- The Federal Reserve indicated its determination to bring down inflation and keep interest rates high in the minutes of its December meeting

- This came as markets expect rate cuts in the second half of 2023, despite the Fed’s recent hike in the benchmark lending rate

- The Fed’s rate projections were “notably above” market expectations and Fed Chair Jerome Powell said the committee has “more work to do” to achieve its goals of stable prices and low unemployment.

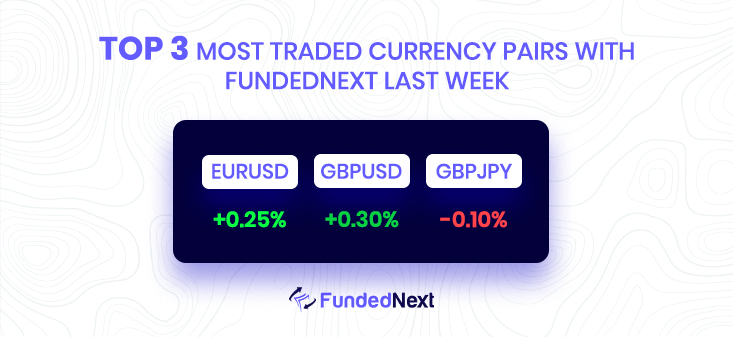

EURUSD: EUR/USD Falls to Multi-Week Lows

- EUR/USD extends bearish trend, falls below 1.0500

- Further decline could reach weekly low at 1.0443 or 55-day SMA at 1.0365

- Pair must hold above 200-day SMA at 1.0311 for further gains.

USDJPY: USD/JPY Falls on Dovish Fed Outlook

- Weak US Dollar following December Nonfarm Payrolls data and lower Average Hourly Earnings

- US Treasury bond yields drop 9 bps to 3.625%, weighing on USD/JPY

- Atlanta Fed President Raphael Bostic says Fed needs to maintain current course to combat high inflation, with base case for Federal Funds rate reaching 5.00-5.25% range into 2024.

GBP/USD: GBP/USD Rises Sharply on Weak US Services PMI

- GBP/USD surges more than 160 pips following disappointing ISM Services report and earlier jobs data

- US Dollar Index drops more than 1% to 104.000 on weak Services PMI and easing wage inflation

- Upcoming economic calendar for UK and US to feature Retail Sales, GDP, Trade Balance, CPI, unemployment claims, and UoM Consumer Sentiment.

AUD/USD: AUD/USD Remains Below 0.6800 Ahead of US NFP Report

- AUD/USD recovers some of the previous day’s losses due to easing COVID-19 restrictions in China and improved risk sentiment.

- Concerns about a global economic downturn and strong follow-through USD buying act as headwinds for the AUD/USD pair.

- The release of the US monthly jobs report, known as the NFP, could influence the Federal Reserve’s policy outlook and drive USD demand in the near term.

USD/CHF: USD/CHF finishes week with gains despite Friday decline

- The USD/CHF pair finished the week with gains of 0.45% despite falling 1% on Friday.

- From a weekly chart perspective, the pair has a downward bias and could test the 0.9200 mark in the near term.

- If the USD/CHF can reclaim the 0.9300 level, it could pave the way for a rise to 0.9400.

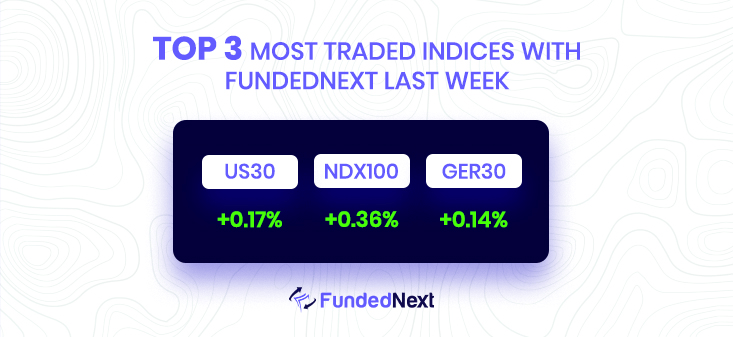

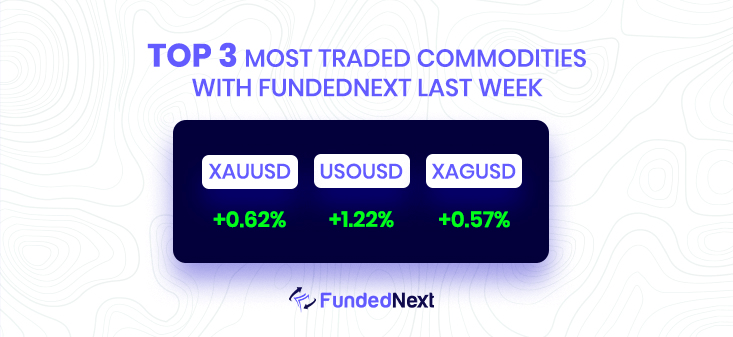

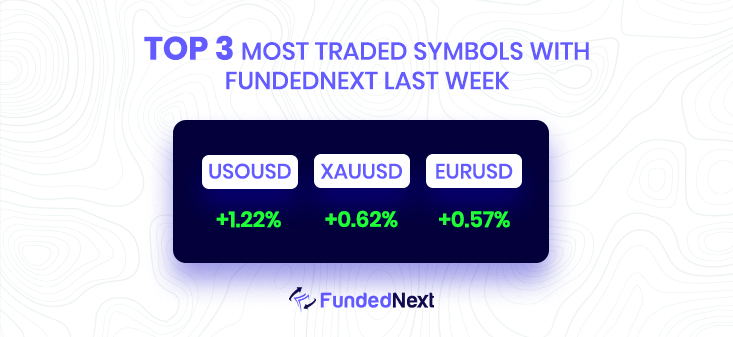

GOLD: Gold Price Increases Following Positive US Employment Data

- US Nonfarm Payrolls exceeded expectations with 223K jobs added in December.

- Unemployment rate declined to 3.5%.

- Average Hourly Earnings were lower than expected at 4.6%.

SILVER: XAG/USD Stabilizes Near Two-Week Low

- Silver recovers from two-week low, but technical setup still favors bearish traders.

- Any subsequent move up may be seen as a selling opportunity and quickly fizzle out.

- Immediate support at $23.20-$23.10, failure to defend could lead to further near-term depreciation.

OIL: Despite a weaker US dollar, WTI is struggling.

- WTI hovers around $73.60 despite a decline in the value of the US Dollar

- WTI set to end the week with significant losses of 8.40%

- Mixed US economic data, including a decline in wages and a drop in the ISM Services PMI, weigh on oil prices amid global recession concerns.

Watch Out This Week

- On Jan 12th, the US inflation rate will come out. A figure that is higher than anticipated should be viewed as positive (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- The release of the core inflation report on January 12th will be closely monitored by market participants. A higher-than-anticipated figure may be interpreted as supportive of the US dollar, while a lower-than-expected result may be seen as detrimental to the currency.

- It is important to pay attention to the speech given by the Federal Reserve on 10th January, as it may have significant impacts on major currencies. It is advisable for traders and investors to closely monitor any updates or announcements made during this event.

One Response

Yes. As A Newbie Yet To Discover These site