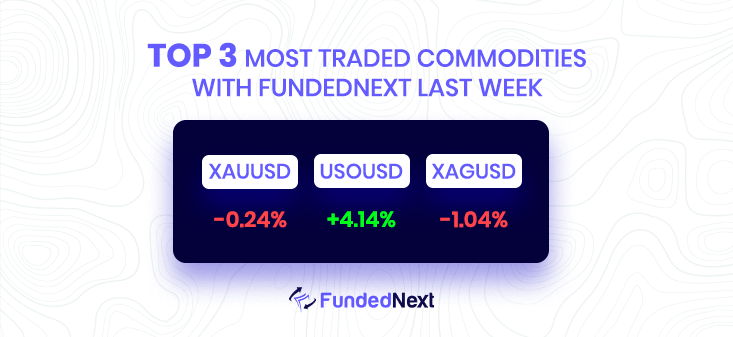

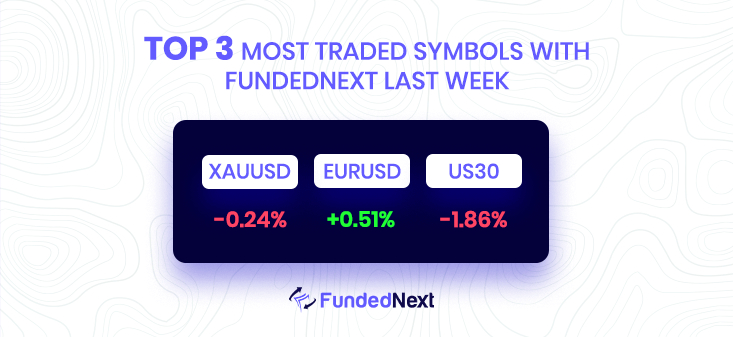

- Despite Thursday’s significant loss, gold was able to get slightly above the 200-day SMA. While above this level, the positive tendency for XAU/USD remains.

- Prior to the December PMIs, purchasers are encouraged by the recession’s difficulties and Sino-American tensions.

- Prior to Friday’s European session, the US Dollar Index (DXY) shows minor losses as it moves between 104.30 and 104.40. In doing so, the indicator of the value of the dollar in relation to the six most important currencies consolidates the previous day’s record-breaking daily rise since early November.

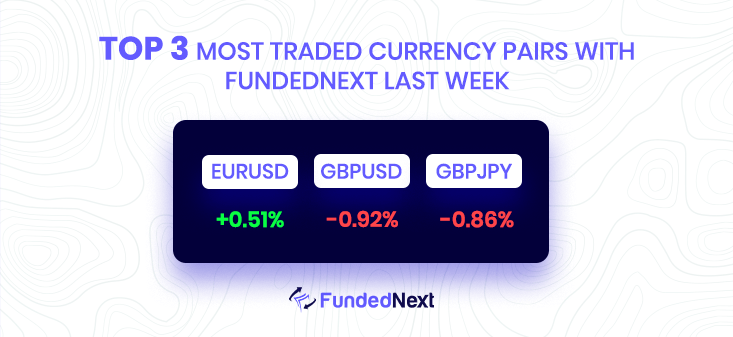

EURUSD: The EUR/USD is marching towards 1.0700 as the US Dollar falls ahead of key PMIs.

- EUR/USD pokes intraday top, reversing the pullback from a six-month high.

- Hawkish ECB statements favor EUR/USD bulls ahead of EU/German PMIs for December.

- Final prints of Eurozone inflation also need observing for clear directions.

USDJPY: In an effort to rectify the US Dollar’s day-old gain, USD/JPY is under pressure in Asia. As of this writing, the USD/JPY has decreased by about 0.28%, going from a high of 137.80 to a low of 137.35.

- USD/JPY bears are moving in within the sideways consolidation.

- The Fed is weighing on risk sentiment, supportive of the US Dollar.

GBP/USD: Despite worse UK retail sales, the GBP/USD remains stable near 1.2200, and upside seems limited.

- GBP/USD gains some positive traction on Friday amid a modest USD downtick.

- The disappointing release of the UK Retail Sales fails to provide any impetus.

- A bleak outlook for the UK economy, BoE’s dovish hike favours the GBP bears.

- The Fed’s hawkish outlook, recession fears support prospects for further losses.

AUD/USD: AUD/USD Price Analysis: 200-EMA probes bears on their way to 0.6550.

- AUD/USD stays sluggish after falling the most since March 2020.

- Clear downside break of three-week-old support line, bearish MACD signals favor sellers.

- Since October, a horizontal area with multiple levels has been marked to attract bears.

USD/CHF: USD/CHF sellers approach 0.9225 support with eyes on US PMIs.

- USD/CHF takes offers to reverse previous day’s bounce off 8.5-month low.

- Markets stabilize after global central banks portrayed a volatile day, allowing sellers to sneak in.

- Failure to cross support-turned-resistance directs bears towards three-week-old trend line support.

- Preliminary PMIs for December, risk catalysts will be important for fresh impulse.

GOLD: XAU/USD hangs near one-week low; risk-off mood limits downside.

- Gold price surrenders its modest intraday gains and hangs near a one-week low set on Thursday.

- A more hawkish stance adopted by major central banks acts as a headwind for the commodity.

- The emergence of some US Dollar buying further contributes to capping gains for the XAU/USD.

- The prevalent risk-off environment lends support and helps limit the downside for Gold price.

SILVER: XAG/USD regains early losses and appears poised to rise further.

- Silver reverses an intraday dip to the $22.55 area and climbs back closer to the overnight swing high.

- The technical setup favors bullish traders and supports prospects for a further appreciating move.

- Any meaningful pullback might attract some di-buyers and remains limited near the $22.00 mark.

OIL: Extends pullback from 21-DMA below $76.00.

- WTI remains pressured around intraday low, defends previous day’s U-turn from two-week top.

- Downbeat RSI conditions, pullback from short-term key DMA hints at further weakness.

- 11-week-old bullish triangle gains major attention, highlighting $78.20 as the key hurdle

Watch Out This Week

- Like for starters, on 20th December, USD Building Permits report will come out. A figure that is higher than anticipated should be viewed as positive (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- On December 21st, the US existing home sales report will come out.After the mortgage is paid off, existing homes are sold in the United States. Following the conclusion of the sales contract, the mortgage is normally closed 30 to 60 days later.A higher than expected figure should be seen as positive (bullish) for the USD while a lower than expected figure should be seen as negative (bearish) for the USD.

- On December 22nd, the US initial jobless claim report will come out. First-time jobless claims have a significant impact on the financial markets since in contrast to continuous claims data, which monitors the number of people receiving unemployment benefits, first-time jobless claims measure fresh and developing unemployment.A figure that is greater than anticipated should be seen negatively (bearish) for the USD, whilst a figure that is lower than anticipated should be viewed favorably (bullish) for the USD.

One Response

Very nice post. I’ll be subscribing to your feed and I hope you write again soon!