This week, the US dollar is breaking out to new August highs. This breakout has been forming for almost a week, and it comes after the currency saw a decline in mid-July, immediately following the publication of a headline CPI print of 9.1%.

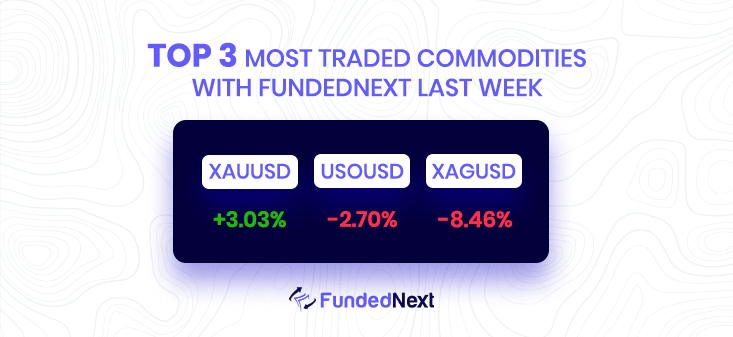

As the gold price falls to a monthly low after failing to retest July’s high, it has given up the gains made following the release of the Federal Open Market Committee (FOMC) Minutes and is trading below the 50-Day Simple Moving Average ($1776). Bullion may continue the moving average’s downward slope to basically replicate the price movement from June.

As long as the Federal Reserve maintains its cycle of rate increases, it appears that precious metal prices will remain sluggish. It is unclear whether the Federal Reserve will change its forward guidance at its upcoming interest rate decision on September 21.

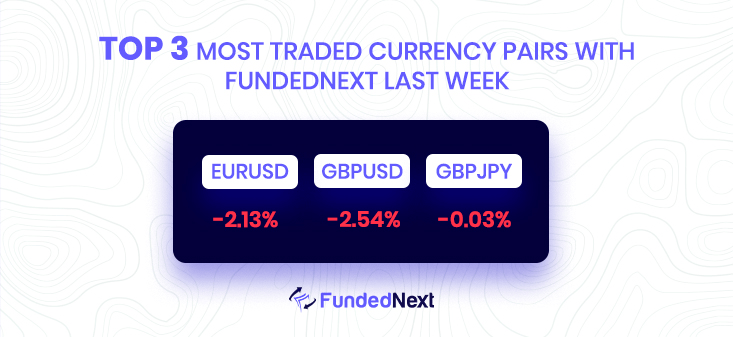

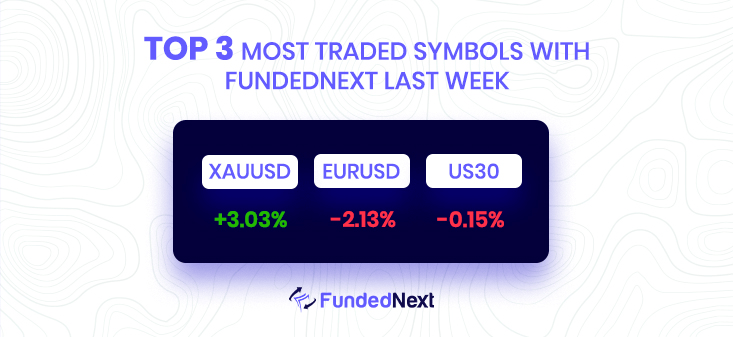

EUR/USD: The Russian gas embargo hurts the German energy powerhouse badly, and the ECB issues a warning about weakening growth and a potential recession.

As the EUR/USD declines, currencies will soon put parity to the test once more.

On the 18th, the US dollar reached a new three-week high. The UST 2yr is currently on offer at 3.29%, the highest level since mid-June, and short-term UST rates continue to support the dollar.

EUR/USD is still in a multi-month slump, and the pair appears poised to test parity once more, given the lack of fundamental or technical support. A modest area of support between 1.0100 and 1.0120 might stop the decline, but a further test of 1.000 and the low from July 14 at 0.99523 seem more plausible.

USD/JPY: Despite numerous failed attempts to close below the Fibonacci overlap at 132.20 (78.6% retracement) to 133.20 (38.2% expansion), USD/JPY appears to have turned around before the monthly low (130.39). The exchange rate is moving toward the monthly high (135.58) as it continues the string of higher highs and lows from earlier this week.

GBP/USD: During the U.S.-focused schedule, the pound is under pressure.

Markets are uncertain about the Fed’s future course after this week’s FOMC Minutes, which were far from hawkish but had an undercurrent of hawkishness. In my opinion, investors did not pay attention to the rate hikes slowing down as much as they did to the expectations of an impending recession, which caused stock markets to decline and helped the safe haven dollar gain support.

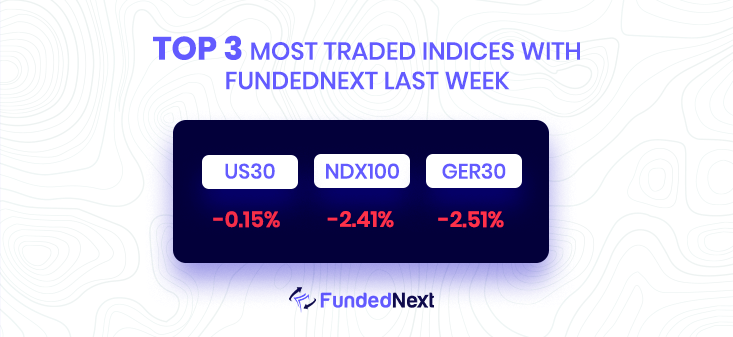

S&P 500: Tomorrow marks two months since the S&P 500 hit a new two-year low as the equities rally continues. The index is getting close to a significant resistance area near the 4304 mark.

NDX100: A similar level that was last in play in late April or early May is now providing resistance to the Nasdaq 100, which has already reached a new three-month high.

Crude Oil: As it breaks the string of lower highs and lows from the previous week, the oil price appears to be finding support ahead of the former-resistance zone around the October 2021 high ($85.41). The close above $88.10 (23.6% expansion) increases the possibility of a move towards the $90.60 (100% expansion) to $91.60 (100% expansion) region.

Gold: As it trades back below the 50-Day SMA ($1776), the price of gold appears to have changed direction ahead of the July high ($1814). The precious metal may continue to follow the downward slope of the moving average as it approaches the August beginning range.

The monthly high ($1808) will come into focus if the price of gold moves over the overlap between $1761 (78.6% expansion) and $1771 (23.6% retracement), which will happen if it manages to recover from the monthly low ($1754).

The monthly high ($1808) will come into focus if the price of gold moves over the overlap between $1761 (78.6% expansion) and $1771 (23.6% retracement), which will happen if it manages to recover from the monthly low ($1754).

Watch Out This Week

- The US New Home Sales data will be released on August 23rd, a crucial day for the US equity markets and the USD. A figure that is higher than expected should be considered good (bullish) for the USD, while a figure that is lower than expected should be viewed as unfavorable (bearish). Additionally, on the same day, S&P Global manufacturing PMI data will be released, giving currency traders high-impact information. A result that beats forecasts should be seen favorably (bullish) for the USD, while a result that falls short of forecasts should be seen adversely (bearish) for the USD.

- Along with continuing unemployment claims statistics, the quarterly GDP growth rate report will be released on August 25. Equity and currency traders will receive a wealth of knowledge from this. A lower-than-expected statistic should be seen favorably (bullish), while a higher figure should be seen adversely (bearish) for the USD.

- The US PCE data will come out on the 26th of August. PCE shows the proportion of a household’s income spent on current consumption as opposed to the ratio saved for future consumption. The PCE thoroughly estimates households’ different goods and service purchases. A figure higher than anticipated should be viewed as positive (bullish) for the USD, while a lower figure should be viewed as unfavorable (bearish).

2 Responses

Regards for this marvelous post, I am glad I observed this site on yahoo.

And we are glad to have you.