seesawed between 136.20 and 137.34. In a tumultuous session, the USD/JPY is currently trading at 137.25, above its opening price.

GBP/USD: As Fed Chair Powell speaks at the Jackson Hole Symposium, the GBP/USD exchange rate swings. The GBP/USD currency pair experienced a strong daytime rally to a new daily high of 1.1900 after rebounding off a daily low at 1.1775. However, as Powell wrapped up his remarks, the GBP/USD began to decline from recent highs in the direction of the 1.1820. The GBP/USD exchange rate is currently volatile and fluctuates between 1.1800 and 1.1810.

- Based on the Fed’s Powell speech, GBP/USD seesawed in a 1.1820-1.1900 range.

- Fed’s Powell speech tone was hawkish but cautious, trying not to derail the markets.

- GBP/USD Price Analysis: Rallied towards 1.1900 as Powell’s ended its speech but has erased those gains.

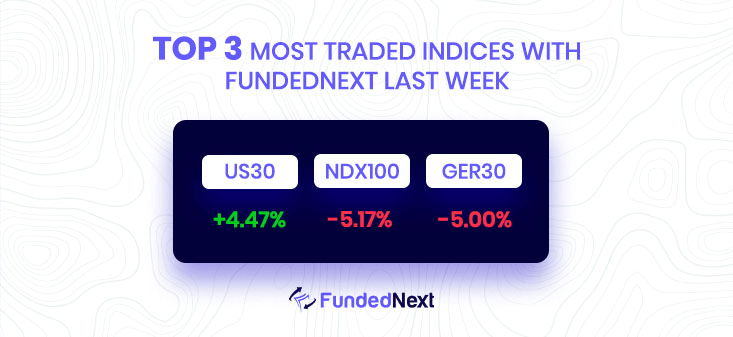

S&P 500:

- Wall Street continues to bleed out on the back of the hawkish Fed’s Powell.

- S&P 500 is making fresh lows for the day.

At this point, the S&P 500 had decreased roughly 1.5% from the seconds before Powell’s statements were made public at 1000 EDT. In general, it was flat before the chairman’s remarks. The index has now dropped 1.9% and reached a new low of 4,106.45.

Crude Oil:

- Oil prices are to climb further as Saudi Arabia considers cutting oil production.

- The perception that Saudi Arabia will not tolerate any price decline below $90 is still present.

- Speculators might see this as a license to wager on more price increases without worrying about further significant price falls.

Gold:

- Volatility soars after USD data and following Powell’s speech.

- Fed Chair keeps hawkish tone, says high-interest rates will persist for some time.

- Gold is under pressure after a short-lived rebound above 1750.

Watch Out This Week

Consumer Confidence, ADP Employment Change, Initial Jobless Claims, ISM PMI, Nonfarm Payrolls (NFP), Unemployment Rate, and Average Hourly Earnings are the important data points for the upcoming week.

- August 31 is an essential date for the euro as Germany’s unemployment report will come out, and the next day, September 1, the eurozone unemployment report will come out. A figure that is greater than anticipated should be seen as negative (bearish) for the euro. In contrast, a figure that is lower than anticipated should be viewed favorably (bullish) for the EUR.

- Euro CPI data will come out on the same day, providing major pairs with enough reasons to make market moves. A figure higher than anticipated should be viewed as positive (bullish) for the EUR, whereas a figure lower than anticipated should be viewed as negative (bearish).

- On September the 2nd, two critical pieces of news will come out, and they will have a huge impact on the USD. One being the monthly awaited NFP and the other being the unemployment rate.

14 Responses

Everything is very open and very clear explanation of issues. was truly information. Your website is very useful. Thanks for sharing.

You are most welcome dear

you might have an important blog here! would you wish to make some invite posts on my weblog?

No thank you for the offer.

It?¦s actually a nice and useful piece of information. I am satisfied that you shared this helpful info with us. Please keep us informed like this. Thanks for sharing.

Welcome dear

Thanks for the post, can I set it up so I receive an alert email every time you publish a fresh article?

You can sign up and follow the weekly newsletter

Hello! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back frequently!

And we are happy to see you dear.

you have a great blog here! would you like to make some invite posts on my blog?

No we don’t accept any guest post here

Yeah bookmaking this wasn’t a high risk determination great post! .

Thanks, We are glad this has been a beneficial post for you.