- Despite an increase in Consumer Confidence in January, analysts at Wells Fargo warn that sour buying conditions may prevent a spending surge, as higher financing costs weigh on the purchases of traditionally bigger-ticket items.

- Consumer Confidence in January reached its highest level in the past year, according to the preliminary report from the University of Michigan.

- Analysts at Wells Fargo note that relief on the inflation front and wage growth are lifting spirits, but warn that still-sour buying conditions suggest the good vibes in this report may not translate into a spending surge.

- The consumer price data for December showed signs that inflation is continuing to slow and thus suggest the Fed will slow the pace of tightening at its next policy meeting on February 1 by electing to bring the federal funds rate up just 25 bps.

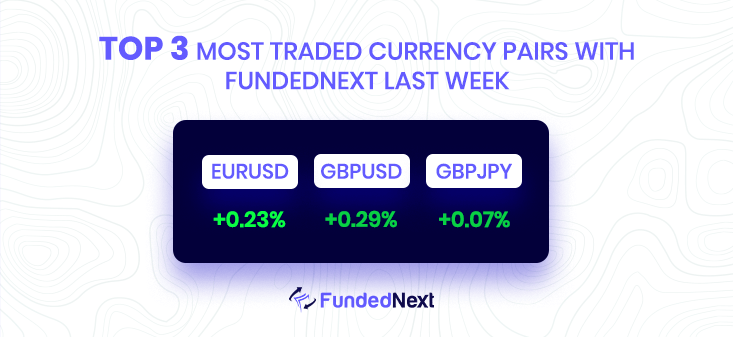

EURUSD: EUR/USD heads for biggest weekly gain since November despite Friday’s slide

- EUR/USD is headed towards the biggest weekly close since May 2022 despite a slide on Friday.

- The US dollar is recovering but remains under pressure and is headed for sharp weekly losses.

- Data released on Friday showed the University of Michigan Consumer Sentiment Index rose in January, surpassing expectations and helping risk appetite but not the dollar.

USDJPY: USD/JPY finds immediate cushion around 129.00 as risk-on profile eases:

- USD/JPY has found immediate support around 129.00 after a vertical fall due to a decrease in risk-on market mood.

- The ease in risk-on market mood has provided support to US Treasury yields, with the 10-year Treasury yields gaining to near 3.49%.

- A downtrend in US inflation has increased the odds of less hawkish monetary policy by the Federal Reserve, with Fed policymakers trimming their expectations for higher interest rate announcements.

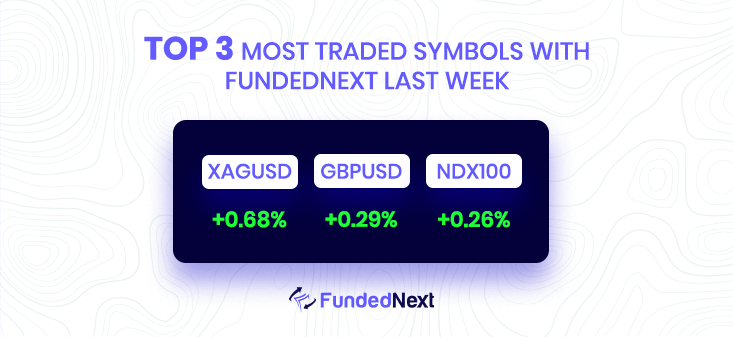

GBP/USD: GBP/USD Slides on Modest USD Recovery and Bleak UK Economic Outlook:

- GBP/USD struggles to capitalize on its modest intraday gains to a nearly one-month high amid a modest USD recovery.

- A softer risk tone and an uptick in US Treasury bond yields revive demand for the safe-haven greenback.

- The bleak outlook for the UK economy, due to disappointing Manufacturing and Industrial Production figures, fuels speculations that the Bank of England is nearing the end of the current rate-hiking cycle, exerting additional downward pressure on the GBP/USD pair.

AUD/USD: AUD/USD Retreats from Multi-month Top, Downside Potential Seems Limited

- AUD/USD fails to hold above the 0.7000 mark and corrects from a multi-month top touched on Friday.

- A modest bounce in US Treasury bond yields and a risk-off impulse benefit the US dollar and weigh on the risk-sensitive Aussie.

- The technical setup favors bulls and supports prospects for the emergence of some dip-buying, with potential support levels at 0.6900, 0.6870-0.6865, and 0.6830.

USD/CHF: USD/CHF drops toward 0.9260 on soft USD and upbeat US economic data:

- USD/CHF retreated from earlier gains and dropped towards 0.9260 due to a weaker US dollar.

- Upbeat US economic data, including consumer sentiment and inflation expectations, is bad for the greenback and weakens the dollar.

- Technical analysis suggests that a break or daily close below 0.9300 would expose the pair to further selling pressure, with key support levels at 0.9200, 0.9167, and 0.9091.

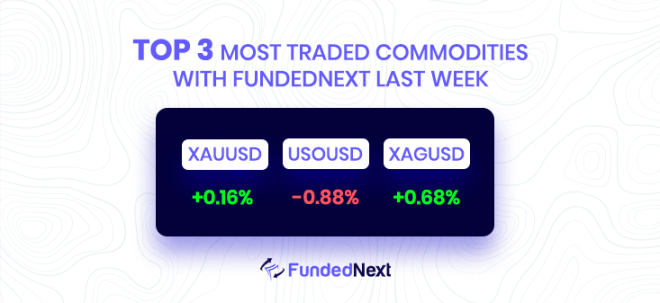

GOLD: XAU/USD uptrend extends, bulls eye $1,920

- Gold price continued to extend its weekly gains above the $1,900 mark, as trader’s speculations that the US Federal Reserve would slow rate hikes pace boosted Gold prices.

- Falling US bond yields and a less hawkish Fed also bolstered XAU/USD’s recent price action.

- A daily close above $1,920 could pave the way toward $2,000, while key resistance levels would be the April 29 high of $1,919.90 and April 18 at $1,998.39, slightly below $2,000.

SILVER: XAG/USD Stabilizes Near Two-Week Low

- Silver recovers from two-week low, but technical setup still favors bearish traders.

- Any subsequent move up may be seen as a selling opportunity and quickly fizzle out.

- Immediate support at $23.20-$23.10, failure to defend could lead to further near-term depreciation.

OIL: WTI struggles to extend recovery towards $79.00

- Oil prices have turned sideways after failing to extend recovery to near $80.00

- The Chinese economy’s reopening measures are expected to spur economic growth and increase oil demand

- A decline in US inflation figures and a slowdown in the pace of the Fed’s policy tightening is expected to support further recovery in oil prices.

Watch Out This Week

- On Jan 17th, the EUR inflation rate will come out. A figure that is higher than anticipated should be viewed as positive (bullish) for the EURO, while a figure that is lower than anticipated should be viewed as unfavorable (bearish).

- The release of the core inflation report on January 18th will be closely monitored by market participants. A higher-than-anticipated figure may be interpreted as supportive of the GBP, while a lower-than-expected result may be seen as detrimental to the currency.

- It is important to pay attention to the report on Jobeless Claims on 19th January, as it may have significant impacts on major currencies. The financial markets are greatly impacted by first-time jobless claims, as they indicate new and emerging unemployment, unlike continuous claims data which tracks the number of individuals receiving unemployment benefits. An above average figure is considered negative for the USD, while a below average figure is considered positive for the USD.

One Response

Nice and good,

More of it .