- Gold prices take a step back from their recent surge, as the dollar and yields show signs of recovery. After reaching new 2023 highs near the $2050 mark, the precious metal corrects lower, meeting initial resistance at $2015. This decline comes as investors anticipate a 25 bps rate hike by the Fed in the upcoming May 3 meeting, with an 80% probability according to CME Group’s FedWatch Tool.

- The US Dollar Index (DXY) rebounds after three consecutive days of losses, with a 0.56% climb as the New York session closes. The DXY currently trades at 101.570, showing a bullish engulfing candle pattern on the daily chart. A potential double bottom formation on the weekly chart hints at an upward bias, with the 200-week EMA at around 99.117. The Relative Strength Index (RSI) and Rate of Change (RoC) suggest waning selling pressure, possibly paving the way for more gains. To reach the initial target of 111.000, the USD bulls must retake 104.000 and challenge the YTD high of 105.883. On the flip side, bears need to reclaim 100.788 and aim for the 200-week EMA at 99.117.

- The USD/JPY jumps to a fresh daily high of 133.18 following the release of weak US retail sales data for March. Despite the larger-than-expected decline in retail sales, the US dollar gained momentum, triggering a bullish correction across the board. The slide in both import and export price indices also suggests a weakening demand and easing inflation pressures. The sudden rise in US yields and positive Wall Street futures further contributed to the Greenback’s appreciation and the Japanese Yen’s decline against major rivals.

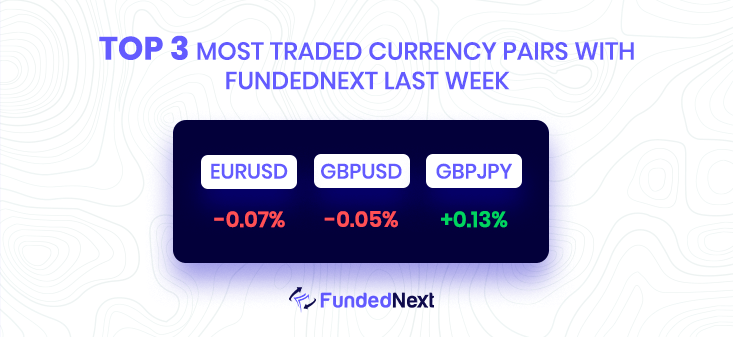

EUR/USD: EUR/USD Maintains Bullish Outlook with Eyes on 1.1100 Milestone:

- EUR/USD reaches new YTD high of 1.1075 before entering corrective decline.

- Uptrend continuation could push the pair to challenge the 1.1100 round level.

- Long-term bullish view remains intact while trading above 200-day SMA at 1.0368.

- Next significant resistance lies at the weekly high of 1.1184 (March 21, 2022).

EUR/GBP: EUR/GBP Eyes 0.8840 Amid Hawkish ECB Expectations and Sluggish UK Labor Market:

- ECB considering 25 and 50 bps rate hikes in May as core inflation persists due to tight labor market conditions.

- Eurozone headline inflation softens, but core inflation remains a concern for ECB policymakers.

- Pound Sterling faces pressure as BoE expects inflation to decelerate quickly, while UK labor market conditions ease.

- A divided ECB outlook with one group advocating a 50 bps hike and another for no change in May policy meeting.

GBP/USD: GBP/USD Aiming for New Heights as Multi-Month Highs Above 1.2500 Loom:

- GBP/USD trades near highest levels since June 2022, maintaining a four-day uptrend

- Break of horizontal resistance between 1.2510-1.2500 suggests further gains ahead

- Key Fibonacci Expansion levels at 1.2555 and 1.2615 could be next targets, followed by May 2022 high of 1.2665

- Bearish pullback must convincingly break below 1.2500 to shift momentum, with 1.2395 as a key support level.

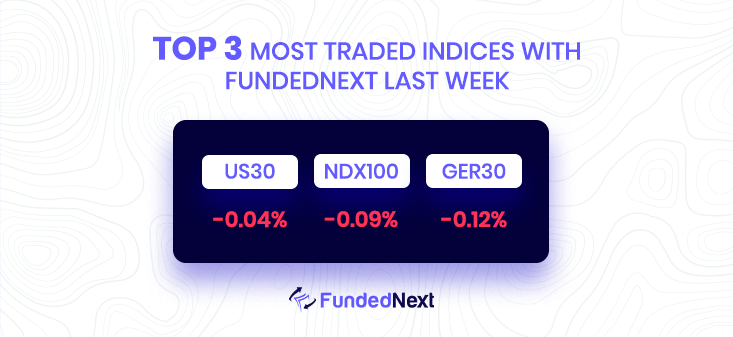

AUD/USD: AUD/USD Challenges 0.6810 as Aussie Bulls Face 200-Day EMA Resistance:

- UD/USD trades at highest levels in seven weeks, with a four-day winning streak

- 1.5-month-old ascending trend line and 200-EMA pose a challenge for Aussie buyers

- Pullback moves may target 100-EMA, but ascending support line from March is crucial for bears

- RSI indicates limited upside room, while resistance levels of 0.7000 and 0.7030 await upon overcoming 200-day EMA.

NZD/USD: XAU/USD Pulls Back from Highs Near $2050 Amid Dollar Rebound and Higher Yields:

- NZD/USD slides past 200, 50, and 100-day EMAs due to risk-off impulse spurred by Fed’s hawkish commentary

- US economic data shows further deterioration, raising the likelihood of another Fed hike past the May meeting

- Mixed signals from Federal Reserve officials add to market uncertainty

- NZD/USD traders shift focus to next week’s NZ CPI report, with Q1 inflation estimated at 1.8% QoQ and 7.2% YoY

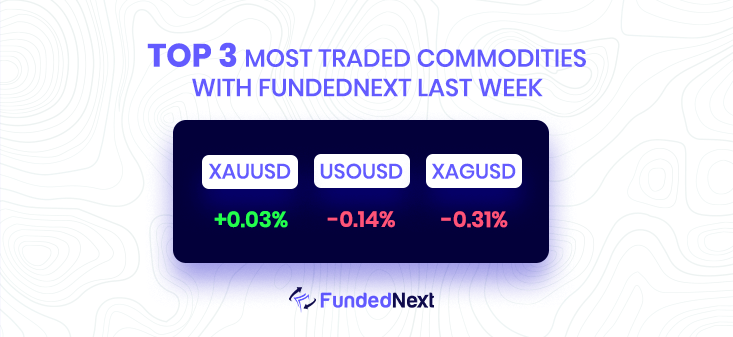

GOLD: XAU/USD Consolidates Amid Good Friday Holiday and US NFP Release:

- Gold prices correct lower after three consecutive daily gains, initially finding support near $2015

- Dollar rebound and higher US yields weigh on the precious metal

- US Retail Sales report shows a downside surprise in March

- Technical outlook: surpassing $2048 could lead to $2070, while a deeper retracement requires clearing $1981 support.

SILVER: Silver Price Retreats from YTD High at $26.08, Bearish-Engulfing Pattern Forming:

- XAG/USD reached a new YTD high at $26.08 before retreating, forming a bearish-engulfing candle pattern.

- The break below $26.00 opens the door for a test of $25.00.

- If XAG/USD falls below $25.00, it could head toward the February 2 high at $24.63, followed by the 20-day EMA at $24.20, and then the psychological $24.00 level.

- For bullish continuation, XAG/USD needs to get above the April 13 low of $25.40, targeting the YTD high at $26.08, followed by the April 18, 2022, swing high at $26.21 and the 2022 high at $26.94.

OIL: WTI Under Pressure Near $82 as IEA Warns of Risks to Economic Recovery from OPEC+ Supply Cuts:

- IEA warns that OPEC+ supply cuts risk aggravating the expected oil supply deficit in H2 2023, potentially hurting consumers and economic growth.

- OECD industry stocks in January surged, while Russian oil exports in March rose to their highest since April 2020.

- Gains of 1 mln bpd from non-OPEC+ starting in March will not offset a 1.4 mln bpd decline from OPEC+.

- Global oil demand set to rise by 2 mln bpd in 2023, reaching a record 101.9 mln bpd, led by non-OECD countries, especially China.

Watch Out This Week

- On 19th April, the EURO CPI report will come out. A figure that is higher than anticipated should be viewed as positive (bullish) for the EUR, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- On 13th April, the GBP Trade Of Retail sales report will have a significant impact on British bond and stock markets. A higher than expected figure should be seen as positive (Bullish) for the GBP while a lower than expected figure should be seen as negative (bearish) for the GBP.

- It is important to pay attention to the continuous jobeless report on 20th April as it may have significant impacts on major currencies. A higher than expected figure should be seen as negative (bearish) for the USD while a lower than expected figure should be seen as positive (bullish) for the USD.