- The US Dollar index (DXY) is hovering around 105.30 in the Tokyo session. The street is having mixed views on Fed’s policy outlook. Upbeat Nonfarm Payrolls (NFP) and robust demand in the service sector have shown strength in the United States economy while expectations for higher interest rate guidance are triggering recession fears.

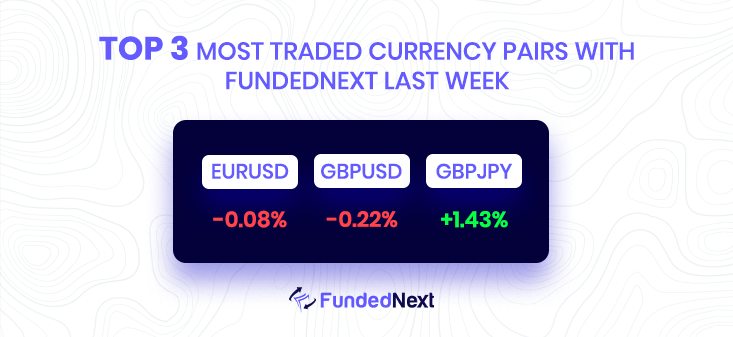

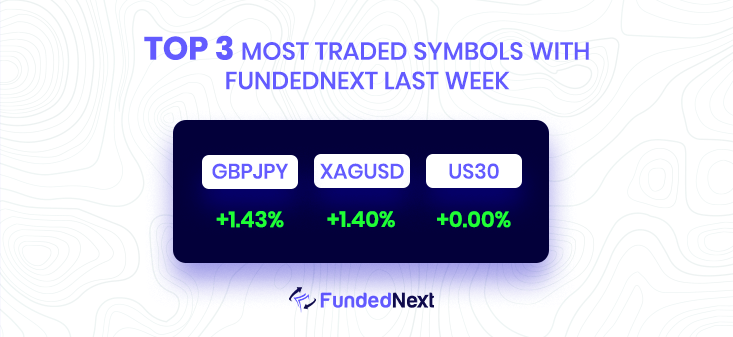

- EUR/USD picks up extra selling pressure after the release of the Nonfarm Payrolls showed the US economy added 263K jobs during November, surpassing initial estimates for a gain of 200K jobs.

- The US Dollar prolongs its steady descent for the third successive day amid firming expectations for a less aggressive policy tightening by the Fed, which, in turn, is seen weighing on the USD/JPY pair. In fact, the markets seem convinced that the US central bank will slow the pace of its rate-hiking cycle and have been pricing in a 50 bps lift-off in December.

EURUSD: Buyers maintain the pressure ahead of the weekly close:

- The US Michigan Consumer Confidence Index improved to 59.1 in December.

- The uncertainty surrounding the US Federal Reserve’s decision weighs on mood.

- EUR/USD eases following upbeat US data but holds above 1.0500.

USDJPY: USD/JPY recovers from a multi-day low, remaining below the mid-136.00s despite a weaker USD.

- USD/JPY drifts lower on Friday amid heavy follow-through selling around the USD.

- Bets for less aggressive Fed rate hikes, depressed US bond yields weigh on the buck.

- Traders, however, seem reluctant ahead of next week’s key US data and FOMC meeting.

GBP/USD: GBP/USD is marching towards 1.2300 on hawkish BOE concerns and a weaker US dollar ahead of key Fed data.

- GBP/USD rises for the third consecutive day despite mixed markets.

- BOE is expected to announce 50 bps rate hike as rents rise more than wages.

- Easing of financial services rules for London adds strength to the Cable pair’s run-up.

- US consumer-centric data eyed ahead of the next week’s key Fed, BOE meetings.

AUD/USD: The AUD/USD is poised to break 0.6800 as risk-on firms and US PPI take center stage.

- AUD/USD is aiming to surpass 0.6800 as the market sentiment has become extremely bullish.

- China’s factory-gate price deflation has cemented a dovish commentary from the PBOC.

- A decline in the US PPI data is going to delight the Fed as expectations for a drop in inflation will get stronger.

USD/CHF: USD/CHF declines towards 0.9350 as focus shifts to the Fed/SNB interest rate decision.

- USD/CHF is likely to display weakness to near 0.9350 as a risk-on impulse has hogged the limelight.

- Volatility in the currency market is accelerating as the Fed is set to announce the last monetary policy of CY2022.

- Investors have ignored uncertainty over Fed’s interest rate peak.

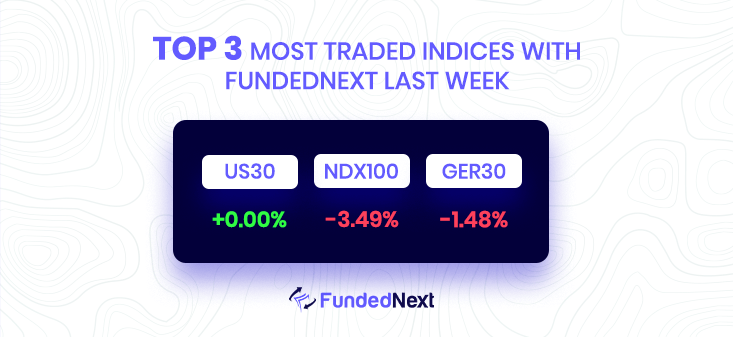

S&P500: The risk profile improves during early Thursday as a holiday in the US joins a light calendar. Also keeping the buyers hopeful are the expectations from the Chinese authorities, as well as chatters surrounding the Fed’s pivot and the easy monetary policy.

- Market sentiment remains cautiously optimistic despite the Thanksgiving holiday and light calendar.

- Fed Minutes propelled ‘pivot’ discussions, China brushes aside virus woes to ease zero-covid policy.

- Wall Street closed positive, and US Treasury bond yields refreshed their weekly low.

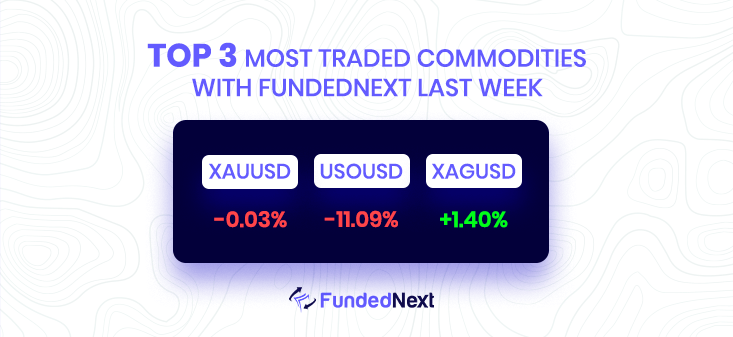

GOLD: As the Fed’s policy outlook muddles the US dollar, XAU/USD seeks a cushion above $1,780.

- Gold price is seeking a cushion near $1,780.00 as US Dollar dwindled on the Fed policy outlook.

- The cautious market mood amid uncertainty over Fed’s policy outlook is impacting risky assets.

- A policy change from the FOMC in CY2023 would set the stage for a prolonged decline in the Greenback.

SILVER: XAG/USD regains early losses and appears poised to rise further.

- Silver reverses an intraday dip to the $22.55 area and climbs back closer to the overnight swing high.

- The technical setup favors bullish traders and supports prospects for a further appreciating move.

- Any meaningful pullback might attract some di-buyers and remains limited near the $22.00 mark.

OIL: Crude oil sits at its lowest point for the year.

- Europe and the G-7 started applying a price cap to oil prices, crude plunged.

- EU Commission President Van der Leyen anticipated more sanctions ahead.

- WTI trades near a weekly low of $71.11 a barrel, the lowest since December 2021.

Watch Out This Week

- Like for starters, on 12th December, GBP trade balance news will come out The goods trade balance in the United Kingdom equals the difference between goods exports and goods imports. A higher than expected figure should be seen as positive (bullish) for the GBP while a lower than expected figure should be seen as negative (bearish) for the GBP. The Euro CPI news will come out on the same day.

- 13th December, this day is going to be very important as Britain’s employment rate will come out eventually resulting in movements in the GBP attached pairs. A value that is greater than anticipated should be interpreted negatively (bearish) for the pound, while a figure that is lower than anticipated should be interpreted favorably (bullish). On the same day USD CPI news will come out as well.

- On December 15th, the US FOMC will come out. The Board decides whether to modify the discount rate after hearing suggestions from one or more of the regional Federal Reserve Banks. The Federal Open Market Committee (FOMC) decides on open market transactions such central bank money levels and the federal funds market rate. A result that exceeds expectations should be seen positively (bullish) for the USD, while a figure that falls short of expectations should be viewed negatively (bearish) for the USD.

2 Responses

سلام عشقم کجای نیستی دوستت دارم موفق

خیلی ممنون عزیزم. برای شما نیز موفق باشید، من به تیم بانکداری جهانی خود اطلاع داده ام تا حساب شما را بررسی کنند.