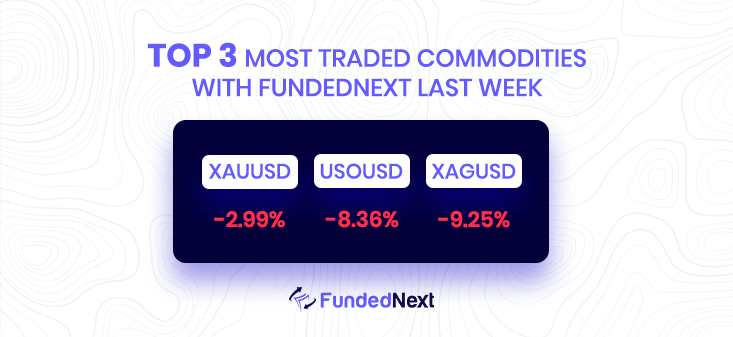

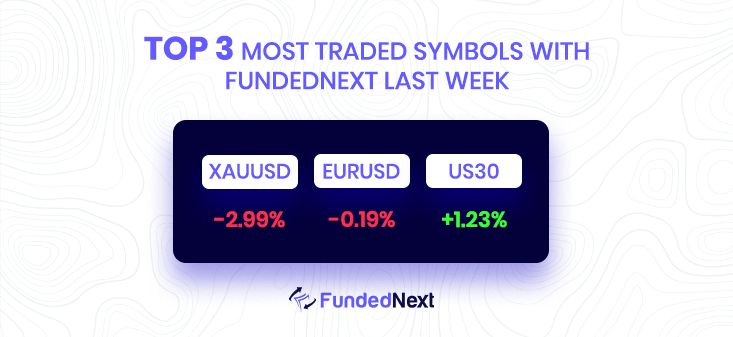

- The US dollar’s strength and aggressive monetary tightening continue to make conditions difficult for the gold market. By the end of the year, ANZ Bank strategists predict that XAU/USD will crash around $1,600.

- The US Federal Reserve will likely continue its aggressive monetary tightening cycle for a considerable time if inflation remains persistently high. Real rates should continue to rise as a result, which is a major drag on gold.

- Recently, the USD and gold have had a stronger association. Given that the USD should continue to appreciate as a result of more rate hikes, gold will certainly come under pressure. The unpredictable factor is the sale of US Treasury bonds by central banks as a kind of currency defense. To our eyes, that would be a positive risk.

- Following Thursday’s US inflation report, the gold price continued to decline while the dollar gained some ground. This will keep the Fed’s foot on the gas as markets get ready for significant rate rises at the November and December FOMC meetings. After reaching a day high of $1671, the XAU/USD is currently trading at $1646 per troy ounce.

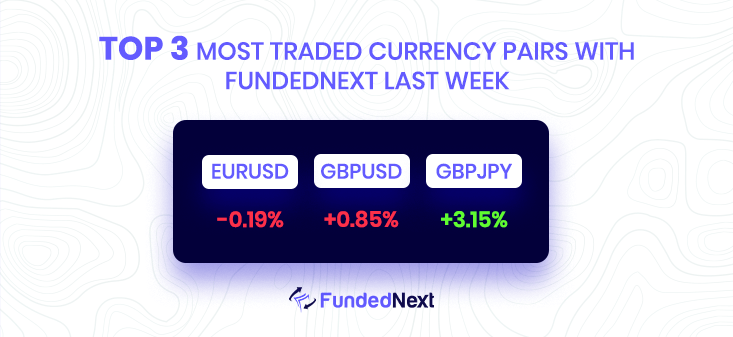

EURUSD: The euro gives up some of its recent gains against the dollar, which causes EUR/USD to drop to the 0.9750 area by the end of the week.

- Losing momentum, EUR/USD drops down to the mid-0.9700s.

- After the post-CPI decline, the dollar regains some of its confidence.

- Next of note: US Retail Sales and preliminary Consumer Sentiment.

USDJPY: Unstoppable USD/JPY is at over 148.40, the greatest level since August 1990.

- The value of the Japanese yen continues to fall overall.

- The USD/JPY is getting close to 150.00, levels last seen in 1990.

- Over the next several hours, intervention seems improbable, but Monday will be different.

- The USD/JPY benefits from the difference in interest rates and the divergence in monetary policy between central banks.

GBPUSD: In response, the GBP/USD pair experiences downward pressure. On Friday, modest dip-buying in the US dollar halts the previous day’s strong retracement decline from the post-US CPI swing high. Early optimism in the equities markets swiftly wanes as worries about a deeper global economic collapse grow. This aids in reviving demand for the safe-haven greenback together with the likelihood of a quicker Fed policy tightening.

On the final day of the week, the GBP/USD pair experiences rejection close to a falling trend-line resistance that dates back to late August. Early in the European session, the pair falls to the 1.1255–1.1250 range, and for the time being, it appears that a two-day losing run has been broken.

- A two-day winning run for GBP/USD is broken on Friday as a result of some selling pressure.

- Fears of a recession and aggressive Fed rate rise bets boost USD demand and serve as a hindrance.

- Ahead of the final day of the BoE’s emergency gilt purchase program, bulls also became apprehensive.

USD/CHF: The robust inflationary pressures were underscored by US consumer pricing data released on Thursday, which also increased confidence in a fourth consecutive 0.75% Fed rate hike in November. As a result, investors now find the US dollar to be more appealing.

- At 1.0065, the dollar surpasses parity and sets a two-year high.

- The US currency is rising on expectations of Fed tightening.

- Credit Suisse: Higher objectives are probable if the USD/CHF crosses 1.0074/98.

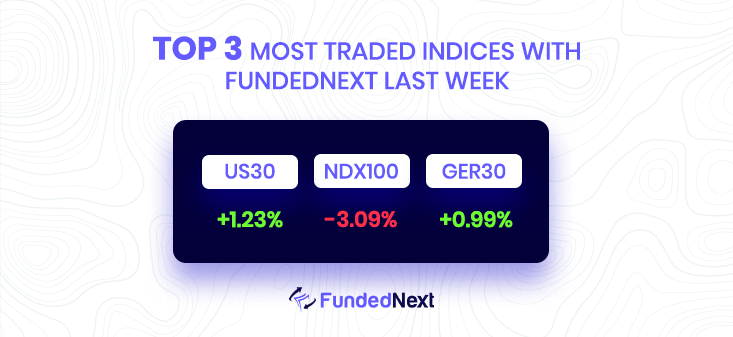

S&P500: After a wild session after the release of the US Consumer Price Index (CPI) data, the S&P 500 finished a significant bullish “reversal day.” Credit Suisse analysts anticipate a more prolonged period of recovery for the index.

The immediate danger is still higher over 3688 for 3707 and then the peak of the price difference from last Friday at 3745. To confirm that a more significant low is truly in place and to support a challenge of the current October high and the 38.2% retracement of the August/October decline at 3807/10, closing above this level is required. To indicate a short-term basis, move on beyond this point.

- After this predicted strength, however, we watch for a continued decline below 3595 in due course, with our main goal of a cluster of supports at 3235/3195 as the final destination.

- After a wild session after the release of the US Consumer Price Index (CPI) data, the S&P 500 finished a significant bullish “reversal day.” Credit Suisse analysts anticipate a more prolonged period of recovery for the index.

GOLD: While today’s retail sales showed some signs of softening, Mary Daly of the San Francisco Fed later said that inflation is not slowing. She echoed what Fed’s George said on the need for policy restraint and predicted that the Federal funds rate (FFR) would peak at between 4.5% and 5%.

While everything was going on, Lisa Cook, one of the Fed’s newest members, echoed some of the organization’s remarks from last week, stating that inflation is still “stubbornly and unacceptably high” and that she does not support a “stop and go” approach.

- The price of gold fell below $1650 and added 2.8% to its weekly losses.

- According to US statistics, retail sales underperformed while consumer confidence increased.

- XAU/USD Price Prediction: A test of the weekly low at $1642.49 was made possible by the breach below $1660.

SILVER: Analysis of the silver price: XAG/USD bears continue to monitor $18.20 despite a recent recovery.

- The price of silver recovers from a two-week low and ends a five-day losing trend.

- Further recovery is predicted by MACD and RSI, but the important SMAs impede upward progress.

- Bears are drawn in by a six-week-old support line unless the price exceeds $19.50.

OIL: To maintain control, the immediate trend line obstacle at $88.65 has to be broken decisively to the upside. After that, the upside advances will be tested by the late August–September moves’ 61.8% Fibonacci retracement level, which is close to $89.20. However, it should be highlighted that a six-week-old horizontal resistance region between $92.25-65 would be difficult for the WTI purchasers to overcome.

- WTI slows the largest daily advances in a week and loses ground after falling to an eight-day low.

- Even if oscillators favor buyers, resistance that has already become support from late September shields immediate gains.

- Oil prices are floored by the 200-SMA, and buyers require proof starting around $92.65.

Watch Out This Week

Now that the US CPI report is in the rearview mirror, the next important events in the EURO calendar would be September CPI figures and the University of Michigan Consumer Sentiment in the next week. This week the GBP and USD have major news on the calendar.

- For starters, on October 20th, The unemployment rate of the AUD is described as the number of people actively seeking work as a percentage of the population, all of whom are considered to be labor force participants. A higher-than-expected figure should be seen as negative (bearish) for the AUD, while a lower-than-expected figure should be seen as positive (bullish) for the AUD.

- Oct 19, the EURO CPI report will come out, giving vital information about the overall production capacity of the country. A higher-than-expected figure should be seen as positive (bullish) for the EURO, while a lower-than-expected figure should be seen as negative (bearish) for the EURO.

- On October 21th, the retail sales data will come out. The news is expected to eventually result in aggressive market movements among all the pairs intertwined with the GBP. A result that exceeds expectations should be seen positively (bullish) for the GBP, while a figure that falls short of expectations should be viewed negatively (bearish) for the GBP.

One Response

*