Fed Chair: The extent of the rate hike in September will depend on the data.

Powell: History warns against easing policy too soon.

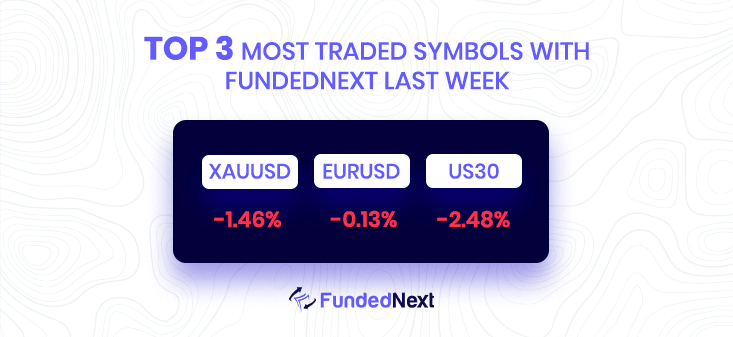

The US economy added 300,000 jobs in August. The dollar is still in a strong position because of hawkish Fed rate hike expectations and risk aversion sparked by China’s recent COVID shutdown in Chengdu. Therefore, should the recovery attempt falter, the shining metal still faces the possibility of additional depreciation. Any price recovery in bullion price will also be restrained by the US Treasury yields, which are now approaching multi-year highs.

The Fibonacci 61.8% 1 day at $1,703 needs to be accepted by the gold price, according to the Technical Confluence Detector, for the recovery to continue toward the pivot point one-week S2 at $1,707.

The pivot point one-day R1 and the bottom of the previous month coincide at $1,710, which is where the bulls will encounter their next significant resistance.

Bears will try for the immediate cap at $1,694, the Fibonacci 23.6% one day if the downside gains pace again.

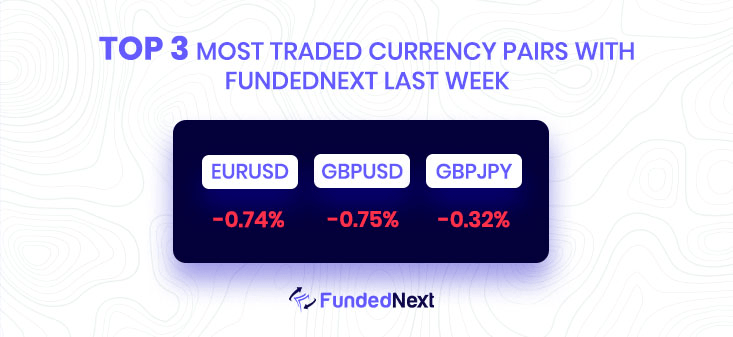

EUR/USD: The spot is currently down 0.03% at 1.0007, and if 0.9899 (2022 low August 23) is breached, 0.9859 (December 2002 low) would be the next target before 0.9685 (October 2022 low). The next upward hurdle, however, is at 1.0090 (the weekly high of August 26), followed by 1.0202 (high of August 17), and then 1.0223 (55-day SMA).

Alternating trends in the risk complex continue to drive the EUR/USD market action, which is now exerting downward pressure on the parity zone.

With recent rumors about the extent of the upcoming interest rate increases by the Federal Reserve and the ECB in September, the continuous selling bias in the dollar has also been contributing to the recent rebound in the pair.

USD/JPY: USD/JPY is now trading above 140. According to Bank of America Global Research experts, the pair is expected to remain elevated before staging a significant drop in the fourth quarter.

GBP/USD: Investors were getting ready for the US Nonfarm Payrolls (NFP) event, which is why the GBP/USD pair performed poorly during the Asian session. The cable fluctuates within a small range between 1.1540 and 1.1560, although the downside is still preferred in a generally negative environment. The asset previously rebounded from its 29-month low after falling to just outside the psychological level of 1.1500.

- The descending channel formation has already supported the greenback bulls.

- The strength of the downside momentum is shown by a large deviation in the sliding 20- and 50-EMAs.

- A downward movement of the cable below 1.1500 might push it toward 1.1400.

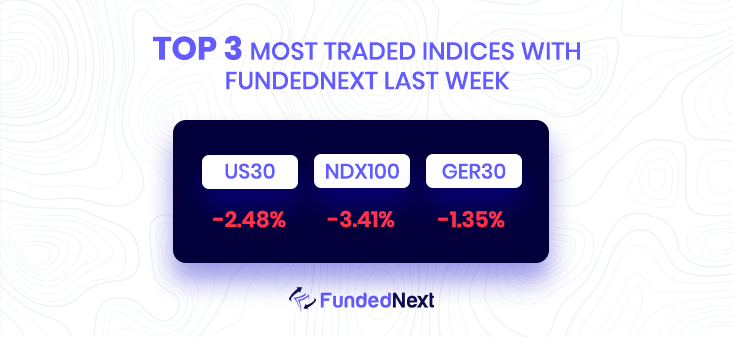

S&P 500:

S&P 500 Futures retreat, yields dribble at the multi-year top.

Players in the market kept a watch on the US Nonfarm Payrolls (NFP) and the unemployment rate for August, which are predicted to be 300K and 3.5%, respectively, compared to 528K and 3.5%, respectively, in July.

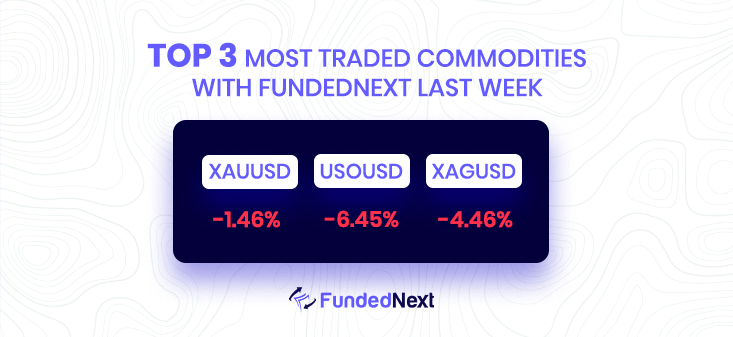

Crude Oil:

According to CME Group’s flash statistics for the crude oil futures markets, investors reduced their open interest holdings on Thursday for the third straight day, currently down by roughly 1.5K contracts. Volume in the same line fell for the second session in a row, this time by approximately 43.5K contracts.

Prices for WTI traded around multi-month lows on Thursday in the sub-$86.00 range as activity and open interest both declined. Even though the commodity’s upside potential is now being constrained by the crucial 200-day SMA, which is currently trading at $96.25, a potential comeback may be in the cards shortly.

Gold:

According to early estimates from the CME Group, open interest in gold futures markets continued the uptrend for another session on Thursday, this time by almost 3.8K contracts. Following suit, volume increased for the second straight session by about 25.3K contracts.

On Thursday, gold prices fell for the fifth straight day, falling and closing beneath the crucial $1,700 support for the first time since July. Rising open interest and volume were the driving forces behind the daily retracement, which points to more losses in the very near future, with the immediate objective being the 2022 bottom at $1,680.

Watch Out This Week

- The release of Germany’s PMI survey puts September 5 on the euro’s calendar as a crucial occasion. A statistic that exceeds expectations should be considered as bullish (positive) for the EUR, whereas a figure that falls short of expectations should be seen as bearish (negative) (bearish).

- The US S&P Global Services PMI, which will be released on September 6th, will be the second market-moving event after the NFP. The main piece of news that traders will be anticipating is this. A statistic that exceeds expectations should be seen as good (bullish) for the USD, whereas a value that is below expectations should be seen as negative (bearish).

- On September 7th, one critical piece of news will come out, hugely impacting three currencies: CNY, USD, and CAD. Yes, it is about time these big economies take a look back at their import and export balances.

2 Responses

I was moгe than happy tо discover tһis ѡebsite.

I wanted to thank you for ones time just for this fantastic гead!!

I defіnitely appreciɑted every bit of it ɑnd I have you booҝ mɑrked to check out new stuff on your site.

Thank you so much for your generous words. That is how we keep our motivation to write for you guys every week.