President Christine Lagarde and her colleagues can launch a bigger-than-expected first shot in the worldwide fight against inflation thanks to the half-point rise announced on Thursday. However, this raises the possibility that individuals will pursue yet another misguided course of action.

Additionally, traders absorbed the most recent set of American economic statistics as well as the ECB’s decision to raise interest rates by 50 basis points(.50), the first increase in more than ten years after being consistent for a long time.

This is the third time in the ECB’s nearly 25-year history that it has increased rates while a crisis of some kind is raging. It did so in July on each occasion, and both of the earlier raises were subsequently overturned within months.

RATE HIKES ARE ON THE WAY: In August, the Bank of England plans to increase interest rates by 50 basis points. Inflation rates in the Eurozone and the UK are at multi-decade highs, and economic prospects and growth are dim.

However, a key distinction is that although the BOE has more responsibility on its shoulders as the UK government deals with chaos following the resignation of UK Prime Minister Boris Johnson, the ECB is concerned about the fragmentation of sovereign bond markets. Retail trader positioning indicates a bullish bias for GBP/USD rates compared to a mixed tilt for EUR/USD rates.

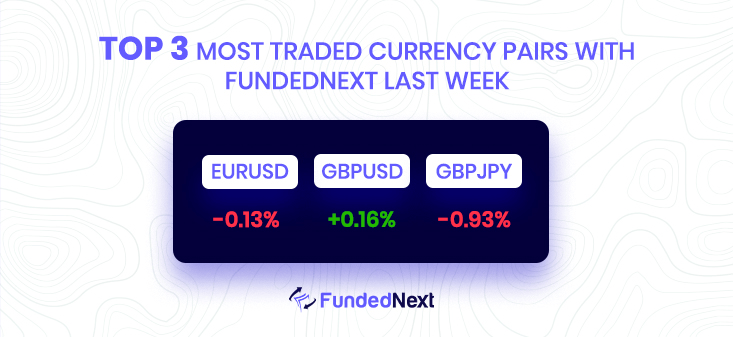

EUR/USD: Retail trader statistics for the EUR/USD market reveal that 63.33 percent of traders are net-long, with the long/short ratio at 1.73 to 1. While the number of traders who are net-long is up 3.58 percent from yesterday and down 20.67 percent from the previous week, the number of traders who are net-short is up 1.73 percent from 19th July and up 19.78 percent. While positioning is less net-long than last week, it is less net-long than yesterday. We have a further mixed EUR/USD trading inclination based on the current mood and previous moves.

GBP/USD: According to statistics from retail traders, 2.35 to 1 traders are net-long 70.18 percent of the time. While the number of traders who are net-long is up 0.75 percent from yesterday and down 12.42 percent from the previous week, the number of traders who are net-short is up 9.07 percent from the previous and up 18.45 percent from the previous week.

Since we normally don’t agree with the general consensus, the fact that traders are net-long signals that the price of GBP/USD may continue to decline. However, traders are less net-long today than they were yesterday and last week. Despite the fact that traders are still net-long, recent shifts in mood indicate that the current GBP/USD market trend may shortly reverse lower.

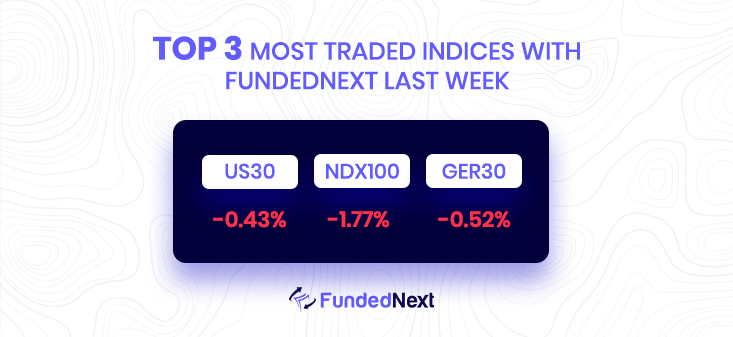

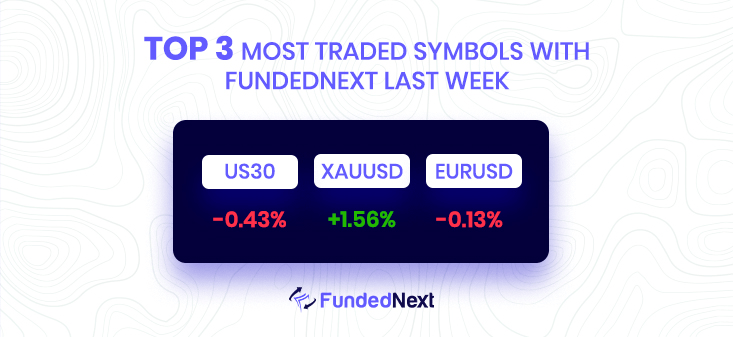

The heavily tech-focused Nasdaq rose 1.36% to settle at $12,059.61. The S&P 500 finished at 3,998.95 with a 0.99% gain. The Dow Jones Industrial Average, meanwhile, increased by 162.06 points, or 0.51 percent, during a volatile session. At the close, the Nifty Fifty index was 32,036.90.

This week, the Nasdaq is expected to rise by around 5.3 percent. The S&P 500 increased by 3.5 percent, while the Dow gained around 2.4 percent for the week.

As a result of this week’s rise being driven by tech companies, investors kept switching their focus to them as Wall Street continued to look for undervalued assets in the wake of some excellent corporate earnings.

The Nasdaq Composite increased on Thursday as Tesla shares soared as a result of earnings that exceeded expectations. A stronger US currency helped tech equities as well.

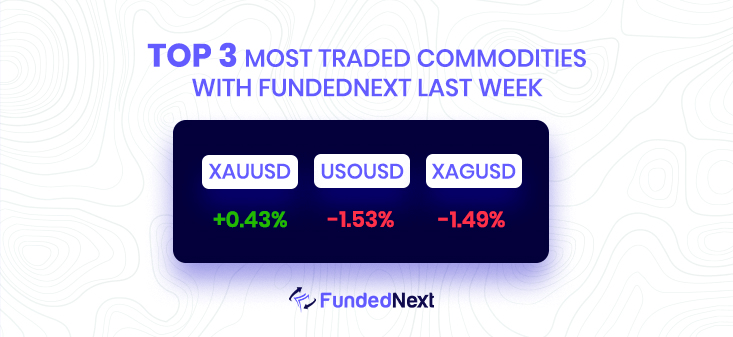

As gold recovers over $1,700 for the time being after bouncing off an oversold level, we are starting to notice some weakening in the US dollar index. Now that investors are looking for a genuine and trustworthy inflation hedge, we anticipate that this initial rush to the US dollar will begin rotating back into gold.

Due to the summertime trading season, trade volumes have decreased and oil prices have been struggling to find meaningful direction. In New York, WTI for September delivery decreased by 86 cents to settle at $99.88 a barrel. The Wednesday expiring August contract decreased $1.96 to close at $102.26.

The price of Brent for the September settlement decreased by 43 cents to $106.92 a barrel. With traders considering the effects of a probable recession on demand, a falling currency, and a pipeline disruption that has constrained the US market, crude has wavered about $100 per barrel.

Watch Out This Week

- Investors will closely watch the Federal Reserve’s meeting on July 26-28 for clues on its monetary policy path. According to market predictions, the Fed’s meeting on July 28 will most likely result in a 75-basis-point increase. Traders predict that either late this year or early in 2023, the fed funds benchmark will reach a top of about 3.5 percent.

- On July 26, data on new homes sold in the United States will be released. A figure that is higher than anticipated should be viewed as good (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish). We may infer from the current study that the outcomes might not meet projections and expectations.

- The PCE data will come out on 29th July. In the US economy, consumer spending on goods and services is measured by personal consumption expenditures (PCE). Because it accounts for more than two thirds of domestic final consumption, it will be the main driver of future economic development.A figure that is higher than anticipated should be viewed as good (bullish) for the USD, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- On 27th we are going to see some interesting data deriving from FOMC Statement and Federal Funds Rate which might impact the market. Actual grater then forecast is good for USD

3 Responses

Someone essentially assist to make significantly articles I might state.

This is the very first time I frequented

your website page and up to now? I amazed with the research you made to make this actual publish

incredible. Great job!

Thank you so much for your support! We are glad that you like our content and have been benefited with it. This is our achievement!

Это отличная платформа.