The world of trading and investing is constantly changing, and staying on top of the latest market trends and data is crucial for making informed decisions. This post analyzes the previous week’s market statistics and their implications for traders and investors. It covers top payouts, trading stats, and instruments, as well as the impact of the global market update on major currency pairs.

Top 5 Payouts:

Last week, the highest payouts recorded were $31,697, $27,351, $25,528, $22,520, and $19,500, respectively. These substantial payout amounts demonstrate the volatility of the market and the presence of numerous profitable opportunities for traders. The significant payouts indicate that traders were successful in capitalizing on these opportunities by making astute investment decisions.

Weekly Trading Stats:

During the week, traders received a total payout of $1,141,237, distributed among 861 individuals. This suggests that a considerable number of traders actively engaged in the market, and those who made sound investments were able to achieve substantial profits.

Throughout this period, a total of 178,678 trades were executed, involving a total of 159,227 lots. These figures highlight a notable level of trading activity, indicating a market environment characterized by volatility and movement.

Weekly Trading Instruments:

The top trading pairs during the week were XAUUSD, EURUSD, US30, GBPUSD & NDX100. These pairs are popular among traders and investors and are known to be volatile, which makes them attractive for investment. The high trading volume of these pairs indicates that they were in demand during the week, and traders were able to make profits by investing in them.

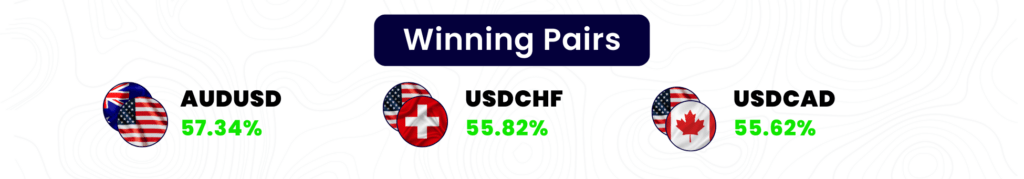

During the week, the AUDUSD, USDCHF, and USDCAD currency pairs performed well and had winning percentages of 57.91%, 55.82%, and 55.62% respectively. This implies that traders who traded these pairs potentially made notable profits.

On the other hand, the NZDUSD, EURUSD, and AUDCHF currency pairs did not perform as well and had losing percentages of 50.96%, 49.08%, and 48.39% respectively. This suggests that traders who invested in these pairs might have experienced losses.

|| USD Index Surges Above 102.00, Targets Monthly High – Will the Bullish Momentum Continue? ||

Global Market Update:

- The USD Index, represented by DXY, has continued its upward trajectory, surpassing the 102.00 mark and aiming for the next resistance level at 102.40. This bullish momentum suggests a potential advance towards the monthly high, which would alleviate the downside pressure. The index would need to surpass the 55- and 100-day SMAs at 102.70 and 102.93, respectively, to further solidify the upward trend. However, it is important to note that the 200-day SMA at 105.84 still looms above, indicating an overall negative outlook for the index.

- The recent rebound of the Dollar suggests that market sentiment remains sensitive to developments surrounding the US debt ceiling. With no progress towards a deal in sight, the Dollar is finding support as investors anxiously monitor the situation. The lack of resolution may continue to bolster the Dollar’s position, keeping it afloat in the near term. However, the outcome hinges on Washington’s actions, as an adverse market reaction could potentially break the impasse.

- Gold prices are currently in a consolidation phase near the $2,020 mark, presenting an intriguing outlook for XAU/USD. According to strategists at ANZ bank, if recent highs are surpassed, the precious metal could experience a notable advance towards the uncharted territory of $2,100. The technical chart reveals a sustained bullish momentum, as evidenced by the upward channel, which indicates a broad range for gold prices between $1,900 and $2,100. However, a crucial resistance level at $2,062 must be overcome to trigger fresh technical buying interest and propel prices higher. On the downside, any disappointment regarding the prospects of a rate hike could potentially push gold prices back towards the trend line support at $1,900. The interplay between technical factors and monetary policy developments will likely play a significant role in shaping the future trajectory of gold prices in the coming period.

EUR/USD: EUR/USD Hits One-Month Lows at 1.0850 Amidst Strong US Dollar

- EUR/USD extends weekly losses, reaching fresh one-month lows near 1.0850.

- US Dollar gains momentum across the board, driven by higher yields and weaker sentiment.

- The US Dollar Index climbs 0.60% on Friday, reaching a one-month high above 102.50.

- Short-term outlook for EUR/USD remains bearish, with immediate support at 1.0800 and potential long-term USD rally if 1.0745 is breached.

GBP/USD: GBP/USD Price Analysis: Bulls Seek Deceleration in Supply, Targeting 1.2500:

- GBP/USD bears currently push the pair into the 1.2450s, which are currently holding as a support level.

- Upside potential is seen around the 1.2480/1.2500 range if the bulls regain control.

- GBP/USD experiences a 0.45% decline on the day, dropping from 1.2540 to 1.2448, as short GBP positions are reduced by speculators.

- The pair encounters a potential area of support, indicating the possibility of a rebound, as outlined by forthcoming technical analysis.

EUR/JPY: EUR/JPY Price Analysis: Potential for Additional Losses in the Near Term:

- EUR/JPY shows a rebound from previous monthly lows near 146.00.

- Despite the rebound, the possibility of additional losses should not be overlooked at this time.

- The pair reverses three consecutive daily pullbacks and recovers above the 147.00 level on Friday.

- The current downtrend remains unchallenged, potentially leading EUR/JPY to test the May low of 146.13 and the provisional 55-day SMA at 145.29. However, further upside potential may still exist as long as the cross maintains a position above the 200-day SMA at 143.00.

AUD/USD: AUD/USD Drifts Lower Below 0.6700 Amid Global Economic Concerns:

- The safe-haven appeal of the US dollar limits the losses for the pair, supported by a modest uptick in US Treasury bond yields.

- The uncertainty surrounding the Federal Reserve’s next policy move restrains aggressive bets on the US dollar, while a positive tone in equity markets provides some support for AUD/USD.

- The hawkish outlook from the Reserve Bank of Australia adds caution for bearish traders, suggesting potential for further tightening of monetary policy.

- While waiting for strong follow-through selling, the AUD/USD pair is on track to end the week with losses, reversing a significant portion of recent gains.

NZD/USD: NZD/USD Struggles Near Weekly Low, Bulls Defend 200 DMA:

- NZD/USD experiences a second consecutive day of downward movement, reaching a one-week low on Friday.

- Concerns about a global economic slowdown weigh heavily on the risk-sensitive New Zealand dollar.

- A modest decline in the US dollar provides some support, although the overall fundamental backdrop favors bearish traders.

- The pair shows resilience near the 200-day Simple Moving Average (SMA), which bulls attempt to defend.

GOLD:

Gold Price Forecast: XAU/USD Remains Bearish Below $2,030 Amid US Debt Ceiling Talks:

- Gold price breaks two-week winning streak, falling below the confluence level at $2,030.

- US debt ceiling talks and concerns over banking issues contribute to a stronger US Dollar and weigh on XAU/USD.

- US policymakers will convene early next week to address default fears, while a speech by Fed Chairman Jerome Powell adds to market focus.

- Mixed sentiment allows the US Dollar to maintain strength, reinforcing the bearish bias for XAU/USD.

SILVER:

Silver Price Analysis: XAG/USD Vulnerable Near One-Month Low, Bears Eye 50-day DMA:

- Silver continues to drift lower for the third consecutive day, reaching over a one-month low on Friday.

- Breakthrough of the $24.50-$24.40 horizontal support strengthens the bearish sentiment.

- Potential for further losses if there is follow-through selling below the 38.2% Fibonacci retracement level.

- Support found near the 50-day Simple Moving Average (SMA), followed by the 38.2% Fibonacci retracement level, may be tested.

OIL:

WTI Rebounds from Multi-Day Lows, Focuses on Data:

- WTI crude oil prices bounce back from multi-day lows near $70.00, currently holding gains above the $71.00 mark.

- Traders are divided between recession fears in the US and the prospects of a Chinese recovery.

- The unresolved US debt ceiling issue and concerns over banking stability contribute to a cautious sentiment surrounding the commodity.

- News of the US government starting to refill its Strategic Petroleum Reserve (SPR) and lower Nigerian oil output in April help limit the daily decline.

Watch Out This Week

- h) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- On 16th May, the GBP Employment Change report will have a significant impact on British bond and stock markets. A higher than expected figure should be seen as positive (Bullish) for the GBP while a lower than expected figure should be seen as negative (bearish) for the GBP.

- It is important to pay attention to the continuous jobless report on 18th May as it may have significant impacts on major currencies. A higher than expected figure should be seen as negative (bearish) for the USD while a lower than expected figure should be seen as positive (bullish) for the USD.