- US Nonfarm Payrolls for October increased by 261K, exceeding predictions of 193K, according to the Bureau of Labor Statistics (BLS), indicating that the US Federal Reserve will need to keep raising rates owing to the tight labor market. Given that the US central bank increased interest rates by 0.75% for the fourth time this year and acknowledged an overheated labor market, the December meeting may be live, and the Fed may decide to increase rates by 0.5% or 0.75%.

- Following the publication of a conflicting US NFP report on Friday, the dollar’s downward trend accelerated. With non-farm private payrolls expanding by 261K in October, exceeding predictions of 200K, and September’s data revised up to 315K from the previously estimated 4 K, employment growth is still strong.

- In contrast, the jobless rate grew from 3.5% in September to 3.7% in October, exceeding the consensus estimate of 3.6%, while hourly wages rose from 5% in September to 4,7% in October. These numbers have brought back the potential of a more modest rate hike in December and indicate that labor market conditions may be beginning to relax.

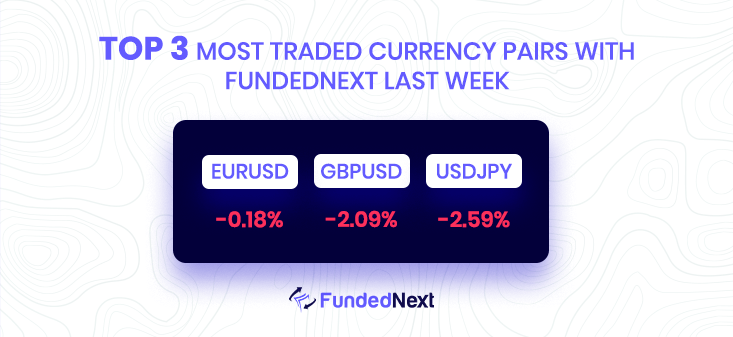

EURUSD: In Friday’s US afternoon trading, the euro has pushed higher, with the pair already hitting session highs at 0.9960. With an unexpected 2.2% daily recovery, the common currency reversed the losses from the previous four days and turned positive on the weekly chart.

- Euro recovery extends to 0.9960 and erases losses from the previous four days.

- US unemployment and wage growth data send the US dollar tumbling.

- EURUSD Further decline to 0.9500 is still likely – Rabobank.

USDJPY: In the US afternoon trading session, the US dollar is attempting to get back over 147.00 to pare losses after falling almost 0.9% on the day and hitting one-month lows at 146.55.

- The dollar dives 0.9% on the day and hits one-month lows at 146.55.

- US payrolls increase, but unemployment rises, and salaries slow down.

- USDJPY: More likely to peak at 155 than at 160 – MUFG.

GBP/USD: Support for the GBP/USD’s reversal from 1.1300 is found at 1.1200.

As a result of widespread USD weakness, the pound has continued to appreciate during Friday’s US afternoon trading, reaching session highs of 1.1380.

After rebounding from the lower region of the 1.1100s on Friday, the pair defied the previous day’s bearish pressure to conduct an astonishing 1.9% daily gain, closing the week a few tick shy of 1.1400.

- The pound rallies 1.9% on the day to close the week near 1.1400.

- US unemployment and wage inflation data hit the dollar.

- The pound has shrugged off post-BoE’s bearish pressure.

USD/CHF: In the midst of a general decline in the value of the dollar, the USDCHF lost close to 200 pips on Friday, its worst performance in weeks. The US jobs report coming in stronger than expected did not assist the dollar, which ended the week pointing to additional weakening.

- US Dollar extends losses during the American session.

- NFP surpasses expectations but does not help the dollar.

- USDCHF erases most weekly gains, back under parity.

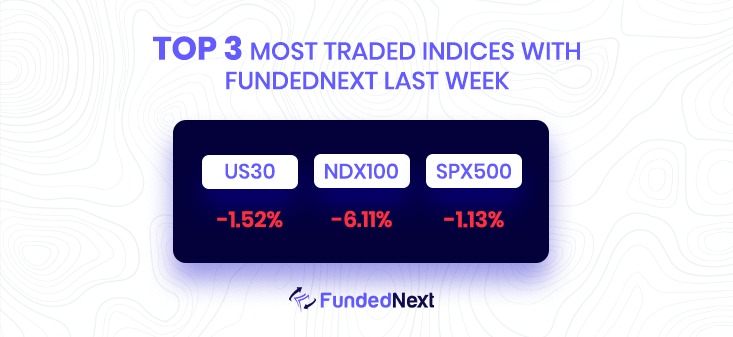

S&P500: The S&P 500 and Nasdaq 100 finished the week lower after the Federal Reserve indicated that its terminal rate will be higher than previously expected. Inflation will be the most important price action catalyst next week. For market sentiment to improve, CPI data must show a meaningful slowdown in price pressures.

- After the Federal Reserve announced a further 75 basis-point increase at its November meeting, the S&P 500 and Nasdaq 100 experienced significant losses this week. But verbal guidance, not this completely discounted decision, was the key bearish catalyst. The central bank admitted that it is too early to talk about a “pause,” and that the final level of interest rates will be higher than anticipated due to persistently rising inflation, even as it hinted that it may slow down the pace of tightening at some time in the future.

- Implied terminal rate on Fed funds futures of approximately 5.1% by the middle of next year, up from 4.85% on Monday, reflecting traders’ increased repricing of the direction of monetary policy as a result of Powell’s hawkish message, which alarmed traders and caused them to react negatively. Even if the FOMC shifts to a slower cycle to more accurately examine the cumulative effects of its prior actions taking into account the lag of policy transmission, this aggressive blueprint is likely to increase recession risks and damage equity markets.

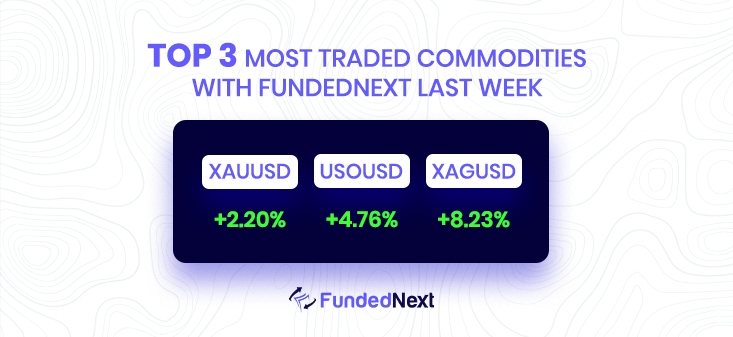

GOLD: Gold Price Forecast: XAU/USD slides towards $1,638 support on firmer DXY ahead of Fed’s verdict, US NFP. XAUUSD is pressured as core PCE jumps, justifying further Fed action..

- The American Dollar has difficulty finding its feet, down 1.39%, as shown by the US Dollar Index.

- Speculations that the Fed would tighten in smaller increases mounted as the labor market gave signs of easing.

- The US 2s-10s yield curve inversion, the deepest since the 1980s, and US recession fear increased.

OIL: WTI hits three-week highs above $92.00 PB, as the USD extends its losses.

- Western Texas Intermediate (WTI) jumps more than 4%, courtesy of a weaker US Dollar.

- Changes in China’s Covid-19 zero-tolerance stance will support higher oil prices.

- WTI could rally on OPEC’s cut to crude oil output and the EU’s ban on Russia’s oil.

Watch Out This Week

- On the 8th of November, EURO retail sales data report will come out. Retail sales in the Eurozone indicate the progression of the products sold. A higher-than-expected figure should be seen as positive (bullish) for the EUR while a lower-than-expected figure should be seen as negative (bearish) for the EUR.

- November 10, the US jobless claim report will come out along with the CPI news, giving vital information about the overall currency value movements. A higher-than-expected figure should be seen as positive (bullish) for the USD, while a lower-than-expected figure should be seen as negative (bearish) for the USD.

- On November 11, the Trade balance report will come out for Great Britain. A higher-than-expected figure should be seen as negative (bearish) for the GBP, while a lower-than-expected figure should be seen as positive (bullish) for the GBP.