In this article, we are delving into the dynamic world of trading and investing, highlighting the importance of staying updated on current market trends and data to make informed decisions. We analyzed the market statistics of the previous week, exploring their relevance for traders and investors. The article covers various aspects such as notable earnings, trading statistics, and instruments. Additionally, it considers the impact of the global market update on major currency pairs.

Top 5 Payouts:

During the previous week, the top 5 payouts were;

- $30,660 – 280k Account Size (Scaled Up) – 10.95% Growth

- $28,224 – 200k Account Size – 14.11% Growth

- $26,746 – 200k Account Size – 13.37% Growth

- $25,195 – 140k Account Size (Scaled Up) – 17.99% Growth

- $24,917 – 100k Account Size – 24.91% Growth

These substantial payout figures exemplify the market’s volatility and the existence of multiple lucrative prospects for traders. The significant payouts serve as evidence that traders achieved success by capitalizing on these opportunities through prudent investment choices.

Weekly Trading Stats:

Last week, traders collectively received a payout totaling $1,144,22; which was distributed among 831 individuals. This indicates significant participation of traders in the market, with those who made wise investment decisions reaping substantial profits.

During this timeframe, a total of 290,550 trades were executed, involving a cumulative sum of 269,782 lots. These numbers emphasize the considerable level of trading activity, signifying a market environment characterized by volatility and dynamic movement.

Weekly Trading Instruments:

The most prominent trading pairs observed throughout the week encompassed XAUUSD, EURUSD, US30, GBPUSD, and NDX100. These pairs hold popularity among traders and investors, known for their volatility which adds to their investment appeal. The substantial trading volume associated with these pairs indicates their high demand throughout the week, presenting traders with profit-making opportunities.

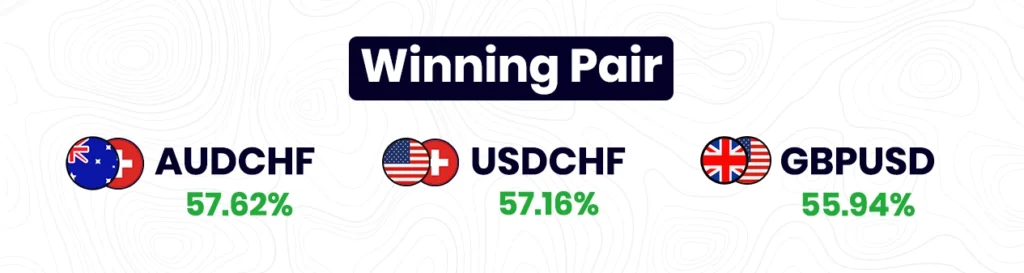

Among all the currency pairs, AUDCHF, USDCHF & GBPUSD demonstrated favorable performance, boasting winning percentages of 57.62%, 57.16%, and 55.94% respectively. This suggests that traders who engaged in these pairs potentially achieved notable profits.

Conversely, the CADJPY, EURCAD & AUDUSD currency pairs did not exhibit favorable performance, reflecting losing percentages of 58.12%, 50.53%, and 48.94% respectively. This implies that traders who invested in these pairs might have encountered losses.

|| Dollar Dilemma: Nonfarm Payrolls Surge, Yet USD Index Remains Resilient at 103.50 ||

Global Market Update:

- In an unexpected turn of events, the USD Index (DXY) has consistently traded around the 103.50 zone despite the stunning surprise from May’s Nonfarm Payrolls. The US economy created a whopping 339K jobs, momentarily buoying the greenback to a daily high of 103.70/75. Yet, despite this promising news, the USD Index swiftly retreated to its comfort zone amidst an improving risk scenario and a palpable shift in consensus towards a potential Fed pause. The mercurial behavior of the greenback continues to confound observers, raising crucial questions about the health and future of the US economy.

- Gold prices took a tumble from the $1,980 mark down to $1,971, following the release of the US official employment report. This drop was triggered by an unexpected surge in Nonfarm Payrolls that eclipsed market predictions. The US economy generated 339K jobs in May, dwarfing the anticipated 190K and achieving the highest count in four months.

- The US Dollar initially gained ground against major counterparts such as the EUR, GBP, and JPY, even trimming losses against the CAD, NZD, and AUD. However, this momentum started to wane. Concurrently, US yields briefly spiked before pulling back as markets pondered whether the robust jobs figures were sufficient to prompt another rate hike from the Federal Reserve. This uncertainty and the subsequent increase in Treasury yields placed additional pressure on Gold, driving its price further down in a volatile post-NFP environment.

EUR/USD: ECB Rate Hikes on the Horizon to Support EUR/USD, Says MUFG

- The minutes from the European Central Bank (ECB) meeting on 4th May indicate the likelihood of two more rate hikes, bolstering the prospect for the EUR/USD.

- ECB President Lagarde has declared that there’s ‘no clear evidence’ of peaking underlying inflation, suggesting the continuation of this narrative in her upcoming policy press conference on 14th June.

- There’s an expectation for a probable hike of 25 basis points at the next ECB meeting.

- Considering the current economic climate and the potential drift towards higher services inflation due to tourism-related pressures over the summer, there’s limited scope for lower yields at the front end in the Eurozone. This outlook should provide support for the Euro at lower levels.

GBP/USD: GBP/USD Sees Bullish Consolidation, Awaits US NFP Report Amid Diminishing Odds for Fed Rate Hike

- GBP/USD ascends to a nearly three-week peak, aided by continued USD selling and diminished expectations for a June Fed rate hike.

- Speculations about further tightening measures by the Bank of England provide additional support to the pair ahead of the anticipated US NFP report.

- A slide in the USD, driven by Fed officials’ backing of a case to skip the upcoming interest rate hike, in combination with a positive risk tone, is bolstering the GBP/USD pair.

- Traders seem hesitant to place aggressive bets until the release of the US monthly employment details, the NFP report, which will shape market expectations about the Fed’s next policy move and influence the USD’s demand. Despite this, spot prices are set to break a three-week losing streak.

EUR/JPY: EUR/JPY Surpasses 149.50 Despite Softening Eurozone Inflation, Fueled by Hawkish ECB and BoJ Measures

- EUR/JPY ascends above 149.50, displaying potential for further upside, supported by expectations of a hawkish ECB stance even amidst softening Eurozone inflation.

- The Harmonized Index of Consumer Prices (HICP) in the Eurozone reported lower-than-anticipated figures, with annual HICP decelerating notably to 6.1% from the previous release of 7.0%, reflecting increased cost of living pressures.

- Despite a slowdown in Eurozone inflation and Germany’s recession situation, ECB President Christine Lagarde has emphasized the need to continue the hiking cycle until inflation is on track to return to the ECB’s target.

- Anticipating volatility on the Japanese Yen front, the Bank of Japan (BoJ) is expected to modify its Yield Curve Control (YCC) to maintain inflation steadily above 2%, while continuing its bond-buying operations.

AUD/USD: AUD/USD Price Forecast: Bulls Take Charge, Eye Key Resistance Amid Favorable Market Conditions

- AUD/USD bulls aim for a significant move upward to test a key resistance area, signaling an optimistic outlook for the currency pair.

- The “W-formation” neckline is noted on the downside by bearish observers, indicating potential shifts in the market.

- The AUD was buoyed by positive China factory data and hopes of a pause in the Federal Reserve’s rate hike, leading to a climb away from the 6-1/2 month low reached on Wednesday.

- Despite a 1.7% loss last month, the AUD/USD pair continues to recoup losses, with technical structures indicating prospects of a continuation before an anticipated downturn.

NZD/USD: NZD/USD Experiences Volatility After Strong US NFP Data; Yields Rise, Greenback Gains Interest

- The NZD/USD pair, despite initially surging to a five-day high, retreated to the 0.6065 area following strong US labor market data, resulting in increased favor for the US Dollar.

- The US Bureau of Labor Statistics reported robust employment growth in May with an increase of 339k jobs, surpassing the anticipated 190k, albeit with a slight rise in the Unemployment Rate to 3.7%.

- US bond yields witnessed an upward trend, with the 10-year yield reaching 3.68% for the day, while the 2-year and 5-year yields rose to 4.51% and 3.84% respectively, in response to growing inflationary pressures.

- Looking ahead, the May Consumer Price Index (CPI) data, due to be released next week, will play a key role in shaping the Federal Open Market Committee’s decision on future interest rates. Despite this, the CME FedWatch tool suggests markets are still heavily leaning towards no hike for the June 13-14 meeting.

GOLD:

XAU/USD Dips Following Upbeat US NFP Report and Rising Treasury Yields:

- Gold prices fell after the release of the US Nonfarm Payrolls report for May, which showed job growth significantly exceeding expectations.

- A surge in US Treasury bond yields and a robust US Dollar exerted downward pressure on gold prices, although the yellow metal is still set to end the week with decent gains.

- Expectations have risen that the US Federal Reserve will keep rates unchanged at the June meeting, but a 25 basis points rate hike is nearly certain in July.

- Approval of the US debt-ceiling bill by the House and Senate led to a drop in US bond yields, potentially offering some respite for gold.

SILVER:

Silver Price Sees Dip as US Treasury Bond Yields Strengthen Amid Strong Jobs Report:

- Silver price faces a downturn as strong US jobs report bolstered US Treasury bond yields, pulling precious metals lower.

- The May Nonfarm Payrolls report showed 339K new jobs, significantly more than the anticipated 190K, putting pressure on silver prices.

- The Federal Reserve is expected to raise rates in July, further pressuring precious metals, despite talk of a potential pause to assess the impact of the current tightening.

- The US debt-ceiling drama’s resolution offers potential relief for silver, with a bill to avoid a US government default set to be signed into law by President Biden over the weekend.

- In the technical outlook, the XAG/USD appears neutral, with the potential to remain sideways, waiting for the next significant market event.

OIL:

Oil Price Rallies on Debt-Ceiling Bill Passage and OPEC+ Speculation:

- Oil prices show recovery for the second day following the US Senate’s approval of the debt-ceiling extension bill, which relieved global markets and curbed the US Dollar’s advance.

- Speculations surrounding the US Federal Reserve’s potential pause on interest rate hikes in their June 14 meeting have also contributed to the oil price recovery.

- Tensions within OPEC+, particularly between Russia and Saudi Arabia over production quotas, introduce uncertainty ahead of their meeting on June 4, supporting oil prices.

- Despite the recovery, WTI Oil price remains in a long-term downtrend since July 2022, favoring short sellers, with the 200-week SMA serving as a key support level.

Watch out for Next Week’s Important Dates

- On 5th June,, the United States S&P Global Services PMI report will come out. A figure that is higher than anticipated should be viewed as positive (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- On 6th June, the United Kingdom S&P Global/CIPS Construction PMI report will have a significant impact on British bond and stock markets. A higher-than-expected figure should be seen as positive (Bullish) for the GBP while a lower-than-expected figure should be seen as negative (bearish) for the GBP.

- It is important to pay attention to the continuous jobless report on 8th June as it may have significant impacts on major currencies. A higher-than-expected figure should be seen as negative (bearish) for the USD while a lower-than-expected figure should be seen as positive (bullish) for the USD.

4 Responses

Am interested

We are glad. Have a look at all our features here; https://fundednext.com/. Thank You.

How does it work in the company is in progress put me through more

Sure, you can learn more about our features and updates in our “market analysis” & “important announcement” category blogs. You can find them here; https://blog.fundednext.com/.