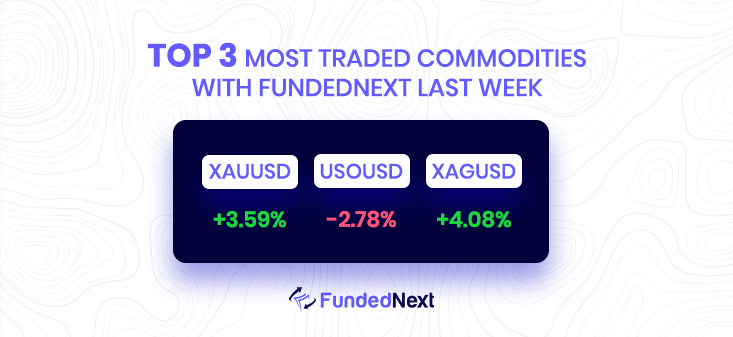

- Gold price surged by more than 3% and is approaching the $2,000 mark, with XAU/USD set for its best week in years. The rally was driven by a sharp reversal in Treasury yields and banking jitters, which boosted the demand for the yellow metal. Despite expectations of a 25 basis point rate hike by the Federal Reserve, analysts predict a possible pause at the upcoming meeting. Traders should exercise caution despite the bullish outlook, as there could be sharp corrections in the market.

- The USD Index (DXY) continues to face downward pressure and is currently hovering around the mid-103.00s. There is significant support at the March lows near 103.50, but if momentum continues to decrease, the index could challenge the weekly low at 102.58. Overall, the outlook for the greenback remains negative as long as it stays below the 200-day SMA at 106.64.

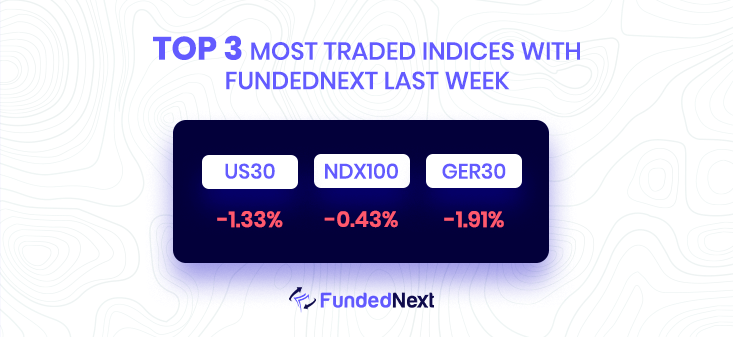

- Wall Street indexes closed higher after a volatile week, with the Nasdaq gaining over 4% despite bumpy trading. Banking concerns dominated market activity, with several banks experiencing issues. European and Asian indices closed with weekly losses. The upcoming week will continue to focus on financial market turbulence, with the Fed expected to raise interest rates by 25 bps on Wednesday, which could trigger a shock if they decide to hold rates in response to current market tensions. Clues about the future will be watched closely, and China is expected to leave rates unchanged on Monday.

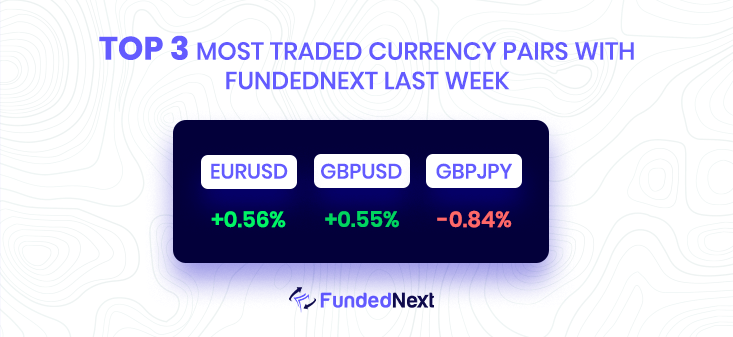

EUR/USD: Wells Fargo Predicts Medium-Term Strength for EUR/USD on ECB Tightening

- EUR/USD is gaining recovery momentum, and Wells Fargo expects further gains against the USD.

- The European Central Bank (ECB) is predicted to deliver further rate hikes, with the deposit rate peaking at 3.50% by June 2023.

- Market pricing currently implies a peak policy rate of around 3.09%, which appears light to Wells Fargo.

- The outlook for ECB policy is a significant factor supporting Wells Fargo’s prediction of medium-term strength for the Euro against the US Dollar.

GBP/JPY: GBP/JPY Stuck in Range Below 162.00 Mark Amid Diverging Forces:

- GBP/JPY is struggling to find a firm direction and remains in a narrow range below the 162.00 mark.

- Fears of a global banking crisis benefit the safe-haven JPY and act as a headwind, while the BoJ’s dovish outlook lends support.

- Heavy selling around the US Dollar benefits the GBP and multi-billion-dollar lifelines for troubled banks ease concerns about contagion.

- The fundamental backdrop suggests the path of least resistance for the GBP/JPY cross is to the upside, but caution is advised due to repeated failures near the 164.00 mark.

GBP/USD: GBP/USD Steadies Near 1.2150, Set to End Week with Gains:

- GBP/USD remains in positive territory, currently trading around 1.2150.

- The US Dollar is struggling to find demand due to plunging US yields and renewed weakness.

- The pair is on track to post weekly gains despite initial declines in the European trading hours.

- The decline in the Consumer Confidence Index and inflation expectations has led investors to reassess their positions ahead of next week’s Federal Reserve policy meeting, with a lower probability of a 25 basis points rate hike.

AUD/USD: AUD/USD Expected to Remain Range-Bound, According to UOB Group:

- AUD/USD is likely to continue its range-bound theme for the time being.

- The 24-hour view suggests further sideways trading with a range of 0.6630/0.6690.

- Over the next 1-3 weeks, AUD/USD is expected to trade within a consolidation range between 0.6570 and 0.6770.

- The expected range has been narrowed to 0.6570/0.6735 due to decreased volatility.

NZD/USD: NZD/USD Rallies as Banking Crisis is Quickly Resolved, but Questions Remain:

- NZD/USD benefits from a revived risk appetite and a softer US Dollar amid a relief rally in response to quick intervention in the banking crisis.

- Most Asian equity complexes are trading in the green, and steady US Treasury yields also contribute to the positive sentiment.

- While investors are confident that there will be some support from authorities to ease any financial glitches, questions remain about future bank support and policy implications.

- The market is uncertain about how many more liquidity-related issues may arise and what stance central banks will adopt, as seen by the ECB’s decision not to shift its rate hiking plan despite the Credit Suisse crisis, and the unlikely possibility of a pivotal change at the March FOMC meeting.

GOLD: XAU/USD bulls approach $1,955 with eyes on Fed – Confluence Detector:

- Gold price is grinding higher amid a weaker US Dollar and sluggish sentiment.

- Sustained trading beyond key support levels keeps XAU/USD buyers hopeful.

- Receding fears of a banking crisis and lack of major data/events strengthen the bullish bias.

- Second-tier US data and bond market moves are being watched for clear directions as Fed’s 0.25% rate hike seems given.

SILVER:

- Silver regains positive traction but struggles to move beyond $22.00.

- Acceptance above the $21.65-$21.70 confluence supports additional gains for XAG/USD.

- A break below the $21.00 mark is needed to negate the near-term positive bias.

- XAG/USD might extend the slide towards the $20.00 mark if it breaks the $21.00 support level.

OIL: WTI oil price bounces from 2023 lows amid financial turmoil and concerns over banking sector:

- Financial turmoil and concerns over the banking sector weigh on investors’ mood and drag WTI oil price to fresh 2023 lows.

- WTI bounces modestly from its low of $65.22 a barrel amid ongoing worries about the banking crisis.

- Technical readings suggest further declines ahead, with a potential slump to $62.41 and $60.00 acting as a major psychological barrier.

- WTI is finding sellers at around $70.00, with gains above the level unlikely to prosper.

Watch Out This Week

- On 22nd March, the fed interest rate decision will come out.. A figure that is higher than anticipated should be viewed as positive (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- On 24th march, the S&P Global Manufacturing PMI report will have a significant impact on USD, bond and stock markets. A higher than expected figure should be seen as positive (Bullish) for the USD while a lower than expected figure should be seen as negative (bearish) for the USD.

- It is important to pay attention to the continuous jobless report on 23rd March as it may have significant impacts on major currencies. A higher than expected figure should be seen as positive (bullish) for the USD while a lower than expected figure should be seen as negative (bearish) for the USD.