As the USD and the euro hit parity for the first time in 20 years, the ECB is in a very precarious position:

After Wall Street closed with a slight down as investors scaled back expectations of how aggressively the Fed will hike interest rates to battle inflation, S&P 500 and Nasdaq 100 contracts fluctuated before moving higher. Investors are analyzing the expected impact on the economy and how conservative the Fed needs to be to reduce inflation. After the most recent comments suggested a 75 basis point increase, bets on a July rate increase of one percentage point(100basis) have been reduced.

The euro has had a rapid and severe decline this year, and it has already crossed a significant milestone:

Multiple challenges, including the Ukraine conflict, the energy crisis, and the growing possibility that Russia would cut off gas exports and send the euro area into recession, have contributed to the loss of 12%. Some analysts believe parity may not be the goal but rather a stepping stone to greater decline because of the divergent rates being moved by central banks and the strong demand for the dollar.. According to Erin Gibbs, chief investment officer of Main Street Asset Management, “It’s a challenge, it’s a difficult situation, transition. I don’t envy the Federal Reserve, but we’ve known there has been too much money out there and that’s why we’re here in this position.”

Similarities between current and past Euro Slumps:

After a brief period of decline, the euro experienced a period of gain, hitting a high of $1.60 in 2008. Politicians in the eurozone claimed that this strength was hurting businesses and that it was harmful to the economy. France’s finance minister at the time, Christine Lagarde, was one of those voices. When the global financial crisis hit in 2008, the euro lost ground once more. Later, as Europe’s sovereign debt crisis wreaked havoc, the currency entered a period of instability. Amidst rising borrowing prices, bailouts for debt-ridden countries, a recession, and record unemployment, the future of the euro was once again in doubt. Mario Draghi, the ECB president at the time, compared the euro to a bumblebee at the time, calling it a “wonder of nature” that should not be able to fly but can.

Hedge firms and investment banks anticipate continued dollar strength. Those who obstruct the dollar surge run the risk of being overwhelmed by its overwhelming power. Hedge funds and investment banks from New York to Melbourne share this opinion as the indicator of the world’s reserve currency rises, surpassing its epidemic peak to set a new record.

Numerous potential triggers may be found on both sides of the dollar grin debate, which contends that both economic expansion and contraction can be advantageous for the US dollar. Investors believe it may only be a matter of time before the dollar strengthens due to factors ranging from a hawkish Federal Reserve to a global recession. The difference between budget receipts (income) and expenditures represents the federal government’s budget balance (spending). Positive numbers represent a surplus. A negative figure indicates a budget deficit.

A figure that is higher than anticipated should be viewed as positive (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

Data derived from 15th July:

Previous:-$66B Expected:-$76.5B Actual:-$89B

In Australia, the term “employment change” refers to both the overall shift in the proportion of individuals who work for pay or profit and the proportion of people who perform unpaid domestic labor. The estimations also take into account both full-time and part-time employment.

A figure that exceeds expectations should be seen positively (bearish) for the AUD while a figure that falls short of expectations should be interpreted negatively (bullish).

Data derived from 15th July:

Previous:60.6K Projected:30K Actual:88.4K

The Electronic Retail Card Spending program estimates credit card purchases made by New Zealanders for consumables, durables, travel, the fashion sector, transportation, and petrol. The electronic card transactions series includes transactions made with New Zealand-based merchants using debit, credit, and charge cards. This indicator can be used to produce indicators of changes in consumer expenditure and economic activity. A result that is more or lower than anticipated should be interpreted as bullish or bearish for the New Zealand dollar, respectively.

Data derived from 11th July:

Previous:1.8% Expected:0.2% Actual:0.1%

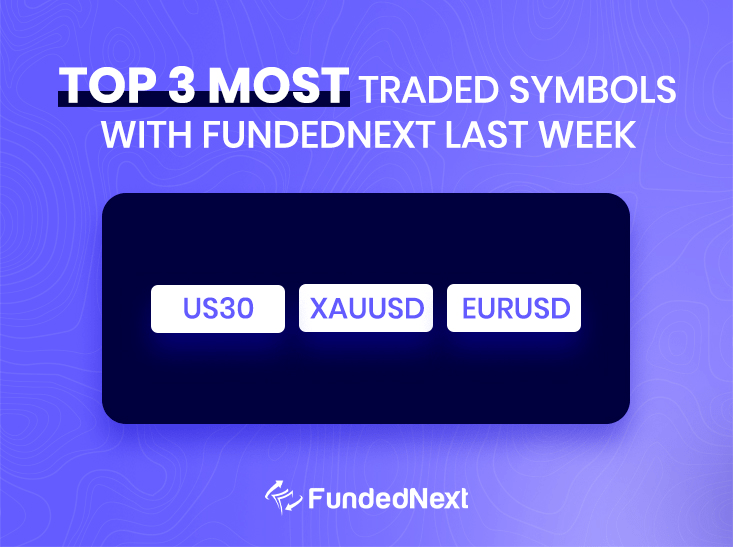

US: At the end of a week in which markets were thrown into a loop by shifting expectations for monetary tightening by the Federal Reserve and concerns over global economic growth, US equity-index futures varied and the dollar’s ascent stopped.

The S&P 500 and Nasdaq 100 contracts pointed to a soft opening for US equities as Wall Street ended with a slight down as investors tempered their expectations for how quickly the Fed will raise interest rates to fight inflation. The inflation expectations, which are based on a nationally representative internet survey of about 1,200 American household heads, refer to the median inflation rate one year from now.A figure that is higher than anticipated should be viewed as positive (bullish) for the US Indices, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

Data from 12 July:

Previous: 6.6% Consensus: 6.6% Actual: 6.8%

EU: The FTSE 100’s unexpected position as the safest haven among global markets in 1H22 appears likely to persist in the second half. Its distinctive makeup, which includes dominant positions in commodities, financials, and globally-focused staples and pharma, is crucial.

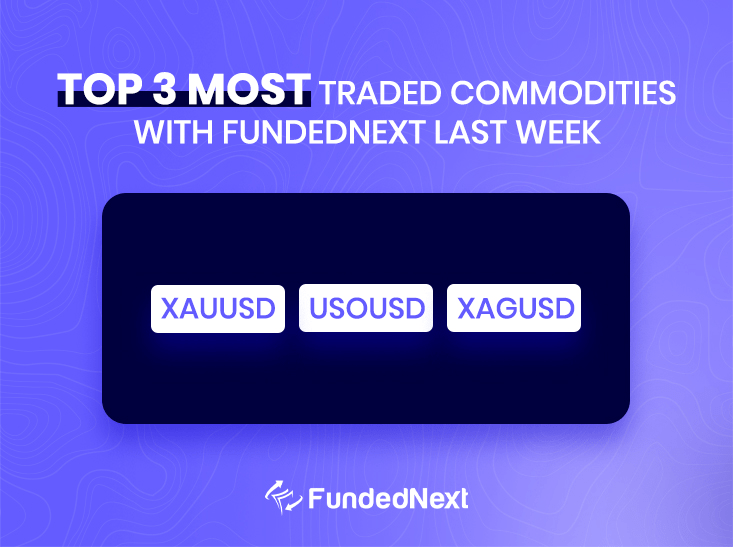

For the first time this year, gold dropped below $1,700 per ounce on Thursday.With speculators turning extremely optimistic on the US dollar, gold is on track for its fifth consecutive week of losses, the longest run of such dips in almost four years.

The precious metal is wilting as investors consider the possibility of larger or more frequent interest rate hikes from a Fed aiming to reduce pricing pressures, even though strong inflation and growth threats normally support gold. Gold doesn’t pay interest, and like other goods with dollar values, it loses value when the value of the dollar increases.

With this week’s drop, gold’s turbulent 2022 comes to a close. After Russia’s war on Ukraine, gold prices climbed above $2,000 an ounce. Since then, when the Fed increased interest rates and the dollar grew stronger, gold has crashed.

Watch Out This Week

- On July 19th RBA’s Lowe is going to have a speech, also the Monetary Policy Meeting Minutes is also scheduled to start Tuesday, July 19. AUD pairs might tend to be volatile during the release time of these events.

- Also on Tuesday-Wednesday, a mass of economic statistics will start to build. The United Kingdom Unemployment Rate data will come out on 19th July followed by United Kingdom’s monthly Inflation rate on 20th July, in both cases it is projected that the numbers will drop from last month by .1 from 3.7 to 3.6 and inflation from 2.5 to 0.6. But the latest data shows it might differ from the projection data and the actual data might be more. A higher actual data from the expected results will result in starling losing its value.

- Euro Area CPI data will come out on 19th July, a higher actual data from the expected results may result in Euro catching pace upwards.

- Canada Inflation Rate data will come out on 20th July, which will show how the CAD will fare in the upcoming month. It is expected the numbers will increase from the past month’s .6% to 1% but looking at the current data it might be even more than the expected numbers. A higher actual data from the expected results will result in CAD losing its value.

- On July 21st we have the early market opening hours filled with BOJ Outlook Reports and Monetary Policy Statement followed by a BOJ Press Conference

- We also have ECB Press Conference following the prior release of the Main Refinancing Rate with Monetary Policy Statement on 21st July.

- On Friday, July 22. We have multiple high-impact events in our hands including German Flash Services PMI and Manufacturing PMI along with Canada’s Core Retail Sales m/m and US’s Flash Services PMI. Traders can expect a lot of momentum in the market.

One Response

This is a good thing to study as a Newbie